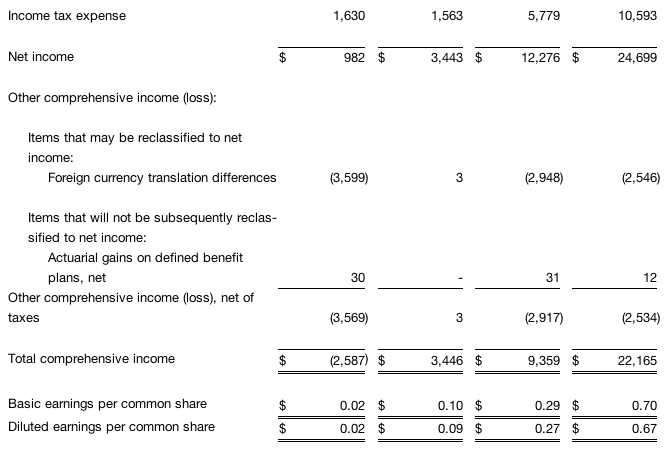

Performance Sports Group Ltd. reported adjusted earnings jumped 49.3 percent in its fiscal second quarter ended Nov. 30, to $11.2 million, or 24 cents a share.

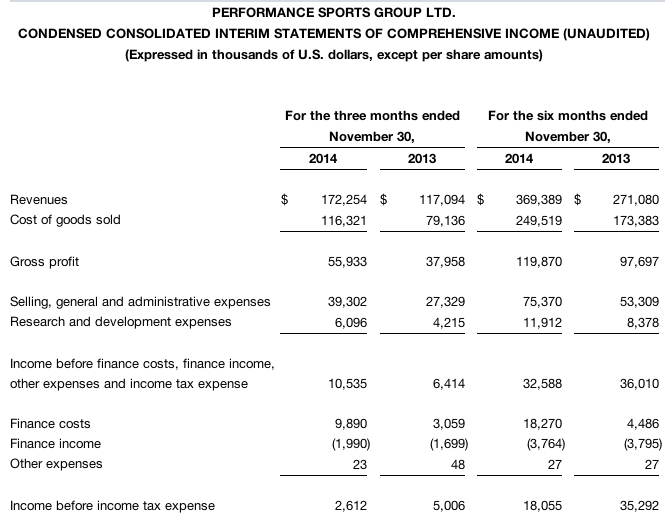

Revenues climbed 47.1 percent to $172.3 million, and grew 50.5 percent on a currency-neutral basis.

The gains were due to the addition of revenues generated by the acquisition of Easton Baseball/Softball and strong growth in ice hockey equipment, partially offset by an unfavorable impact from foreign exchange. Excluding the results of Easton Baseball/Softball, as well as the impact from foreign exchange, revenues grew organically by 10.2 percent.

Adjusted gross profit climbed 57.1 percent to $62.2 million and increased as a percent of sales by 230 basis points to 36.1 percent. The margin increase was primarily driven by the addition of Easton Baseball/Softball as well as improvements in production costs for uniforms, partially offset by the unfavorable impact from foreign exchange.

SG&A expense increased 43.8 percent to $39.3 million, primarily due to the addition of Easton Baseball/Softball, costs related to the temporary lacrosse helmet decertification at Cascade, and higher sales and marketing costs. As a percentage of revenues and excluding acquisition-related charges and share-based payment expenses, SG&A expenses decreased 20 basis points to 20.3 percent.

Research and development expenses in the quarter rose 44.6 percent to $6.1 million compared to $4.2 million due to continued focus on product development and the addition of Easton Baseball/Softball. As a percentage of revenues, R&D expenses decreased 10 basis points to 3.5 percent.

On a conference call with analysts, Kevin Davis, president and CEO, said that due in part by the timing of product launches, Easton grew 37 percent, driven by the continued success of the Mako family of products, including the Torq bat. Hockey drove its organic performance, generating 12 percent growth, led by successful launches. It h for hockey. Representing the fourth consecutive quarter of growth for the category, hockey was driven by a 22 percent growth in helmets and facial protection; 20 percent growth in its protective line, which includes gloves, pants and under protective gear; and a 19 percent growth in skates

Apparel jumped 31 percent, driven by a 55 percent increase in its performance line and helped by the launch during the quarter of its exclusive 37.5 fabric technology last quarter.

Lacrosse saw a 9 percent decline due to a disruption in Cascade's business as a result of NOCSAE's decertification of the R helmet during the second quarter. It estimated that the impact on Q2 sales due to this disruption was approximately $2 million. Excluding the disruption, lacrosse was estimated to be up approximately 10 percent in the quarter.

Davis said a modification to the R lacrosse helmet has recently met NOCSAE’s certification standards and new R helmets began shipping last month. NOCSAE also last week reinstated Cascade's license to use the NOCSAE certification on all of its current models of lacrosse helmets in addition to the R lacrosse model. Added Davis, “That means that our Liverpool facility is now fully back in business, producing all of our current models: the R, CPX-R, CPV-R, CS-R and CS.”

Davis also said strong demand in the lacrosse segment was seen for its new Maverik products due to the launch of the Optik and Tank heads, as well as the new line of shafts.

On a regional basis, revenues in North America grew 60 percent, which was aided by Easton, and increased by 2 percent in the rest of the world. Revenues outside North America are nearly all hockey revenues.

“These strong reported results in the face of such headwinds are a testament to the strength of our brands, platform and people,” said Davis. “As we look to the second half of the fiscal year, we expect that strong currency headwinds, including the sharp devaluation of the Ruble, will continue to challenge our hockey business, and even more so than in the first half of the year. However, fiscal 2015 currently remains on track to deliver another record year of top and bottom-line performance.”