Poshmark, the secondhand e-commerce platform, filed for an initial public offering (IPO).

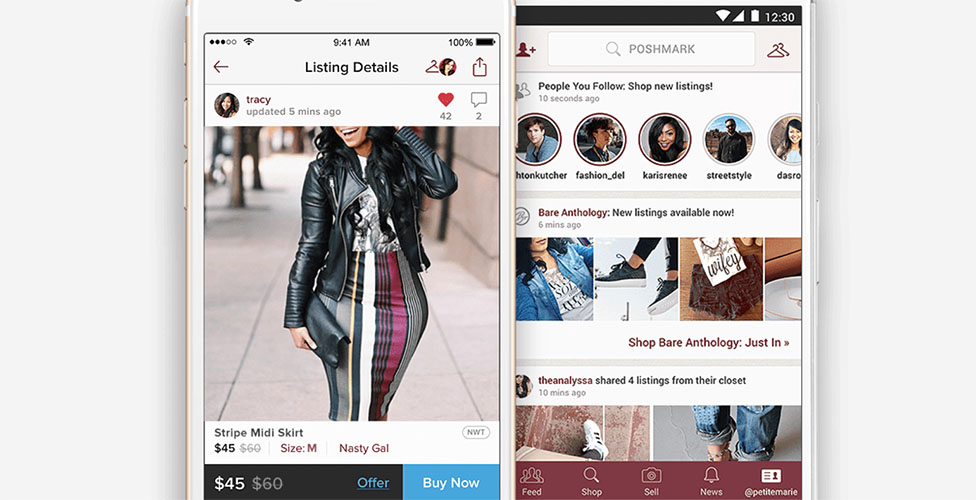

The social commerce marketplace, founded in 2011, connects sellers of used clothing, shoes and accessories to buyers looking for deals. According to a filing with the Securities & Exchange Commission, more than 70 million Poshmark users have sold more than 130 million items with a combined value exceeding $4 billion.

The first profitable quarter was for the three months ended June 30, according to the filing. For the nine months ended September 30, Poshmark said it had a net income of $21 million on revenue of $193 million, compared with a net loss of $34 million on revenue of $150 million during the same period in 2019.

The filing notes that for 2019 apparel was Poshmark’s biggest category, representing 45 percent of sales; followed by footwear, 21 percent; bags, 17 percent; accessories, 12 percent; and other, 5 percent. The marketplace is currently only available in the U.S. and Canada, but the company has plans to expand worldwide.

Poshmark listed the size of its offering as $100 million, a placeholder that will likely change. The number of shares to be offered and the price range for the proposed offering have not yet been determined. Poshmark has applied to list its Class A common stock on the Nasdaq Global Select Market under the ticker symbol “POSH”.

Morgan Stanley & Co. LLC, Goldman Sachs & Co. LLC and Barclays Capital Inc. are acting as lead book-running managers for the offering. Stifel, Nicolaus & Company, Inc., William Blair & Company, LLC, Raymond James & Associates, Inc., Cowen and Company, LLC, and JMP Securities LLC are acting as book-running managers.

Photo courtesy Poshmark