Peloton Interactive, Inc. ended the 2024 fiscal year with strong Q4 performance, meeting or exceeding guidance on all key metrics and continued to progress on several of its financial goals. The company reported that, with a stable financial foundation now in place, it can focus on innovation more strategically, enhancing the member experience and driving sustainable, profitable growth over the long term. In the fourth quarter, the fitness firm launched new content across its portfolio, emphasizing Tread programming and social tools designed to enhance community-building on its platform.

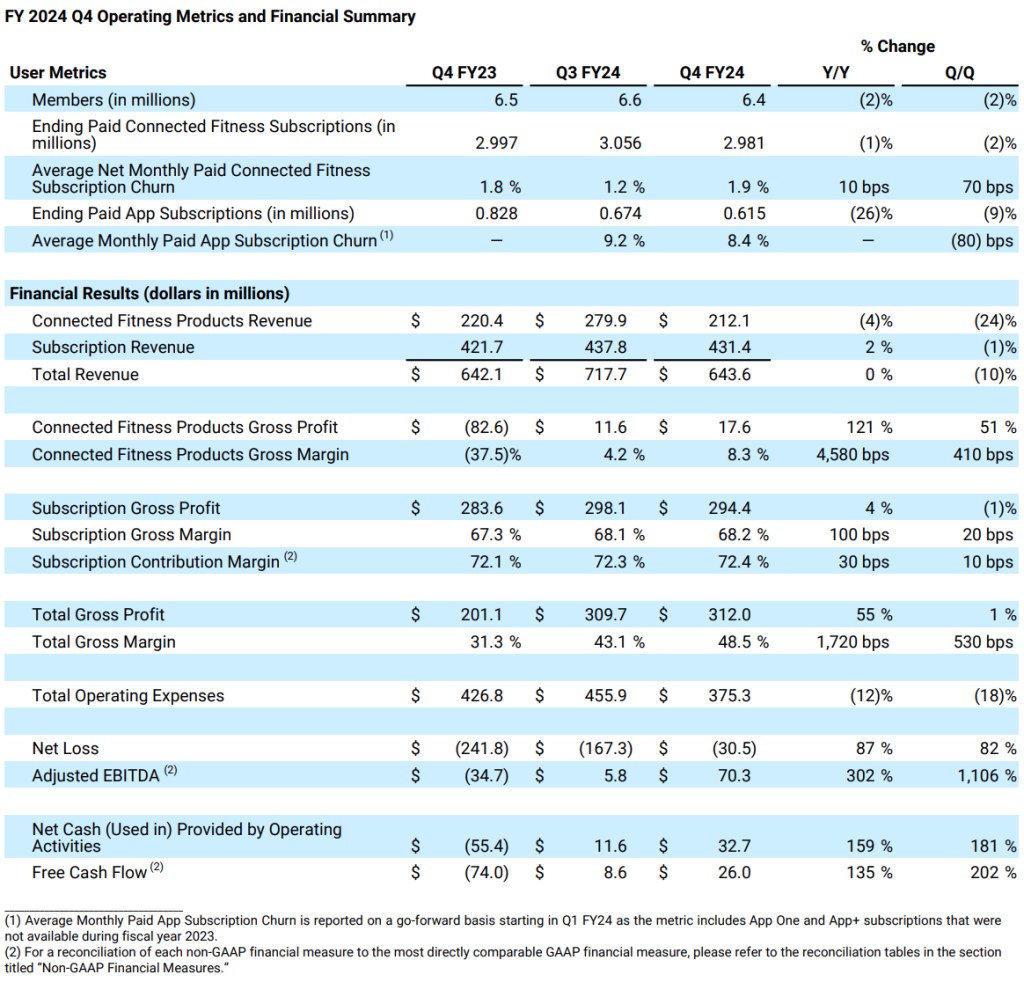

Peloton achieved modest year-over-year (y/y) revenue growth in Q4 for the first time since fiscal Q2 2022. Total revenue in the fourth quarter was $644 million, up 0.2 percent y/y, and the subscription segment delivered $431 million of revenue, up 2.3 percent y/y. This recurring subscription revenue stream continues to provide low churn with a gross margin of 68.2 percent in Q4, up 100 bps y/y.

The company said it has improved its key profitability metrics. The net Loss for Q4 was $30 million, an improvement of $211 million y/y and $137 million sequentially quarter-over-quarter (q/q). Net Cash Provided By Operating Activities was $33 million, an increase of $88 million y/y and $21 million q/q.

The company said it outperformed across all of its non-GAAP profitability metrics. It delivered positive Adjusted EBITDA and Free Cash Flow for the second consecutive quarter, which the company reported it has yet to accomplish since Q2 FY21. In Q4, PTON achieved $70 million in Adjusted EBITDA, up $105 million y/y and $64 million q/q. It also achieved $26 million in free cash flow, up to $100 million y/y, tripling compared to last quarter. The company noted it is making significant progress toward right-sizing its cost structure and will continue to optimize expenses.

PTON’s improvement in profitability reflects a continued focus on aligning costs with the size of the business, making progress toward achieving over $200 million run-rate cost savings from its restructuring plan announced in May, delivering approximately $15 million in cost savings in the quarter. This initiative remains on track to achieve the company’s anticipated savings by the end of FY25. In addition to its restructuring plan, the company began allocating media investment more efficiently. In Q4, Sales & Marketing expenses decreased by $26 million, or 19 percent y/y. The company expects continued y/y reductions in Sales & Marketing spending throughout FY25.

In May, Peloton concluded a refinancing of its balance sheet, deleveraging and extending maturities with more flexible terms at a reasonable cost of capital. It decreased debt by roughly $200 million and the average maturity was extended to 2029. With the expectation of sustainable positive Free Cash Flow, the company is looking at how to use the excess cash on its balance sheet as part of an overall capital allocation strategy.

Aside from the company’s financial improvements, it reported making headway on several other fronts.

In Q4, PTON launched the Bike+ rental program in the UK, and the early results outperformed expectations. Globally, the company’s bike rental offering continues to drive incremental subscribers with continued improvement in retention, with average net monthly paid subscription churn for rental down 110 bps y/y in Q4. Using refurbished inventory is key to achieving sustainable unit economics for its original Bike rental offering. As the company’s refurbished inventory levels come down, sufficient refurbished inventory is no longer available to support the original Bike rental program, so the company ceased offering it as of August 1. Since then, it has seen higher take rates for its other offerings catering to cost-conscious customers, including Bike+ rental, refurbished original Bike sales and financing on new Bike sales. These alternative programs have higher unit economics than original Bike rentals, with more cash paid upfront and better retention.

The secondary market continues to deliver a steady stream of paid connected fitness subscriber additions, up 16 percent y.y in Q4. The company believes “a meaningful share of these subscribers” are incremental and exhibit lower net churn rates than rental subscribers. These secondary market sales are not from Peloton-owned channels or any of its third-party distribution partners. With that in mind, the company initiated a new, one-time $95 USD/$125 CAD used equipment activation fee in the U.S. and Canada. For Peloton Bike and Bike+ purchasers, the company offers a virtual custom fitting so members can get the most out of their subscription. Subscribers also have access to a history summary on the pre-owned hardware. Peloton also offers member discounts on accessories, including bike shoes, bike mats and spare parts.

Growing its Tread business remains a primary focus. Connected Fitness revenue from its treadmill portfolio grew 42 percent y/y in Q4 and the company is making product and content investments designed to enhance walking and running on its products, achieving a 76 NPS, the highest across all of its Connected Fitness products.

To support Tread’s growth efforts, PTON launched Pace Targets in Q4, a new offering that enables instruction for personal intensity levels rather than treadmill speed, and reports seeing positive responses from repeat usage among performance runners on the platform. On Global Running Day in June, PTON launched a half marathon training program, followed by a new marketing campaign in July to help prospective members better understand the value proposition of its Tread offering. In the first few weeks, the company reported positive results in traffic to Tread product pages on its website and traffic to new pages designed to educate consumers on its treadmill offerings.

The company also reported continued progress on the turnaround of its Precor business, part of its Connected Fitness segment. Precor grew revenue by more than 20 percent y/y, partly driven by key product launches, including the FY24 launch of next-gen cardio consoles and new strength products. Gross margin improved over 22 percentage points y/y driven in part by the exit of manufacturing operations in North Carolina. Precor achieved these revenue and gross margin increases while reducing operating expenses by over 40 percent y/y in Q4 following restructuring activities.

Finally, company stakeholders remain focused on the search for Peloton’s next CEO, which is well underway.

Quarterly and Recent Highlights

Product Innovation

Peloton recently launched Find Friends to enhance community-building potential. New and prospective members can connect with existing members on the PTON network, helping to drive member retention and acquisition over time.

Peloton for Business

Peloton for Business brings Peloton to commercial settings, including gyms. In June, the company launched a pilot with the YMCA of Metropolitan Chicago, bringing Peloton to the gym with over 100 Bike+ and Rows across 15 locations in the metro Chicago area and integrating the Peloton App’s content library with over 16 modalities into the YMCA membership. PTON plans to use the partnership with the YMCA to gather insights for potential future gym-focused initiatives.

Building on content licensing, which has delivered incremental subscription revenue and subscription gross margin accretion, PTON announced a multi-year content licensing agreement with Google Fitbit last week to offer a broad portfolio of Peloton classes in the U.S., the UK, Canada, and Australia. Fitbit will distribute Peloton content to the user base on Fitbit’s App. Peloton Members will also receive offers on Google Pixel Watch and Fitbit Charge 6 devices.

Member Experience

Peloton reported that member satisfaction scores (MSAT) show that the company’s investments in improving the member experience when they contact Peloton for customer support have driven “significant improvements,” steadily improving the average MSAT every month since December 2023 from 3.4 to 4.1, an increase of 22 percent over that time period.

Operating Metrics

Paid Connected Fitness Subscriptions

We ended the quarter with 2.98 million paid connected fitness subscriptions, reflecting a net decrease of 75,000. Despite the decline, the number exceeded internal expectations due to higher gross additions in first-party, third-party retail and secondary market channels. The Average Net Monthly Paid Connected Fitness Subscription churn was 1.9 percent, which aligns with seasonality expectations for a sequential increase in Q4.

Paid App Subscriptions

We ended the quarter with 615,000 paid app subscriptions, reflecting a net reduction of 59,000. Average Monthly Paid App Subscription Churn was 8.4 percent in the quarter. PTON continues to invest in new content and features for the App, focused on enhancing its Strength content offering, personalization and social features. While in development, the company has reduced the amount of media spend supporting growth in Paid App subscriptions to maximize media efficiency.

Q4 Financial Results

Revenue

Total revenue was $643.6 million for the three months ended June 30, 2024, comprised of $212.1 million of Connected Fitness Products Revenue and $431.4 million of Subscription Revenue, outperforming the company’s $618 million to $643 million implied guidance range.

Gross Profit and Margin

Total Gross profit was $312.0 million for the three months ended June 30, 2024, yielding a gross margin of 48.5 percent versus 48 percent implied guidance. PTON’s Connected Fitness segment gross margin was 8.3 percent, slightly ahead of internal expectations, which included $10.7 million of write-offs for excess and returned inventory. The Subscription Segment gross margin of 68.2 percent was in line with expectations.

Operating Expenses

Total operating expenses, including restructuring and impairment expenses, were $375.3 million for the three months ended June 30, 2024, compared to $426.8 million for the three months ended June 30, 2023. Sales and marketing expenses decreased by $25.5 million versus the year-ago period, reflecting lower spending on advertising and marketing programs. Research and development expenses decreased by $2.8 million versus the year-ago period, primarily driven by reductions in business operations, product development and research costs. General and administrative expenses increased by $23.3 million versus the year-ago period, driven by an increase in stock-based compensation, primarily related to expenses recognized in connection with the CEO transition, partially offset by lower depreciation and amortization expense.

Peloton recognized $7.8 million of impairment and restructuring expenses this quarter, of which $8.2 million was non-cash. The non-cash charges were primarily driven by impairment losses related to Connected Fitness assets. The cash charges were primarily driven by a $3.5 million benefit to severance and other personnel costs due to reversals in severance accruals, partially offset by $3.1 million relating to exit and disposal costs and professional fees. Net Cash Provided by Operating Activities, Free Cash Flow and Cash Balance Net cash provided by operating activities was $32.7 million, and Free Cash Flow was $26.0 million. Peloton ended the quarter with $697.6 million in unrestricted cash and cash equivalents. The company also has access to a $100.0 million revolving credit facility, which remains undrawn to date

Q1 Outlook

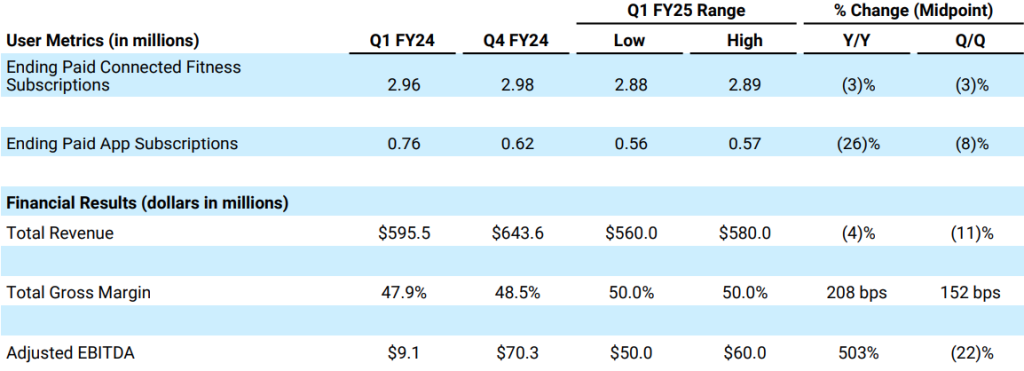

Peloton’s Q1 Paid Connected Fitness Subscription guidance reflects an expected y/y decline in hardware sales based on multiple factors. From a market perspective, Q1 is typically a seasonally low quarter for hardware sales, and the company expects continued sales headwinds as a result of an uncertain macroeconomic environment. Additionally, as the company continues to focus on sustainable, profitable growth, its sales outlook reflects its decisions to reduce sales and marketing spend y/y as it focuses on improving media efficiency, running fewer promotions within the quarter and no longer offering a rental option for its original Bike. The company expects an Average Net Monthly Paid Connected Fitness Churn rate similar to Q4 FY24.

The company’s Q1 Paid App Subscription guidance reflects an expected sequential decline in gross additions due to seasonality and sequential improvement in Average Monthly Paid App Subscription Churn due to stabilization in our Corporate Wellness Paid App subscriber base. The company’s Q1 Revenue guidance reflects the hardware sales and subscription trends mentioned above. It expects a sequential increase in Q1 total gross margin due to a seasonal mix-shift toward its Subscription segment. PTON also expects a significant y/y improvement in Q1 Adjusted EBITDA mainly due to lower sales and marketing expenses and continued progress toward achieving our cost reduction plan.

Q1 FY25 Outlook

Full Year Outlook

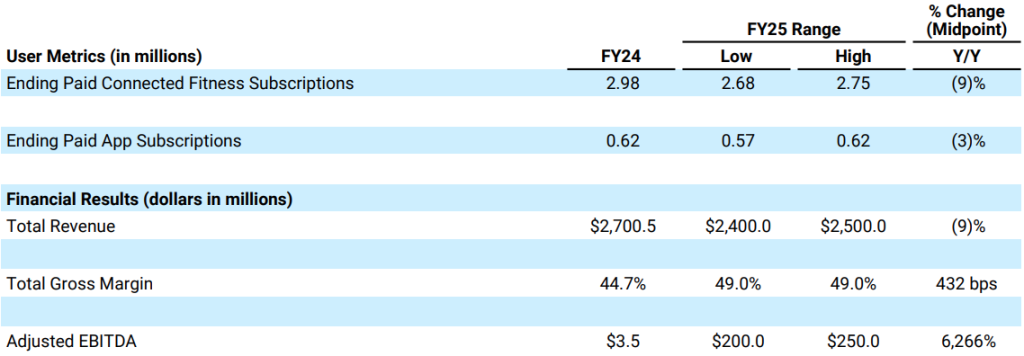

PTON’s full-year FY25 guidance reflects the expectation that hardware sales will decline y/y and that Average Net Monthly Paid Connected Fitness Churn will continue to increase modestly y/y and follow the company’s historical seasonal pattern. Peloton’s FY25 guidance range for Paid Connected Fitness Subscriptions reflects a broad range of potential outcomes. The company reported it will continue to refine its strategy over the year, which could include possible changes in pricing, promotional strategies and other levers to pull to achieve financial targets. Any changes in these areas could affect its gross additions for Paid Connected Fitness Subscriptions and Paid App Subscriptions. Additionally, as the company continues to improve its Member experience, it sees opportunities to improve engagement, which could enhance its Average Net Monthly Paid Churn rates for both Connected Fitness and App. While the company is optimistic that it can improve engagement through product and content innovation and evolve its marketing strategy, it is uncertain when it will start to see a “meaningful benefit: from its efforts.

The company’s Guidance for Paid App Subscriptions reflects a y/y decline at the midpoint. The company decided to reduce media spend supporting the App while investing in innovating the product to improve the Member experience and lower churn.

PTON’s Revenue outlook is tempered by uncertainty surrounding its ability to grow Paid Connected Fitness efficiently and Paid App subscribers, including an assumption that its investments in new initiatives will not deliver subscriber growth within the fiscal year and an uncertain macroeconomic outlook. Gross margin is expected to improve y/y due to Connected Fitness’ gross margin expansion and revenue mix shift toward its Subscription segment. The company’s Adjusted EBITDA guidance reflects a significant y/y improvement in profitability primarily due to gross margin expansion, the operating cost savings it expects to achieve related to its previously announced cost restructuring plan, and lower y/y media spend. PTON also expects to deliver free cash flow on a full-year basis of at least $75 million.

FY25 Outlook

Peloton’s outlook for FY25 prioritizes improving profitability and Free Cash Flow. The company remains optimistic about its content and product development investments and will share new features in upcoming quarters. As it tests new fitness and wellness offerings, the company expects it will take time to apply what it has learned and iterate on these features before it can enhance the Member experience.

As a result, PTON’s outlook does not include a benefit to connected fitness hardware sales in FY25 from its growth initiatives. By aligning its cost structure better to the current size of its business and a planned path to sustainable positive Free Cash Flow, PTON believes that it now has a solid foundation upon which to build long-term, profitable growth and shareholder value.

Image courtesy Peloton