Oxford Industries, Inc., owner of the Tommy Bahama, Duck Head, Jack Rogers,Johnny Was, and Lily Pulitzer lifestyle brands, reported consolidated net sales in the fiscal 2024 13-week fourth quarter were $391 million compared to $404 million in the 14-week fourth quarter of fiscal 2023.

“We are pleased to report fourth quarter net sales and adjusted earnings per share that were near the top end of our guidance ranges,” offered Tom Chubb, chairman and CEO, Oxford Industries, Inc. “Our results were driven by a successful holiday season as our consumer showed up to buy their loved ones and friends the gifts that they really wanted from the brands that they love. Following a strong finish to calendar year 2024, trends moderated in January as there was less of a reason to shop, a pattern we’ve witnessed for the past several quarters, as well as a deterioration in consumer sentiment that also weighed on demand.”

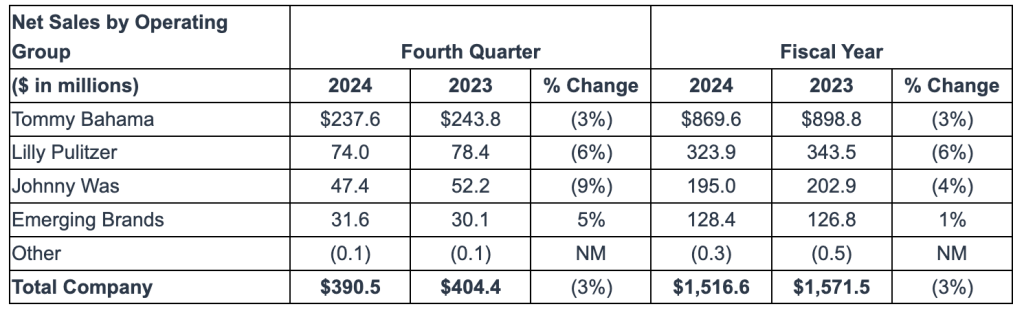

Consolidated net sales for the 52-week fiscal 2024 year decreased 3 percent to $1.52 billion compared to $1.57 billion in the 53-week fiscal 2023 year.

Sales by Operating Group

For the full fiscal year 2024, full-price DTC sales of $1.0 billion decreased 3 percent versus fiscal 2023.

For the fourth quarter, full-price DTC sales of $282 million in fiscal 2024 decreased 1 percent versus the prior-year fourth quarter.

Full-price retail sales of $524 million decreased 2 percent for the year.

For the fourth quarter, full-price retail sales of $136 million decreased 1 percent.

E-commerce sales of $519 million decreased 4 percent for the year.

For the fourth quarter, e-commerce sales of $145 million decreased 1 percent.

Outlet sales of $75 million increased 3 percent for the year. For the fourth quarter, outlet sales were flat.

Food and beverage sales grew 1 percent for the year. For the fourth quarter, food and beverage sales decreased 7 percent.

Wholesale sales of $281 million decreased 10 percent for the year.

For the fourth quarter, wholesale sales of $61 million decreased 13 percent.

Profitability and Expenses

Gross margin was 62.9 percent on a GAAP basis and 63.2 percent on an adjusted basis for the full fiscal year 2024 compared to 63.4 percent on a GAAP basis and 64.0 percent on an adjusted basis in the prior year.

For the fourth quarter of fiscal 2024, gross margin was 60.6 percent on a GAAP basis and 60.8 percent on an adjusted basis compared to 60.9 percent on a GAAP basis and 61.7 percent on an adjusted basis in the prior year.

The decreased gross margin for both the fourth quarter and year was primarily due to full-price retail and e-commerce sales representing a lower proportion of net sales at Tommy Bahama, Lilly Pulitzer and Johnny Was with more sales occurring during promotional and clearance events.

SG&A was $855 million for the full fiscal year 2024 compared to $821 million in the prior year. On an adjusted basis, SG&A was $841 million compared to $807 million in the prior year.

For the fourth quarter, SG&A was $220 million compared to $218 million in the prior year. On an adjusted basis, SG&A was $216 million compared to $214 million in the prior year.

The increase in SG&A for the full fiscal year 2024 was primarily driven by:

- The annualization of expenses related to the 23 net new stores opened in fiscal 2023 and the 30 net new store openings during fiscal 2024, including three Tommy Bahama Marlin Bars;

- Pre-opening expenses related to five Tommy Bahama Marlin Bars, three of which opened in Fiscal 2024 and two that opened last week; and

- The addition of Jack Rogers.

Full year EPS was $5.87 compared to $3.82 in fiscal 2023. Fiscal 2023 results included non-cash impairment charges totaling $114 million, or $5.32 per share primarily associated with the Johnny Was reporting unit. On an adjusted basis, EPS was to $6.68 in fiscal 2024 compared to $10.15 in fiscal 2023.

Fourth quarter diluted earnings per share (EPS) on a GAAP basis was $1.13 compared to a loss per share of $3.85 in the fourth quarter of fiscal 2023. On an adjusted basis, EPS was $1.37 compared to $1.90 in the fourth quarter of fiscal 2023.

Full-year operating income was $119 million in fiscal 2024, compared to $81 million in fiscal 2023. On an adjusted basis, full-year operating income was $136 million compared to $216 million in fiscal 2023.

For the fourth quarter of fiscal 2024, on a GAAP basis, operating income was $20 million compared to an operating loss of $81 million in the prior year, while adjusted operating income was $25 million in fiscal 2024 and $39 million in fiscal 2023.

Interest expense decreased to $2 million from $6 million in the prior year period primarily due to lower average outstanding debt during fiscal 2024 than the prior year.

The effective tax rate for fiscal 2024 was 20 percent compared to 19 percent for fiscal 2023, both of which are lower than a typical effective tax rate of 25 percent.

The effective tax rate for the fourth quarter of fiscal 2024 was 8 percent compared to 27 percent for the fourth quarter of fiscal 2023. The effective tax rates for each period included certain favorable discrete items that are not expected to recur in future periods.

Balance Sheet and Liquidity

Inventory increased $8 million, or 5 percent, on a LIFO basis and increased $11 million, or 5 percent, on a FIFO basis compared to the end of fiscal 2023 primarily due to the timing of the Chinese New Year and early shipments from Asia. The company said it believes that inventory levels in all operating groups are appropriate to support anticipated sales plans.

During fiscal 2024, cash flow from operations was $194 million compared to $244 million in fiscal 2023. The cash flow from operations in fiscal 2024, along with borrowings under our credit facility, provided sufficient cash to fund $134 million of capital expenditures, $43 million of dividends and our working capital needs.

Long-term debt increased by $2 million to $31 million of borrowings outstanding at the end of fiscal 2024 as increased capital expenditures primarily associated with the project to build a new distribution center in Lyons, Georgia, acquisitions of $8 million, payments of dividends and working capital requirements nominally exceeded cash flow from operations. At the end of fiscal 2024, the Company had $9 million of cash and cash equivalents versus $8 million of cash and cash equivalents at the end of fiscal 2023.

Dividend

On March 24, 2025, the Board of Directors declared a quarterly cash dividend of $0.69 per share, or a 3 percent increase above the previous dividend payment. The dividend is payable on May 2, 2025 to shareholders of record as of the close of business on April 17, 2025. The Company has paid dividends every quarter since it became publicly owned in 1960.

Share Repurchases

The company initiated, and completed, a $50 million 10b5-1 program in the first quarter of fiscal 2025 under its December 10, 2024 $100 million share repurchase authorization. The Company repurchased 842,000 shares, or approximately 5 percent of outstanding shares, at an average price of $59.38.

On March 24, 2025, our Board of Directors authorized us to spend up to $100 million to repurchase shares of our stock. This authorization superseded and replaced all previous authorizations to repurchase shares of our stock and has no automatic expiration.

Outlook

The company initiated sales and EPS guidance for fiscal 2025, and expects net sales in a range of $1.49 billion to $1.53 billion compared to net sales of $1.52 billion in fiscal 2024. In fiscal 2025, GAAP EPS is expected to be between $4.21 and $4.61 compared to fiscal 2024 GAAP EPS of $5.87. Adjusted EPS is expected to be between $4.60 and $5.00, compared to fiscal 2024 adjusted EPS of $6.68.

Fiscal 2025 EPS figures include a return to a normalized effective tax rate of 25 percent in 2025 that will result in a 20 cents to 25 cents per share negative impact after certain favorable discrete items lowered the tax rate in fiscal 2024. The fiscal 2025 guidance also includes a $9 million to $10 million, or approximately 45 cents to 50 cents per share negative impact from recently enacted, additional tariffs that are currently in effect.

For the first quarter of fiscal 2025, the company expects net sales to be between $375 million and $395 million compared to net sales of $398 million in the first quarter of fiscal 2024. GAAP EPS is expected to be in a range of $1.61 to $1.81 in the first quarter compared to GAAP EPS of $2.42 in the first quarter of fiscal 2024. Adjusted EPS is expected to be between $1.70 and $1.90 compared to adjusted EPS of $2.66 in the first quarter of fiscal 2024.

The company anticipates interest expense of $7 million in fiscal 2025, or a 20 cents to 25 cents per share increase, including $2 million in the first quarter of fiscal 2025.

“We expect higher average debt levels in fiscal 2025 due to capital expenditures primarily associated with completing the new Lyons, Georgia distribution center, opening new stores and the share repurchases executed during the first quarter of fiscal 2025,” the company noted in a media statement.

Capital expenditures in fiscal 2025 are expected to be approximately $125 million compared to $134 million in fiscal 2024. The decrease is due to reductions in expenditures related to the completion of the new distribution center in Lyons, Georgia, along with fewer new store openings.

“We will also continue with our investments in our various technology systems initiatives, data management and analytics, customer data and insights, cybersecurity, automation (including artificial intelligence) and infrastructure,” the company closed.

Image courtesy Tommy Bahama/Oxford Industries, Inc.