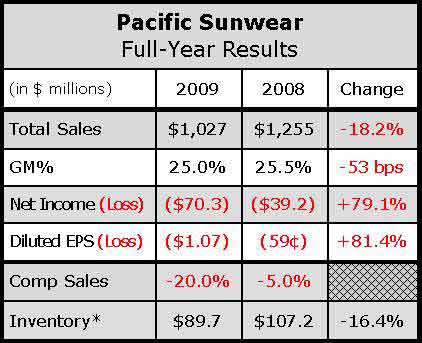

Facing significant and continuing challenges from its juniors business, Pacific Sunwear reported losses widened and sales fell in a fourth quarter that capped off what management called another very difficult year for PacSun. Sales for the Anaheim-CA beach-inspired apparel teen retailer fell 16.8% to $292.6 million in Q4 from $351.7 million in the prior-year period as comps plummeted 19% on fewer transactions.

Throughout a conference call with analysts, management for PacSun stressed the underperformance of juniors as a whole, and maintained that the company will be drastically changing its approach in the near future to get underneath

and look at the opportunities we have in both genders and in key categories of both genders. Management outlined six initiatives to achieve growth which will be based around product strategy, organization and culture, clarity of the consumer, localization in merchandising, market initiatives and leadership from recent personnel additions.

Specifically for the juniors business, CEO Gary Schoenfield said PacSun would focus on elevating the age range of its juniors customer to minimize promotional pressures while also expanding its knowledge of the female consumer and which brands and products she identifies with.

Management also noted that the retailer has seen recent strength from its young mens business, driven by board shorts, denim and tees; and added that PacSun has seen merchandise margins improve 890 basis points on a year-over-year basis. Gross margins for the quarter improved to 22.6% from 16.1% last year.

PacSun reported a net loss of $36.5 million, or 56 cents per diluted share, in Q4, as compared to a net loss of $27.0 million, or 42 cents per diluted share, in the prior-year period. PSUN recorded a non-cash charge of $19 million, or 29 cents per share, in fiscal Q4 2009 to provide a valuation allowance against certain of its deferred tax assets.

Regarding outlook, PacSun management expects to reports a non-GAAP net loss of between 32 cents and 38 cents per diluted share. Same-store sales are expected to decline between 13% and 18%, with the gross margin rate including buying, distribution and occupancy to be between 19% and 20%. For fiscal 2010, the company projected sequential improvement for comps with a gross margin target of 50 to 100 BPS improvement.