London: Laka (laka.co), a community-based insurer of cyclists, has unveiled a rebrand which breathes new life into cycle insurance to challenge the status quo.

Laka has ripped up the rulebook to defy the traditional fundamentals of insurance with a fresh look that injects personality and purpose into the industry – providing the brand with a platform to turn the industry on its head.

The insurance industry is often associated with misfortune and mistrust. Laka needed a brand to challenge those preconceptions and establish a positive, collective-based model.

The rebrand, executed by branding agency Ragged Edge, is reflective of Laka’s progressive mindset. Laka’s fun-loving and characterful new identity is the antidote to the insurance industry. It recognises the different tribes that exist in cycling yet brings them together to feel part of a bigger collective team, celebrating its strength in numbers.

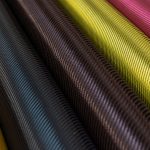

Bold portraiture photography heroes the collective’s diverse members, and strong team colours unites them. Landscape-like patterns are inspired by mud, sweat and tears from a ride. And a tone of voice that’s never afraid to go full-on bike nerd is used as a rallying cry to members – mess with one of us, mess with all of us.

Laka has created, whilst maintaining social distancing, a new brand video to launch the rebrand to introduce cyclists to its new positioning. The brand has also collaborated with Rapha to create a special-edition collection of Laka cycling kit.

The rebrand marks the latest progression in Laka’s journey of forging an innovative approach to cycle insurance. This isn’t the first time Laka has done things differently:

-

Never tied down: It’s the only cycle insurer who doesn’t tie riders into annual contracts so they’re free to leave anytime, no exit fees involved.

-

Insurance flipped: Laka also doesn’t charge cyclists a fixed sum, instead it calculates the customer’s monthly contributions – up to a maxed capped amount – based on the collective’s claims.

-

The 80/20 rule: 80% of cyclists money goes straight back into the collective fixing, replacing, helping, whatever. And the other 20% keeps Laka’s wheels spinning.

Tobias Taupitz, CEO and co-founder at Laka said: “Traditional insurance models, with complex clauses, excesses and a painful claims process are broken. Our customers – starting with cyclists – work as a collective to share the cost of claims that actually happen, rather than ones that might”

”We’ve created a brand that will really resonate with the cycling community, but isn’t restricted to cycling. I hate the word disruption, but it’ll really disrupt the industry. And sets us up perfectly for our international growth as we fundamentally change what insurance means to people.”

For further information about Laka and the new rebrand, check out the Laka website at laka.co.