According to a recent report released by the National Retail Federation (NRF) and Happy Returns, a UPS company, merchandise returns are projected to reach $890 billion in 2024. Retailers estimate that 16.9 percent of annual sales in 2024 will be returned.

“Returns play an important role within the retail ecosystem and offer an additional touchpoint for retailers to provide a positive interaction with their customers,” said NRF Vice President of Industry and Consumer Insights Katherine Cullen. “Retailers recognize the value of returns and their integration with brand loyalty, and many are prioritizing their returns capacity to ensure a seamless customer experience.”

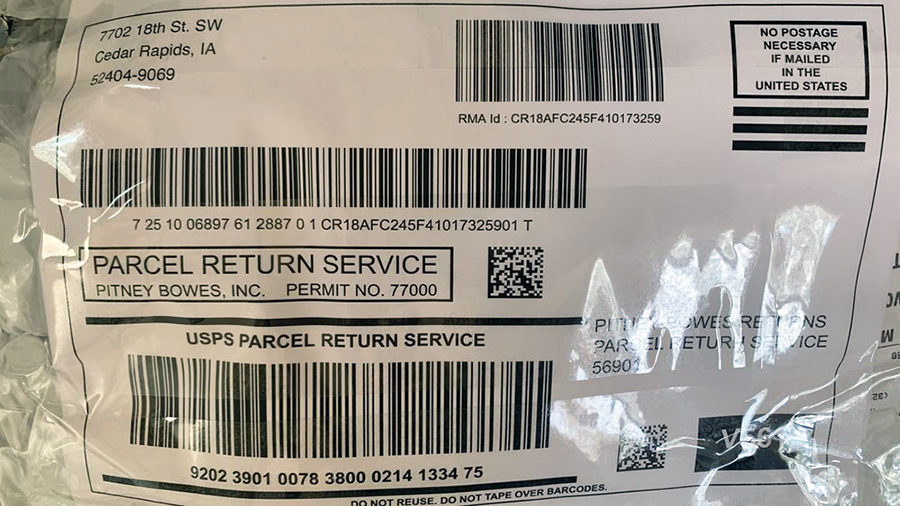

The report notes that 76 percent of consumers consider free returns a key factor in deciding where to shop, and 67 percent agree that a negative return experience would discourage them from shopping with a retailer again. Shoppers also value flexibility during the returns process and acknowledge the impact it can have at the initial point of purchase. The report also claims that 84 percent of consumers are more likely to shop with a retailer that offers no box/no label returns and immediate refunds.

Over two-thirds of retailers surveyed in the report (68 percent) said they have prioritized upgrading their returns policies within the next six months. In addition, improving the returns experience and reducing the return rate are two essential elements for businesses in achieving their 2025 goals.

However, the report notes that retailers “must balance meeting consumer demand for seamless returns against rising costs.” Fraudulent and abusive returns create logistical and financial challenges for retailers. Most retailers (93 percent) said retail fraud and other exploitive consumer behavior is a “significant issue” for businesses. Regarding abuse, retailers see “bracketing” (purchasing multiple items intending to return some) has increased among younger consumers, with 51 percent of Gen Z shoppers indicating they practice this type of shopping pattern.

“Return policies are no longer just a post-purchase consideration—they’re shaping how younger generations shop from the start,” said David Sobie, co-founder and CEO of Happy Returns. “With behaviors like bracketing and rising return rates putting strain on traditional systems, retailers need to rethink reverse logistics. Solutions like no box/no label returns with item verification enable immediate refunds, meeting customer expectations for convenience while increasing accuracy, reducing fraud and helping to protect profitability in a competitive market.”

During the holiday shopping season, customers are more inclined to make returns post-purchase. A separate NRF study found that for the 2024 winter holidays, retailers expect the return rate to be 17 percent higher, on average, than their annual return rate; however, retailers noted in the study that they are taking preventative steps to address the higher volume of returns using third-party logistics providers (40 percent) and hiring seasonal staff for processing returns (34 percent).

Go here to view the 2024 Consumer Returns in the Retail Industry report.

Methodology: This fall, the NRF partnered with Happy Returns to conduct two complementary surveys to understand the dynamics of online returns from consumers and e-commerce professionals. The first survey gathered responses from 2,007 consumers who had returned at least one online purchase within the past year, exploring their shopping preferences, return experiences and expectations for the upcoming 2024 winter holiday season. The second survey engaged 249 e-commerce and finance professionals from large U.S. retailers with more than $500 million in revenue across verticals to gather insights into their return rates and the operational challenges they face with returns processing. The goal was to uncover valuable insights into the online return landscape by comparing perspectives from both sides.

Image courtesy Nordstrom