Peloton Interactive, Inc. reported total revenue for the fiscal first quarter ended September 30 declined 3 percent to $595.5 million, in line with the company’s $580 million to $600 million guidance range.

- Subscription segment revenue rose 1 percent Y0Y to $415.0 million but declined 2 percent versus the prior quarter.

- Connected Fitness segment revenue fell 12 percent year-over-year (YoY) to $180.6 million and fell 18 percent quarter-over-quarter.

Total gross margin was 47.9 percent of sales in fiscal Q1, versus guidance of 46.5 percent guidance, and a 1270 basis point improvement from the year-ago period.

- Subscription segment gross margin was 67.4 percent in fiscal Q1, in line with expectations, and up 120 basis points versus the year-ago period.

- Connected Fitness segment gross margin was 3.1 percent, slightly ahead of expectations, but still more than 30 full points improvement versus the prior-year quarter.

“As our inventory levels normalize and we continue to realize the benefits of our supply chain restructuring actions, we’re seeing significant reductions in our landed and delivery costs. Across our bike portfolio, our blended landed cost per unit was down 17 percent year over year as compared to the three months ended September 30, 2022, as inventory sold last year was burdened with high historical inbound logistics costs. Last mile cost per delivery was down 36 percent year over year, as we see continued benefits from our logistics outsourcing,” explained company CFO Liz Coddington in an investor letter.

Total operating expenses, including restructuring and impairment expenses, were $417.6 million for the fiscal first quarter.

- General and administrative expense decreased by $42.4 million versus the year-ago period, primarily driven by decreases in stock-based compensation expense of $16.9 million, said to be largely due to normalizing of stock-based compensation expense following the acceleration of certain restricted stock unit vesting schedules and the repricing of certain stock option awards during the three months ended September 30, 2022, as well as reductions in personnel-related expenses, legal fees, other professional fees.

- Sales and marketing expense increased $7.4 million versus the year-ago period. Lower personnel-related, stock-based compensation,

and retail showroom expenses were said to be offset by increased investment in acquisition marketing. - Research and development expense reportedly decreased $9.4 million versus the year-ago period, primarily driven by reductions in stock-based compensation expense and product development and research costs.

Peloton recognized $41.9 million of impairment and restructuring expense in the quarter, of which $31.2 million was non-cash. The non-cash charges were said to be primarily related to asset write-downs and write-offs in relation to Peloton Output Park, the closure of retail showroom locations, and other manufacturing and software assets. The cash charges were reportedly comprised of $6.1 million of severance payments as well as $4.5 million relating to other items including facility exit costs.

Peloton posted a net loss of $159.3 million in the first quarter, compared to a net loss of $408.5 million in the year-ago first quarter.

Net cash used in operating activities was negative $79.2 million and free cash flow was negative $83.2 million, of which $23.5 million was associated with the previously-announced Bike seat post-recall.

Peloton ended the quarter with $748.5 million in unrestricted cash and cash equivalents.

The company has access to a $400.0 million revolving credit facility, which remains undrawn to date.

Guidance

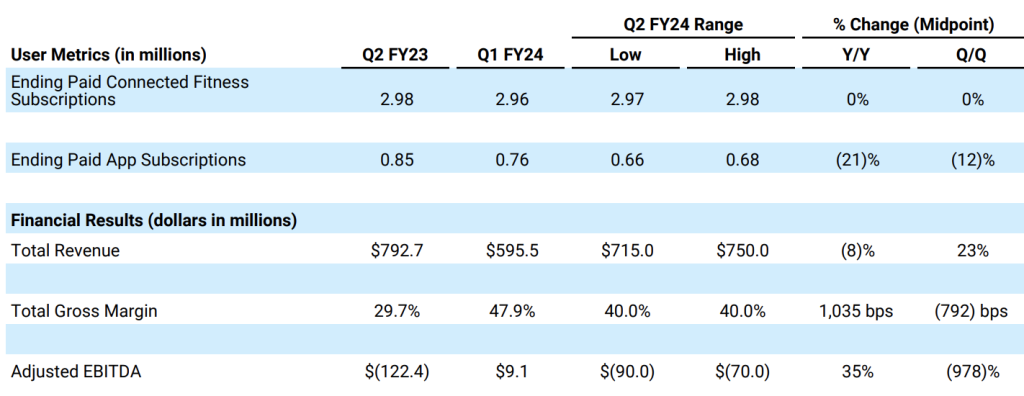

Looking ahead, the company’s second-quarter Paid Connected Fitness Subscription guidance reflects seasonal growth in hardware sales coupled with a continued uncertain macroeconomic environment. Peloton also expects modest sequential improvement to Paid Connected Fitness Subscription churn as Members continue to unpause their subscriptions related to the seat post-recall, coupled with seasonal reductions in churn.

The second quarter Paid App Subscription guidance is said to reflect a sequential improvement in gross additions due to improvements to the conversion funnel to reduce the cannibalization of paid additions from our free tier. The company expects Paid App gross additions to be more than offset by a sequential increase in Paid App Subscription churn due to the expiration of legacy content access for the portion of App subscribers who joined Peloton prior to the announcement of paid tier pricing in May 2023.

Coddington said in the letter that the company expects a sequential decline in Q2 total gross margin as a result of a seasonal mix-shift toward our Connected Fitness segment.

“We also expect a sequential decline in Q2 Adjusted EBITDA; although revenue is expected to increase vs. prior quarter, higher sales and marketing expense will lead to an overall reduction in Adjusted EBITDA,” she shared.

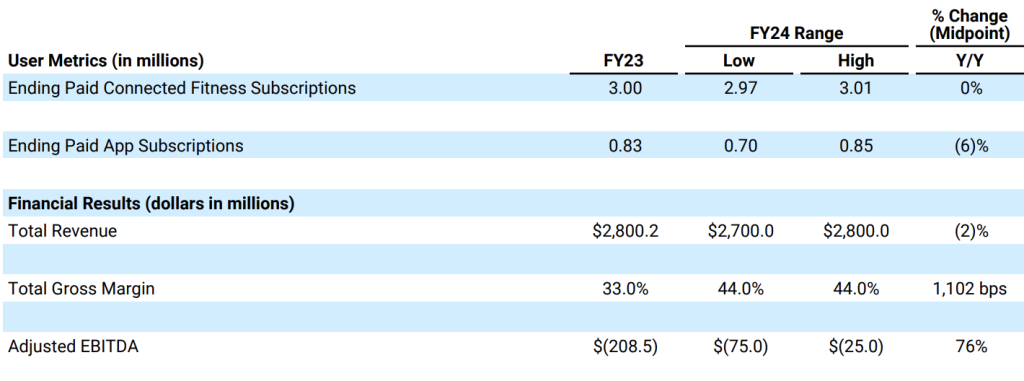

For the full 2024 fiscal year, Peloton’s guidance is said to reflect revenue growth acceleration in the second half of the fiscal year, fueled, in part, by the expected relaunch of Tread+. It also reportedly reflects the expected continued growth of the Bike rental program and strong growth in International markets.

“All of this is tempered by uncertainty related to the performance of the Tread+ relaunch, our ability to efficiently grow Paid App subscribers and other new initiatives, as well as an uncertain macroeconomic outlook,” the CFO cautioned.

“With the distractions of the past few months solidly behind us, Q1 was focused on preparing for the all-important holiday selling season, Coddington concluded in the letter. “With the early performance of our brand refresh, new partnerships, improved features and functionality in our connected fitness platform and our App, and continued investments in our hardware products, we remain optimistic about our ability to accelerate subscriber growth in Q2 and the remainder of fiscal year 2024.”

Photo courtesy Peloton