Perry Ellis International reported a sharp uptick in earnings on an adjusted basis in the third quarter ended Oct. 31 with the help of cost controls. Revenues declined 2.8 percent with growth across its key lifestyle brands of Perry Ellis, Rafaella and Golf Lifestyle.

Key Fiscal Third Quarter 2016 Financial and Operational Highlights:

- Third quarter revenue totaled $205.4 million.

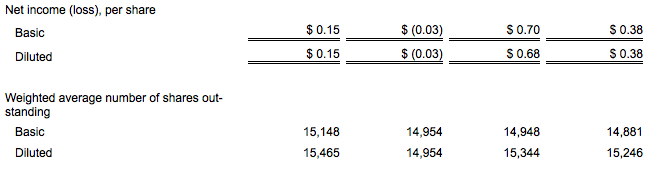

- Adjusted diluted earnings per share increased to $0.16 as compared to adjusted diluted earnings per share of $0.03 in comparable period of prior year.

- Diluted GAAP Earnings per share of $0.15, as compared to a loss of $0.03 comparable period of prior year.

- Gross margin expansion of 240 bps to 35.7 percent as compared to 33.3 percent in comparable period of prior year.

- Adjusted EBITDA margin expansion of 90 bps to 4.3 percent as compared to 3.4 percent in comparable period of prior year.

- Inventory decreased 7 percent to $145 million as compared to end of the third quarter of prior year, the lowest level since fiscal 2011.

- Full-year Adjusted EPS guidance increased to a range of $1.81 to $1.88.

Oscar Feldenkreis, president and chief operating officer of Perry Ellis International, commented: “We had a strong third quarter highlighted by growth across our key lifestyle brands of Perry Ellis, Rafaella and Golf Lifestyle, expansion in gross margin and expense discipline which drove a more than fivefold increase in adjusted diluted earnings per share. We delivered excellent operating results by staying focused on what we do best — bringing relevant, innovative product to the marketplace, amplifying our relationships with consumers and driving operational excellence into every area of our business. Revenues declined in total driven by the strategic sale of C&C California and the transition of certain exclusive labels to our national, lifestyle brands. We ended the period in a strong position with inventory down 7 percent from the prior year and our brands and businesses positioned to capitalize on the holiday season. Overall, I believe today's results speak to the power of our global lifestyle brands and platforms which performed well in what is proving to be a mixed retail environment.”

Feldenkreis concluded: “We will continue to execute on our successful business strategy. We are excited to move into the holiday and spring seasons with a strong order book, solid product selling and improved profitability. We believe that our combination of market leading brands, great product and world class execution provide an on-going opportunity to enhance our leadership position and drive superior value to our shareholders, customers and partners.”

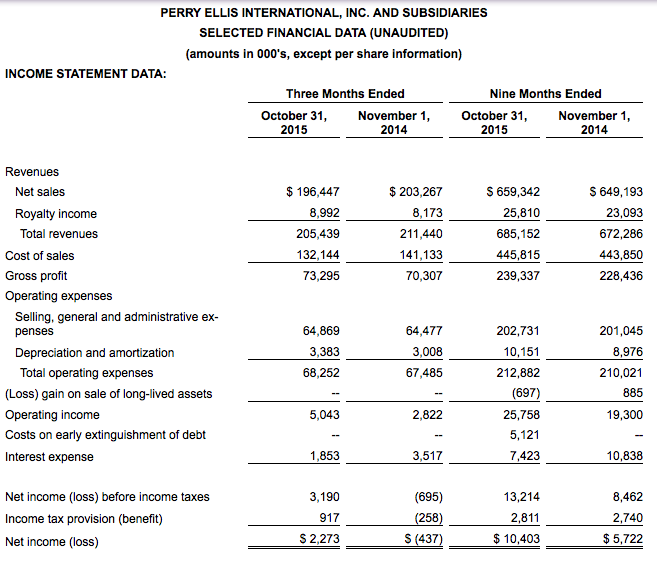

Fiscal 2016 Third Quarter Results

Total revenue for the third quarter of fiscal 2016 was $205.4 million, down slightly from $211.4 million reported in the third quarter of fiscal 2015. The company realized increases in its core global brands, Perry Ellis, Rafaella and Golf Lifestyle, across international, licensing and direct-to-consumer (DTC) businesses. This was offset by the loss of revenues associated with the divestiture of C&C California as well as private and exclusive brand reductions over the prior year. The reduction is in line with the company's continued focus to narrow its portfolio to our national brands and to steer smaller brands to a licensed model.

Gross margin was 35.7 percent, representing a 240 basis point improvement over the same period last year. The expansion reflects benefits from stronger sell-through performance at retail in the Perry Ellis, Original Penguin and Golf Lifestyle collection businesses, and favorable mix from higher margin licensing and DTC businesses.

Selling, general and administrative expenses totaled $64.9 million as compared to $64.5 million in the comparable period of the prior year. Excluding costs associated with streamlining and consolidation of operations, expenses totaled $64.5 million, or 31.4 percent of revenues, as compared to $63.4 million, or 30.0 percent, in the comparable period of the prior year.

As reported under GAAP, the fiscal 2016 third quarter net income was $2.3 million, or $0.15 per diluted share, as compared to a loss of $437k, or $0.03 per diluted share, in the third quarter of fiscal 2015. On an adjusted basis, fiscal 2016 third quarter earnings per diluted share were 16 cents per share as compared to adjusted earnings per share of 3 cents in the third quarter of fiscal 2015. These results benefited from improved operating results as well as a lower interest cost for fiscal 2016.

Adjusted earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA) for the third quarter of fiscal 2016 totaled $8.8 million as compared to $7.2 million in the comparable period of the prior year. Adjusted EBITDA margin expanded to 4.3 percent from 3.4 percent in the prior year. (Adjusted EBITDA excludes certain items as outlined in Table 2, Reconciliation of Net (Loss) Income to EBITDA and adjusted EBITDA.)

Balance Sheet

At the close of the third quarter, the company's balance sheet was solid. Inventories were extremely tight down 7 percent to $145 million as compared to $156 million at the end of the comparable period in the prior year and $184 million at year end. Capitalization reflects a net debt position of $97 million or 23 percent as compared to prior year $120 million or 25 percent.

Update on Strategic Priorities for Fiscal 2016 to Enhance Profitability

The company continues to concentrate on the successful execution of its growth and profitability plan to continue to strengthen its industry leadership, reach new consumers and drive continued growth.

“Fiscal 2016 is on track to be a very strong year for Perry Ellis International, driven by strong performances in our global branded business, International and Direct-to-Consumer platforms,” said George Feldenkreis, Chairman and Chief Executive Officer, Perry Ellis International. “And while we see some retail headwinds in the marketplace, our fundamentals remain solid and we have great confidence in our ability to provide sustainable, long-term returns for our shareholders.”

The company's focused strategy includes:

- Focusing on high performing, high growth brands and businesses. Since Fiscal 2014, the company has exited 30 brands, which accounted for approximately $90 million in lower margin revenues, and refocused its portfolio toward core, high-margin brands. The company also converted smaller owned brands to licensed only brands where applicable.

- Enhancing Retail brand positioning in the menswear arena through the wholesale, retail and licensing of its core brands. The company has focused on product innovation, visual presentation through in-store shops as well as omni-channel marketing. All of these investments have raised consumer awareness and reliance on our brands.

- Expanding international and licensing distribution through direct investment in the Western Hemisphere and Europe as well as strategic partnerships with licensees and other partners. The company realized 10 percent revenue growth in licensing for the quarter and 12 percent YTD. Our International business increased and represented 12.5 percent of total revenues compared to 11.3 percent in the comparable period of the prior year.

- Expanding the DTC channel. The company DTC platform is an important component of the company's growth and profitability strategy and has made important investments in online, mobile and e-commerce to build on its track record of innovation and leadership in technology. The company realized a 1 percent comparable sales increase in DTC which represented nearly 11 percent of revenues as compared to under 10 percent in the year ago period.

- Driving operating efficiencies through process enhancements, inventory management and supply chain improvements. In the third quarter of fiscal 2016, the company realized approximately $1.1 million in savings in cost of goods and in Selling, General & Administrative Expense, while also realizing an additional tightening in inventory carry.

Fiscal 2016 Guidance

The company expects total fiscal 2016 revenues to be in a range of $910 to $920 million. Given the stronger performance in the third quarter, the company now expects adjusted earnings per diluted share for fiscal 2016 in a range of $1.81 to $1.88 as compared to the previous guidance range of $1.78 to $1.85.

Perry Ellis International, Inc. is a leading designer, distributor and licensor of a broad line of high quality men's and women's apparel, accessories and fragrances. The company's collection of dress and casual shirts, golf sportswear, sweaters, dress pants, casual pants and shorts, jeans wear, active wear, dresses and men's and women's swimwear is available through all major levels of retail distribution. The company, through its wholly owned subsidiaries, owns a portfolio of nationally and internationally recognized brands, including: Perry Ellis(R), Original Penguin(R) by Munsingwear(R), Laundry by Shelli Segal(R), Rafaella(R), Cubavera(R), Ben Hogan(R), Savane(R), Grand Slam(R), John Henry(R), Manhattan(R), Axist(R), Jantzen(R) and Farah(R). The company enhances its roster of brands by licensing trademarks from third parties, including: Nike(R) and Jag(R) for swimwear, and Callaway(R), PGA TOUR(R), and Jack Nicklaus(R) for golf apparel.