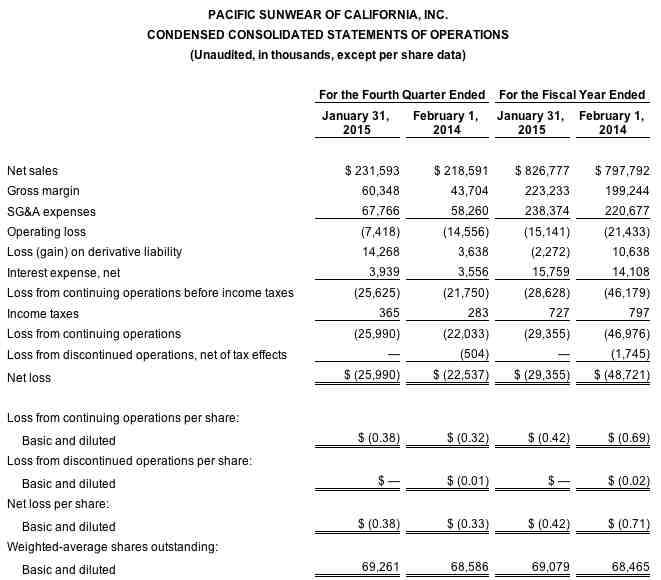

Pacific Sunwear of California reported sales grew 5.9 percent in the fourth quarter ended Jan. 31, to $231.6 million versus sales of $218.6 million a year ago.

Pacific Sunwear of California reported sales grew 5.9 percent in the fourth quarter ended Jan. 31, to $231.6 million versus sales of $218.6 million a year ago.

Comparable store sales for the fourth quarter of fiscal 2014 increased 6 percent. The company ended the fourth quarter of fiscal 2014 with 605 stores versus 618 stores a year ago.

“We are very pleased with our Q4 results led by a 6 percent increase in same-store sales and a $7 million improvement in our operating results,” said Gary H. Schoenfeld, president and CEO. “This also marks our 12th straight quarter of positive comparable store sales and for fiscal 2014, a 500 basis point increase in gross margins over this same three year period which has been characterized as a highly promotional environment for our industry.”

“Building on a strong finish to 2014, we continue to believe in the distinct positioning that we are creating for PacSun which includes developing the most relevant Men's and Women's brands for our targeted 17-24 year old customers and showcasing the creativity, diversity and optimism that embodies Southern California lifestyle,” Mr. Schoenfeld said. “We are excited as we begin the new year and believe that our brand initiatives for 2015 have never been more compelling in the 35 year history of PacSun.”

Schoenfeld added, “Looking ahead, we are similarly focused on our financial goals for fiscal 2015 which include: continuing to achieve positive comparable store sales; furthering our gross margins through elevated merchandising and inventory productivity; and incrementally leveraging expenses. This year will also include investments in key omni-channel initiatives which we believe will further strengthen our position for the long-term.”

Fourth Quarter Results

On a GAAP basis, the company reported a loss from continuing operations of $26.0 million, or 38 cents per diluted share, for the fourth quarter of fiscal 2014, compared to a loss from continuing operations of $22.0 million, or 32 cents, for the fourth quarter of fiscal 2013. The loss from continuing operations for the company's fourth quarter of fiscal 2014 included a non-cash loss of $14.3 million, or 21 cents, compared to a non-cash loss of $3.6 million, or 5 cents, for the fourth quarter of fiscal 2013, related to the derivative liability that resulted from the issuance of Convertible Series B Preferred Stock in connection with the term loan financing the company completed in December 2011.

On a non-GAAP basis, excluding the non-cash loss on the derivative liability, other one-time charges, and assuming a tax benefit of approximately $4.0 million, the company would have incurred a loss from continuing operations for the fourth quarter of fiscal 2014 of $7.1 million, or 10 cents per diluted share, as compared to a loss from continuing operations of $11.8 million, or 17 cents per diluted share, for the same period a year ago.

The retailer in early January had forecast a non-GAAP loss in the range of 11 to 12 cents.

Full Year Results

Net sales for fiscal 2014 were $826.8 million versus net sales of $797.8 million for fiscal 2013. Comparable store sales increased 3 percent during fiscal 2014.

On a GAAP basis, the company reported a loss from continuing operations of $29.4 million, or $(0.42) per diluted share, for the 2014 fiscal year, compared to a loss from continuing operations of $47.0 million, or $(0.69) per diluted share for the 2013 fiscal year. The loss from continuing operations for the 2014 fiscal year included a non-cash gain of $2.3 million, or $0.03 per diluted share, compared to a non-cash loss of $10.6 million, or $(0.16) per diluted share for the 2013 fiscal year, related to the derivative liability.

On a non-GAAP basis, excluding the non-cash gain on derivative liability, and assuming a tax benefit of approximately $10.9 million, the company would have incurred a loss from continuing operations for the 2014 fiscal year of $18.5 million, or $(0.27) per diluted share, as compared to a loss from continuing operations of $23.1 million, or $(0.34) per diluted share, for the 2013 fiscal year.

Financial Outlook for First Quarter of Fiscal 2015

The company's guidance range for the first quarter of fiscal 2015 contemplates a non-GAAP loss per diluted share from continuing operations of between $(0.14) and $(0.11), compared to $(0.11) in the first quarter of fiscal 2014. The company stated that it believes the disruption at the Southern California ports, coupled with severe cold weather in many parts of the country has adversely affected comparable store sales by 2-3 percent and its first quarter non-GAAP loss per diluted share by approximately $(0.03) to $(0.04).

The first quarter non-GAAP guidance range is based on the following assumptions:

- Comparable store sales from minus 1 percent to plus 2 percent;

- Revenue from $167 million to $173 million;

- Gross margin rate, including buying, distribution and occupancy, of 26 percent to 28 percent;

- SG&A expenses in the range of $51 million to $53 million; and

- Applicable non-GAAP adjustments are tax effected using a normalized annual income tax rate.

- The company's first quarter of fiscal 2015 guidance range excludes the quarterly impact of the change in the fair value of the derivative liability due to the inherently variable nature of this financial instrument.

Derivative Liability

In fiscal 2011, as a result of the issuance of the Series B Preferred in connection with the company's $60 million senior secured term loan financing with an affiliate of Golden Gate Capital, the company recorded a derivative liability equal to approximately $15 million, which represented the fair value of the Series B Preferred upon issuance. In accordance with applicable U.S. GAAP, the company has marked this derivative liability to fair value through earnings and will continue to do so on a quarterly basis until the shares of Series B Preferred are either converted into shares of the company's common stock or until the conversion rights expire (December 2021).

As of Mar. 25, 2015, the company operates 605 stores in all 50 states and Puerto Rico.