Puma AG took another hit to the top-line in the third quarter as a tough U.S. mall business and the largest player in the channel continued to severely impact overall footwear sales growth for the period. The EMEA region also saw some challenges of its own as orders pulled forward into the second quarter created a gap for the most recent period. Still, the future looks a bit brighter, at least in Europe and Asia/Pacific as the company looks ahead to the European Championships and further consolidates its business in Asia. The Americas, dominated by the U.S., may not see much improvement until the second or third quarter of next year when the brand will anniversary the declines in the Foot Locker business.

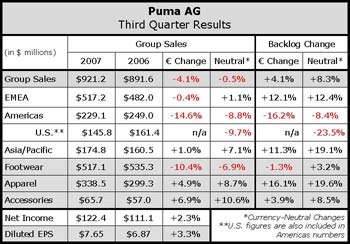

Third quarter consolidated sales declined 4.1% to 376.3 million ($921 mm) compared to 419.8 million ($892 mm) in the year-ago quarter, or a 0.5% dip on a currency-neutral basis. Global brand sales, which include consolidated sales and license sales, were also down 4.1% for the period to 753.4 million ($1.04 bn) during Q3, or a decline of 0.6% in currency-neutral terms. Part of the decline in the license business was due to the expiration of the Korean license at year-end.

EBITDA rose 1.8% to 135 million ($186 mm) and net earnings increased 2.3% to 89.1 million ($122 mm). Diluted earnings per share were calculated at 5.57 ($7.65), compared with 5.39 ($6.87) in Q3 last year. The net return amounts to 13.3% versus 12.5% in third quarter 2006.

Footwear was down 10.4% (-6.9% currency-neutral) to 376.3 million ($523.7 mm); Apparel sales rose 5.0% for the quarter (+8.7% c-n) to 246.3 million ($342.8 mm); and, Accessories sales increased 7.0% (+10.6% c-n) to 47.8 million ($66.5 mm).

Weakness in the U.S. Dollar versus the Euro, the decline in sales in the lower margin U.S. market, and a growing owned-retail business helped boost overall gross margins 270 basis points to 53.0% of sales. SG&A expenses rose 140 basis points to 34.0% of sales.

The EMEA region reported sales of 376.5 million ($517.2 mm) in Q3, or a currency-adjusted increase of 1.1% for the period. Taking into account the move of some shipments to June, sales would have been up in mid-single-digits for the quarter.

EMEA gross margins were up 30 basis points to 54.5% of sales. EMEA represented 56.1% of sales in the third quarter compared to 54.1% of sales in the third quarter last year.

In the Americas, sales fell 15.4% (-8.8% currency adjusted) to 166.7 million ($229.1 mm). Gross margin was up 290 basis points to 49.7% of sales on the reduction of the U.S mall business. U.S. sales were down 9.7% to $145.8 million in Q3, but gross margins jumped “more than 500 basis points” due to the reduction in the key account ratio to the total business in the U.S. The U.S. made up 15.8% of sales in the third quarter, compared to 18.1% in the year-ago period.

Order backlog for the U.S. decreased 23.5% to $187.5 million at quarter-end, which represents the anniversary of the previous ramp-up with the mall guys at the same point last year.

The Asia/Pacific region improved 1.0% (+7.1% currency-neutral) to 127.2 million ($174.8 mm). Gross profit margin improved 10 basis points to 50.7% of sales. Orders backlog was up 19.1% and totaled 247.2 million ($352.8 mm) with a strong increase in the Chinese market. Taiwan was said to be a difficult market, while Japan was described as “fine”.

Total order backlog increased 8.3% currency-adjusted, and increased 4.1% in Euro terms, to 1.07 billion (1.53 bn). The orders are mainly for deliveries scheduled for Q4 2007 as well as Q1 2008. Footwear orders were up by 3.2%, currency-adjusted, to 659.7 million ($941.5 mm), Apparel was up by 19.6% to 345.4 million ($493.0 mm), and Accessories were up by 8.5% to 60.4 million ($86.2 mm).

Management confirmed sales and earnings growth in the low-single-digits for fiscal 2007, but gross margins are now expected to come in “better-than-anticipated,” though offset a bit by a higher SG&A. EBIT is expected to be flat to last year.

>>> Some are concerned that a reported consumer move to more performance-oriented product in Europe could hurt Puma

Management appears to feel its new high-end sailing collection is part of the answer…