Pacific Sunwear management said that they are pursuing a new segmented retail strategy with “value” stores and “core” stores carrying different assortments at different price points. This new assortment in the “value” stores has already started improving margins by roughly 150-200 basis points along with a slight sales up-tick.

“As we were liquidating footwear over the past year, it became apparent that there was a value customer that we could serve better,” said PacSun CEO Sally Frame Kasaksshe. “As a result, we began to expand the so-called value assortment in these stores to also include additional apparel promotions and keep opening price points.”

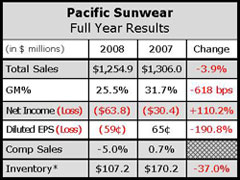

Fourth quarter sales declined 8.5% to $351.7 million from $384.3 million last year, a decline of 8.5%. Same-store sales declined 10% for the quarter while e-commerce sales grew 35% during the period to nearly $18 million compared to $13 million last year.

Much of the fourth quarter focus was placed on inventory reduction through promotional pricing. While this helped move merchandise off the floor, gross margins were considerably eroded. For the fourth quarter, gross margin declined to 16.1% of sales compared to 31.8% of sales last year. PSUNs net loss from continuing operations was $27.6 million or 42 cents per diluted share versus income from continuing operations of $19.6 million or 28 cents per share last year.

The action sports retail chain ended the quarter with 932 stores versus 954 stores last year.

The promotional activity helped pull inventories down 30% per square foot in dollars and 19% per square foot in units. These lower inventory levels are intended to provide PSUN with enough flexibility to absorb sustained negative comps, protect gross margins, chase inventory on trend-right goods and be promotional where needed to drive improved traffic. Management expects to maintain significantly reduced inventory levels throughout the year.

Looking forward, PacSun is assuming a same-store sales decline in the low 20% range for the first quarter and a first quarter loss of 26 cents to 31 cents per diluted share.