June 30, 2020 – The U.S. consumer is expanding their spending consideration set as restrictions ease across much of the country, reports The NPD Group. The importance of enhancing a homebound lifestyle remains, but consumers are increasingly showing their interest in products with a more personal focus. Week-over-week dollar gains that began early for categories like small appliances and toys began to expand into more discretionary categories like apparel and beauty in April and May, which pulled even more of the consumer’s spending in the first half of June.1

“Right now, retail is reflecting the consumer’s need for normalcy in a sea of change,” said Marshal Cohen, NPD’s chief industry advisor, retail. “Purchases are becoming less about making our extended time at home more pleasant, and more about finding ways to enjoy ‘getting out’ and once again expressing yourself as an individual in public.”

In May, more than two-thirds of consumers said they would be comfortable with shopping in a store once stay-at-home requests related to the pandemic were relaxed, and nearly one in ten said going shopping in a store was the first thing they planned to do.2 While sales of apparel, footwear, beauty, and fashion accessories are still down compared to last year, year-over-year losses have been softening since mid-April. The consumer’s ability to go back into stores is a contributing factor, as in-store sales declines improved across most industries in May. 3

Despite facing a very different retail landscape, conventional needs and seasonality still play a role in consumer behavior. Kids’ apparel, underwear, sleepwear, and shorts all achieved year-over-year dollar growth in May 4, and swimwear built momentum with week-over-week gains in early June1. Seasonal impact is also evident in categories like men’s fragrance and fashion watches, where there were week-over-week gains in advance of Father’s Day.1

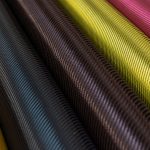

“Even if the shopping experience is different, consumers still want the ‘real-life’ experience of picking out a gift, seeing the color of shoes up close, feeling clothing fabric, or testing out a skincare solution,” added Cohen. “Retailers who can deliver a satisfying and safe shopping experience will win with the consumers who are ready to go beyond virtual shopping.”

1Source: The NPD Group/Point-of-Sale Early Indicator Report, NPD Universe, WE June 13, 2020; Industries Included: Apparel, Footwear, Auto Aftermarket, Watches, Housewares, Small Domestic Appliances, Toys, DVD/Blu-ray, Sports, Accessories, Consumer Technology, Office Supplies, Prestige Beauty, Juvenile Products, Video Games (physical only)

2Source: The NPD Group / May 2020 Omnibus

3Source: The NPD Group / Consumer Tracking Service

4Source: The NPD Group / Retail Tracking Service