Retailers reported a 93 percent increase in the average number of shoplifting incidents per year in 2023 versus 2019 and a 90 percent increase in dollar loss due to shoplifting over the same period, according to a new study released by the National Retail Federation (NRF).

Conducted in partnership with the Loss Prevention Research Council and sponsored by Sensormatic Solutions, “The Impact of Retail Theft & Violence 2024” examines how theft and violence have evolved since before the pandemic and how retailers are combatting today’s retail crime landscape.

“Retailers continue to navigate a rising retail theft landscape that has evolved significantly over time,” said the NRF’s Vice President for Asset Protection and Retail Operations David Johnston. “Protecting store associates and customers, coupled with reducing today’s levels of violence and retail crime, requires a whole-community approach and collaboration across all stakeholders.”

According to the study, retailers surveyed experienced an average of 177 shoplifting incidents per day in 2023. However, that number can reach over 1,000 depending on the retail sector.

Historically, shoplifting was viewed primarily as a crime driven by need or based on opportunity. Individuals enter a store, select items of personal use like food, clothing or personal hygiene, conceal the items and attempt to leave the store unnoticed by store employees. Some incidents may have involved those afflicted or addicted, with others stealing items to quickly sell for cash. Even incidents like “smash-and-grabs” or “mob thefts” occurred occasionally, for example, in a burglary during non-operating hours or looting during civil unrest. Retailers, for the most part, were able to mitigate the impact of these incidents, placing appropriate security measures to help prevent and deter loss. Over the past several years, however, there has been a visible change in the landscape of retail theft in terms of the frequency, scope, and types of theft.

As retail has evolved, so have retail criminals. Over half of respondents report that ORC shoplifting, shoplifting, e-commerce theft, repeat offenders, and buy online, pick up in store fraud, buy online, return in store fraud and return fraud are all more of a concern than they were a year ago.

Shoplifting incidents are on the rise. Retailers surveyed experienced a 93 percent increase in the average number of shoplifting incidents per year in 2023 versus 2019 and a 90 percent increase in dollar loss due to shoplifting during that same period. And the rise in shoplifting has continued post-pandemic.

From 2022 to 2023, retailers surveyed saw an average 26 percent increase in shoplifting incidents. Shoplifting has become a problem many retailers face daily. Those surveyed experienced an average of 177 shoplifting incidents per day in 2023, but that can increase to over 1,000 depending on the retail sector.

Violence on the Rise

Violence remains a significant and growing concern for the retail industry.

“About three-quarters (73 percent) of those retailers surveyed said that shoplifters are exhibiting more violence and aggression than they were a year ago, and 91 percent said that shoplifters are exhibiting more violence and aggression compared with 2019,” the NRF said in the study summary. “Still, retailers continue to take measures to keep those within their retail environments safe. Compared with their last fiscal year, 71 percent of retailers have increased their budgets to support employee training related to workplace violence.”

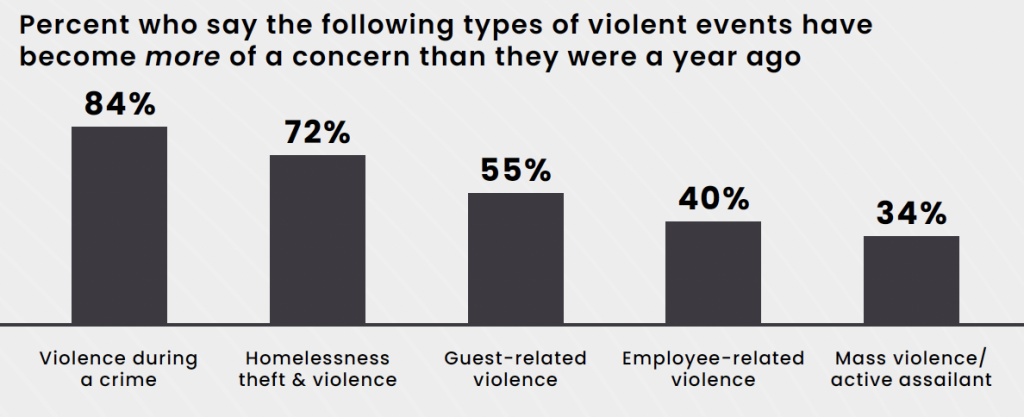

The report indicated that 84 percent of those retailers surveyed said that violence during a crime has become more of a concern in the last year.

Between 2022 and 2023, retailers that tracked these incidents saw a 42 percent increase in shoplifting incidents that involved threats or acts of violence and a 39 percent increase in incidents involving the threat, display or use of a weapon. Retailers, increasingly, must account for the potential for violence, whether during a crime, active assailant threat or acts associated with individuals disrupting their business environment.

“Retailers and solution providers must work together to build and drive technology that goes beyond thwarting theft in the moment to predicting it, so we can proactively lower the chance of violence by mitigating crime,” offered Sensormatic Solutions President Tony D’Onofrio. “Neither party can accomplish this feat alone.”

Multi-person theft incidents are also on the rise, with 62 percent of retailers reporting that two to three individuals working together to steal multiple items is more of a concern than a year ago. Those coordinated incidents within organized retail crime (ORC) groups continue to permeate the industry. Seventy-six percent of retailers said shoplifting connected to ORC is more of a concern than it was one year ago. Furthermore, retailers with the capability to track such incidents saw a 57 percent increase on average in ORC incidents from 2022 to 2023.

“Retail crime is a complex and sophisticated challenge, with trends that continue to metamorphose,” University of Florida Research Scientist and Loss Prevention Research Council Executive Director Dr. Read Hayes said. “The retail industry is working in lockstep with the research community and solutions providers to develop, test and improve the next generation of asset protection tools and strategies in the ongoing battle against ORC.”

Retailers view federal legislation as a necessity to effectively combat organized retail crime. Nearly all (94 percent) respondents believe federal legislation is needed to effectively combat this issue. The NRF continues to advocate for Congress to pass the Combating Organized Retail Crime Act, which would enhance coordination between federal, state and local law enforcement.

The survey was conducted online among senior loss prevention and security executives in the retail industry from June 10 through July 12. The study contains results from mid-size to large retailers across 164 retail brands, which accounted for $1.52 trillion in annual sales in 2023 or 30 percent of total retail sales. The brands represent a variety of retail sectors, including specialty and luxury retail, home improvement, mass merchandise, grocery, and pharmacy.

Apparel, Accessories and Footwear (41.7 percent) Entertainment and Recreation (1.4 percent) Food, Drug, Health and Beauty (13.9 percent) General Merchandise (11.1 percent) Home and Garden (9.7 percent) Specialty/Other (22.2 percent).

Go here to view the full report.

Data and Charts courtesy The Impact of Retail Theft & Violence 2024