Nordstrom, Inc. reported that second-quarter net sales amounted to $3.49 billion, an increase of 3.4 percent versus the corresponding period in fiscal 2023, and total company comparable sales increased 1.9 percent year-over-year (y/y). With one week shifting from the third quarter to the second quarter, the timing of the Anniversary Sale had a positive impact of approximately 100 basis points on net sales compared with 2023.

Gross merchandise value (GMV) increased 3.5 percent for the quarter.

- Nordstrom banner net sales and comparable sales each increased 0.9 percent y/y. GMV increased 1.1 percent.

- The timing shift of the Anniversary Sale positively impacted Nordstrom banner net sales by approximately 200 basis points compared with the second quarter of 2023.

- Nordstrom Rack net sales rose 8.8 percent and comp sales increased 4.1 percent y/y.

- Digital sales increased 6.2 percent compared with the corresponding Q2 period in fiscal 2023.

- The timing shift of the Anniversary Sale positively impacted company digital sales by approximately 100 basis points compared with the second quarter of 2023.

- Digital sales represented 37 percent of total sales during the quarter.

In the second quarter, Nordstrom said active, women’s apparel, beauty, and kids had the strongest growth compared to 2023. During the Anniversary Sale, including one day that fell into the third quarter versus eight days in 2023, the top growing categories were beauty, active, and home.

“We’re pleased with the Anniversary Sale and the enthusiastic response from our loyal customers. They were highly engaged throughout the event and responded favorably to our assortment, experiences and service,” said Pete Nordstrom, president of Nordstrom, Inc. “We appreciate our team’s continued efforts to help our customers feel good and look their best.”

Total company net sales increased 3.4 percent and comparable sales increased 1.9 percent compared with the same period in fiscal 2023. GMV increased 3.5 percent. The timing shift of the Anniversary Sale, with one day falling in the third quarter of 2024, positively impacted net sales of approximately 100 basis points compared with the second quarter of 2023.

Gross margins were 36.6 percent of net sales in Q2, 160 basis points higher than the 2023 Q2 period.

SG&A expenses were 34.4 percent of net sales in the quarter, compared to 32.8 percent in Q2 2023.

The company reported net earnings amounted to $122 million, or 72 cents per diluted share, compared to $137 million, or 84 cents per diluted share, in the 2023 second quarter.

Earnings before interest and taxes (EBIT) of $190 million. Excluding a charge primarily related to supply chain asset impairment, the company reported adjusted EBIT of $244 million and adjusted EPS of 96 cents a share.

“Our second quarter results were solid, and we’re encouraged by the continued topline strength in both banners and the progress we’re making to expand gross margin and increase profitability,” said Erik Nordstrom, CEO of Nordstrom, Inc. “We’re confident in our outlook for the remainder of the year and look forward to sustaining the momentum we’ve built as we execute on our 2024 priorities.”

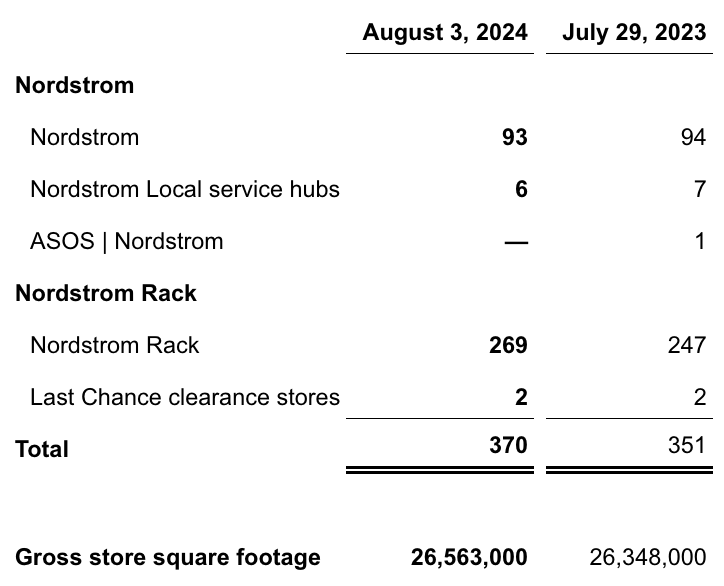

Stores Update

To date in fiscal 2024, the company has opened eleven stores:

The company had the following store counts as of quarter-end:

Fiscal 2024 Outlook

The company has updated its financial outlook for fiscal 2024, which also now reflects the charge primarily related to supply chain asset impairment and related tax impacts recorded in the second quarter, as well as estimated accelerated technology depreciation impacts expected in the second half of fiscal 2024:

Revenue range, including retail sales and credit card revenues, of 1.0 percent decline to 1.0 percent growth versus the 53-week fiscal 2023, which includes an approximately 135 basis point unfavorable impact from the 53rd week.

Comparable sales range of flat to 2.0 percent growth versus 52 weeks in fiscal 2023.

- EBIT margin of 3.0 to 3.4 percent of sales;

- Adjusted EBIT margin of 3.6 to 4.0 percent of sales;

- Income tax rate of approximately 27 percent;

- EPS of $1.40 to $1.70, excluding the impact of share repurchase activity, if any; and

- Adjusted EPS of $1.75 to $2.05, excluding the impact of share repurchase activity, if any.

Image courtesy Nordstrom, Inc.