Nordstrom Inc. on Tuesday reported earnings per share for the fourth quarter ended February 1 of $1.23, including a charge of 19 cents, which missed Wall Street’s expectations by 6 cents.

The company’s revenue of $4.4 billion marked an improvement of 1.3 percent driven by growth in Nordstrom’s Full-Price and Off-Price businesses. Revenue was short of analysts’ estimates by $120 million.

The company also announced it will transition from its Co-President structure to a sole CEO, with Erik Nordstrom to serve in this role. Pete Nordstrom has been named as the company’s president of Nordstrom Inc. and chief brand officer. The new titles reflect their current and ongoing responsibilities. Both Erik and Pete Nordstrom will remain on the company’s board of directors.

Erik Nordstrom stated: “These titles help clarify our respective roles as we strive to maximize our impact both as individual leaders and as a team. Pete and I continue to be partners in ensuring Nordstrom’s success, and we are both focused on executing our long-term plan. We look forward to continue working with our Board to deliver on our shared vision for the future of Nordstrom.”

The company’s Q4 charges of 19 cents, which were not reflected in its prior outlook, were primarily related to the integration of Trunk Club as part of Nordstrom’s market strategy in addition to debt refinancing costs.

For fiscal 2019, earnings per diluted share were $3.18. Excluding charges of $0.19, earnings per diluted share were in-line with the company’s prior outlook of $3.30 to $3.50. Net sales decreased 2.2 percent compared with fiscal 2018, in-line with expectations.

“Through our customer focus, inventory efficiencies and expense discipline, we drove improvement in sales trends in Full-Price and Off-Price, and we increased profitability during the second half of the year. Our 2019 results reflected the accelerated rollout of our market strategy, our strength of Nordstrom Rack’s execution, improved merchandise margins and realized expense savings that were 10 percent above our plan,” said Erik Nordstrom, CEO, Nordstrom Inc. “As we move forward, we are further leveraging digital capabilities and scaling our market strategy to drive sales and earnings growth. The momentum from our investments and market strategy is enabling us to get closer to customers, transforming the way we’re serving them.”

Market Strategy

Nordstrom’s market strategy leverages physical and digital assets to offer customers a greater selection of merchandise available next-day and more convenient access to services. In 2019, the company accelerated its strategy to five top markets — New York, Los Angeles, Chicago, Dallas and San Francisco — resulting in outsized customer engagement and a lift in sales trends of 80 basis points relative to other markets in the fourth quarter.

Based on successful results, Nordstrom will further expand its market strategy through several key initiatives including:

- Expanding to five additional markets — Philadelphia, Washington D.C., Boston, Seattle, and Toronto — for a total of 10 markets, which represent more than half of the company’s sales;

- Adding convenience with additional Nordstrom Local service hubs in addition to express services of order pickup, returns and alterations at more than 50 Nordstrom Racks;

- Launching dedicated e-commerce in Canada to enable a seamless shopping experience across stores and online;

- Ramping its supply chain network to improve delivery speed on the West Coast, which represents 40 percent of customers; and

- Integrating Trunk Club into Nordstrom full-line stores and Nordstrom.com to create a cohesive styling offering across Nordstrom and to gain efficiencies.

Board and Executive Management Update

The company today announced changes to its Board of Directors. Current board members Kevin Turner and Gordon Smith have chosen not to seek re-election to the Board at the expiration of their respective terms at the company’s Annual Shareholders Meeting on May 20, 2020. The Board is working with an external executive search firm for director candidates to fill their seats.

Additionally, the Board has announced planned changes designed to enhance its corporate governance. This will include reducing the maximum size of the Board from 11 to 10 members over the next two years and introducing a 10-year term limit for independent directors.

“Kevin and Gordon each have made invaluable contributions to our Board, including through their important roles as Chairs of the Technology and Corporate Governance and Nominating Committees, respectively,” said Brad Smith, Chairman of Nordstrom’s Board of Directors.

Fourth Quarter Summary

- Fourth-quarter net earnings were $193 million compared with $248 million during the same period in fiscal 2018. Fiscal 2019 included $29 million of charges, after-tax, primarily representing non-cash asset write-downs resulting from the integration of Trunk Club in addition to debt refinancing costs.

- Earnings before interest and taxes (“EBIT”) were $299 million, or 6.7 percent of net sales, compared with $333 million, or 7.6 percent of net sales for the same period in fiscal 2018. Excluding integration charges of $32 million, EBIT margin slightly decreased compared to the prior year.

- In Full-Price, net sales increased 1.0 percent. In Off-Price, net sales increased 1.8 percent. Digital sales grew 9 percent and represented 35 percent of sales. Online order pickup contributed more than half of digital sales growth in Full-Price.

- Gross profit, as a percentage of net sales, of 35 percent decreased 9 basis points compared with the same period in fiscal 2018. This was primarily due to higher costs from the growth of the loyalty program and planned occupancy costs related to the NYC flagship store, partially offset by increased merchandise margins. Ending inventory decreased 2.9 percent from last year, marking four consecutive quarters of sales growing faster than inventory.

- Selling, general and administrative (“SG&A”) expenses, as a percentage of net sales, of 30.5 percent increased 70 basis points compared with the same period in fiscal 2018. Excluding integration charges, SG&A rate was flat, reflecting realized expense savings of approximately $55 million from ongoing productivity initiatives.

Full-Year Summary

- Full-year net earnings were $496 million compared with $564 million for fiscal 2018. Fiscal 2019 included integration charges and debt refinancing costs of $29 million, after-tax. Fiscal 2018 net earnings included a credit-related charge of $49 million, after-tax.

- EBIT was $784 million, or 5.2 percent of net sales, compared with $837 million, or 5.4 percent of net sales, for fiscal 2018. Excluding integration charges of $32 million in 2019 and credit-related charges of $72 million in 2018, EBIT margin deleveraged by approximately 50 basis points.

- In Full-Price, net sales decreased 3.5 percent. In Off-Price, net sales increased 0.2 percent. Nordstrom successfully executed plans to improve sales trends during the year through loyalty, digital marketing and merchandising initiatives. Digital sales grew 7 percent and represented 33 percent of sales.

- Gross profit, as a percentage of net sales, of 34.4 percent was flat compared with fiscal 2018. This reflected increased merchandise margins, offset by higher costs from growth in the loyalty program and planned occupancy costs related to the NYC flagship store.

- SG&A expenses, as a percentage of net sales, of 31.8 percent increased 32 basis points compared with fiscal 2018. Excluding integration charges in 2019 and a credit-related charge in 2018, the SG&A rate increased by approximately 60 basis points, driven by deleveraging of fixed costs from lower volume. Nordstrom achieved annual expense savings of $225 million, exceeding the high end of its plan by more than 10 percent and contributing to a reduction in expense dollars relative to last year.

Financial Position Full-Year Summary

- Operating cash flow was in excess of $1 billion for the eleventh consecutive year;

- The company’s debt leverage ratio, excluding charges, was in-line with expectations; and

- During the year, the company repurchased 4.1 million shares of its common stock for $186 million. A total capacity of $707 million remains available under its existing share repurchase authorization.

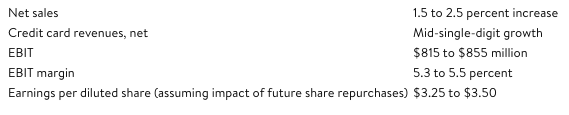

Fiscal Year 2020 Outlook

Nordstrom remains committed to increasing total shareholder returns through three financial objectives: gaining market share; increasing profitability and return on invested capital; and maintaining disciplined capital allocation. The company has provided financial expectations for fiscal 2020, which does not include any potential impact from the current coronavirus situation, as follows:

Expansion Update

Nordstrom has announced plans to open the following stores in fiscal 2020:

Photos/Charts courtesy Nordstrom