One only needs to look at import cargo trends and factory shipments to understand how much attention brands and factories pay to the Trump-China tariffs even as they assess pending but delayed tariff action against Mexico and Canada. Brands, retailers and factories are all working to pull goods and deliveries forward to work around the tariff impact.

Amid continuing tariff turmoil, the National Retail Federation (NRF) imports at the nation’s major container ports are expected to remain elevated through spring 2025, but volume could see year-over-year drops this summer, according to the Global Port Tracker report released Monday, March 10 by the NRF and Hackett Associates.

“Retailers are continuing to bring as much merchandise into the country ahead of rising tariffs as possible,” said the NRF VP for Supply Chain and Customs Policy, Jonathan Gold. “The on-again, off-again tariffs against Canada and Mexico won’t have a direct impact on port volumes because most of those goods move by truck or rail, but new tariffs on goods from China that have already doubled from 10 percent to 20 percent are a concern, as well as uncertainty over ‘reciprocal’ tariffs that could start in April. Retailers have been working on supply chain diversification, but that doesn’t happen overnight. In the meantime, tariffs are taxes on imports ultimately paid by consumers, not foreign countries, and American families will pay more as long as they are in place.”

The NRF said President Trump levied a 10 percent tariff on goods from China in February, then increased the amount to 20 percent last week. Others are reporting that the recent 10 percent tariff came on top of a 10 percent tariff already in place. A 25 percent tariff on goods from Canada and Mexico, first announced in February, has been put on hold for a month for goods compliant with the U.S.-Mexico-Canada Agreement trade pact signed during Trump’s first administration.

Hackett Associates Founder Ben Hackett said imports from all trading partners could also be affected by a new fee between $1 million and $1.5 million each time a Chinese-built ship docks at a U.S. port considered by the Office of the U.S. Trade Representative.

“Given that a significant portion of the global container fleet has been built in China, this means that there will be further costs that will be passed on to cargo owners and ultimately the consumer,” Hackett said.

Carriers will likely make more use of larger vessels and consolidate calls at major ports rather than making multiple stops at smaller ports.

“Ports accommodated the surge in import volume in the final quarter of 2024 without major issues, but this will place additional pressure on the supply chain while also harming the nation’s smaller ports,” Hackett continued.

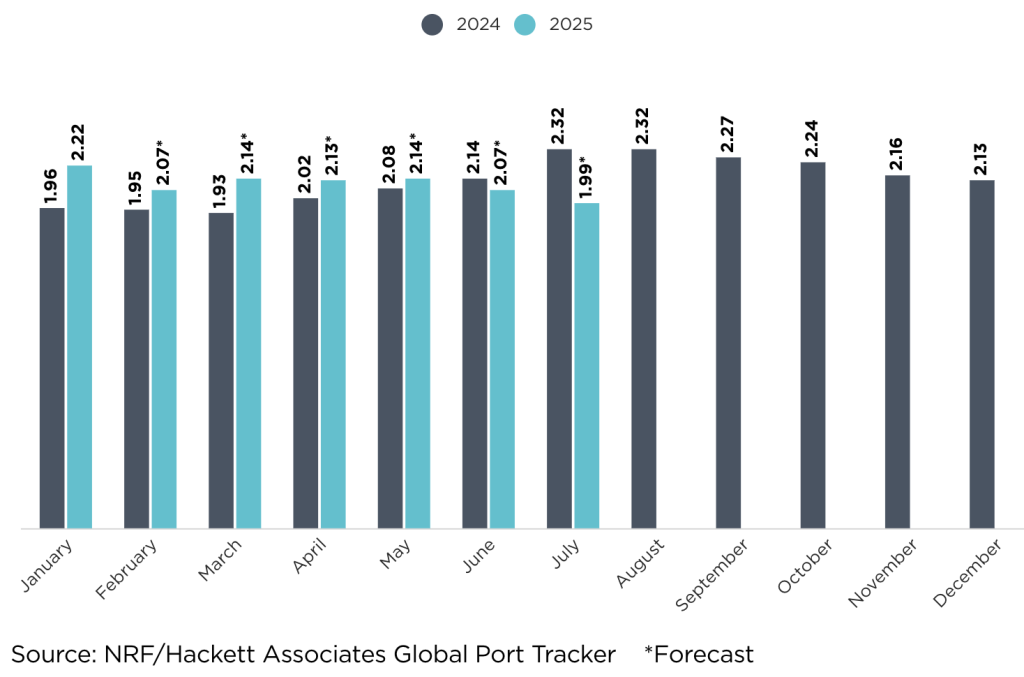

Monthly imports 2024-2025

(TEU-Millions)

U.S. ports covered by Global Port Tracker handled 2.22 million Twenty-Foot Equivalent Units (TEU) — one 20-foot container or its equivalent — in January, the latest month for which final numbers are available. That was up 4.4 percent from December and up 13.4 percent year-over-year.

Ports have not yet reported February numbers, but Global Port Tracker projected the month at 2.07 million TEU, up 6.1 percent year-over-year. That would be the busiest February, traditionally the slowest month of the year because of the Lunar New Year factory shutdowns in China in three years.

March is forecast at 2.14 million TEU, up 10.8 percent year-over-year; April at 2.13 million TEU, up 5.7 percent; May at 2.14 million TEU, up 2.8 percent; June at 2.07 million TEU, down 3.2 percent, and July at 1.99 million TEU, down 13.9 percent.

June and July’s year-over-year declines would be the first since September 2023, and July’s volume would be the lowest since 1.93 million in March 2024. While tariffs could be a factor in the year-over-year decline, imports were elevated last summer as retailers brought in cargo ahead of what turned out to be a short strike at East Coast and Gulf Coast ports in October 2024.

The first half of the year is expected to total 12.78 million TEU, up 5.7 percent from the same time last year. Imports during 2024 totaled 25.5 million TEU, up 14.7 percent from 2023 and the highest level since the 2021 record of 25.8 million TEU during the pandemic.

Global Port Tracker, produced for the NRF by Hackett Associates, provides historical data and forecasts for the U.S. ports of Los Angeles/Long Beach, Oakland, Seattle, and Tacoma on the West Coast; New York/New Jersey, Port of Virginia, Charleston, Savannah, Port Everglades, Miami, and Jacksonville on the East Coast, and Houston on the Gulf Coast.

Data and graphics courtesy NRF and Hackett Associates