Rack Room Shoes Opens in Greeley, Colorado

The newest location is 5,600 square feet and features footwear for men, women and kids. The store will host a grand opening on August 2. Headquartered in Charlotte, NC, Rack Room Shoes has over 520 locations nationwide under the Rack Room Shoes and Off Broadway Shoe Warehouse brands.

Kontoor Brands Expands Executive Leadership Roles

Jenni Broyles will assume leadership responsibility for all international and commercial operations for the Lee and Wrangler brands as executive vice president, chief commercial officer and global head of Brands; Joseph Alkire will assume leadership responsibility for Kontoor’s supply chain operations as executive vice president, chief financial officer and global head of Operations.

EXEC: PwC Sees Continued Sluggish M&A Activity in Consumer Sector In Second Half

After a timidly optimistic start to the year, the global M&A market cooled in the first half, conditioned by a highly uncertain economic and geopolitical environment, and is expected to remain challenged in the back half, according to PwC’s mid-year report. Between January and May 2025, M&A global volume in the consumer sector fell 9 percent.

La Jolla Group Beefs Up Executive Leadership Team

The parent of O’Neill Clothing, Mountain Khakis and other apparel brands, has hired Nathan Boroff as CFO, David Kranz as VP of growth & partnerships and Ted Bramble as creative director.

Merrell Appoints Kathy Forstadt to Director of U.S. Lifestyle and Pure Play Accounts

The former Senior Director of Merchandising at Zappos has been named director of Lifestyle and Pure Play for U.S. Wholesale, a newly created role at Merrell. Forstadt will report to Jessica Adler, VP of Sales.

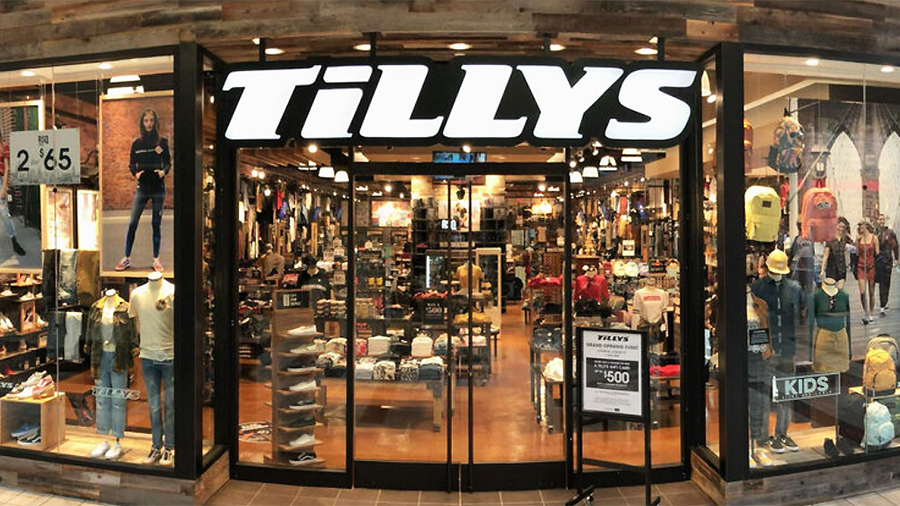

Tilly’s Inc. Names Nate Smith as New President and CEO

Smith has served as CEO of Marolina Outdoor, Inc. since September 2024. Previously, he was at Boardriders, Inc. as president, Americas. Prior to Boardriders, Smith served as VP/GM, North American Wholesale at Oakley, Inc. and as VP, Oakley Defense. He has also served in executive roles at Ipath Footwear, MV Transportation, Inc. and Patagonia, Inc., following his eight years of service in the United States Navy.

Compass Diversified Agrees to Extended Forbearance with Lender Group

The parent of the 5.11, Boa and Primaloft brands has entered into a second forbearance agreement with its lender group on July 25, 2025, extending the prior forbearance period until October 24, 2025.

Columbia Sportswear Sues Columbia University

The University and the sportswear company tackled the problem in 2023, Columbia Sportswear said, when it signed an agreement that allowed the University to sell Columbia-emblazoned gear, as long as it also featured some of the University’s indicia (symbols that indicate the school alone), which include a shield, a crown, a “C” design, or Columbia’s lion mascot.

Parent of Oboz and Rip Curl Appoints CFO

KMD Brands, Ltd. appointed Carla Webb-Sear as chief financial officer. She joins the company from Qantas, where she served as chief financial and strategy officer of its Loyalty Division. Webb-Sear will be based at the Group’s global headquarters in Melbourne, Australia.

Polygiene’s Loss Widens in Q2, Blames U.S. Tariffs

Sales in the quarter ended June 30 amounted to SEK 31.9 million ($3.4 mm), down 12.2 percent from SEK 36.4 million a year ago. The loss was SEK 3.13 million, compared to a loss of SEK 1.37 million a year ago.

Scheels to Open Location in Blaine, Minnesota

Scheels announced plans to open a 250,000-square-foot store in Blaine, MN, in spring 2028. The location will be the company’s second location in the Twin Cities metro, joining Eden Prairie, and sixth in the state.

EXEC: Grassroots President Gabe Maier Talks About Connections

Gabe Maier, president of Grassroots Outdoors Alliance talked with SGB Executive about the work the membership organization is doing on behalf of independent outdoor retailers, its evolving Connect show and the prospects for a national show for the outdoor industry.

Rouvy Acquires Bkrool Indoor Cycling Platform

Czech-based indoor cycling platform Rouvy reached an agreement to acquire Spain-based competitor Bkrool. The acquisition will support Rouvy’s expansion with Bkrool having a strong presence in Spain (and Spanish-speaking countries), France and Denmark. Bkrool will continue as a standalone brand within The Rouvy Group.

Backcountry Acquires Local Utah Outdoor Value Retailer Level Nine Sports

The deal is expected to benefit Level Nine Sports’ e-commerce capabilities and physical retail experience while providing a wider range of cost-conscious outdoor goods to Backcountry customers.

Deckers Brands Nominates Former Starbucks and Hyatt CFO to Board

Grismer brings over 35 years of financial leadership experience at major global consumer companies. He currently serves on the Board of Directors of Krispy Kreme and has recently served as Chair of the Board of Directors of Panera Brands.