Nike Inc. reported double-digit revenue growth in the first quarter ended August 31. The performance was driven by the continued success of the Consumer Direct Offense, which fueled growth across all geographies as well as wholesale and Nike Direct, led by digital.

“Nike’s Consumer Direct Offense, combined with our deep line up of innovation, is driving strong momentum and balanced growth across our entire business,” said Mark Parker, chairman, president and CEO, Nike Inc. “Our expanded digital capabilities are accelerating our complete portfolio and creating value across all dimensions as we connect with and serve consumers.”*

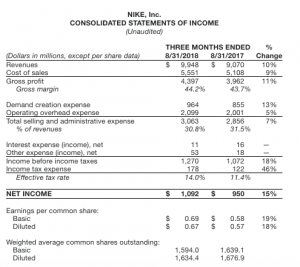

Diluted earnings per share for the quarter were 67 cents, an increase of 18 percent driven by strong revenue growth, gross margin expansion, selling and administrative expense leverage and a lower average share count partially offset by a higher effective tax rate. Results exceeded Wall Street’s consensus target of 63 cents.

“We are delivering stronger global growth and profitability than we anticipated entering this fiscal year,” said Andy Campion, executive vice president and chief financial officer, Nike Inc. “While foreign exchange volatility has increased, our underlying currency-neutral momentum continues to build as we transform how Nike operates, drives growth and creates value for our shareholders.”

First Quarter Income Statement Review

- Revenues for Nike Inc. increased 10 percent to $9.95 billion, up 9 percent on a currency-neutral basis. Wall Street’s consensus target had been $9.94 billion.

- Revenues for the Nike Brand were $9.4 billion, up 10 percent on a currency-neutral basis driven by double-digit growth internationally and in Nike Direct, strong momentum in North America and growth in almost every category led by Sportswear.

- Revenues for Converse were $527 million, up 7 percent on a currency-neutral basis, mainly driven by growth in Europe and Asia.

- Gross margin increased 50 basis points to 44.2 percent primarily due to higher average selling prices, favorable full-price sales mix and margin expansion in Nike Direct, partially offset by higher product costs.

- Selling and administrative expense increased 7 percent to $3.1 billion. Demand creation expense was $964 million, up 13 percent primarily driven by sports marketing investments, brand campaigns and key sports moments. Operating overhead expense increased 5 percent to $2.1 billion driven by investments in capabilities to drive the Consumer Direct Offense, particularly in Nike Direct and global operations.

- The effective tax rate was 14 percent which reflects the new U.S. statutory rate and implemented provisions of the U.S. Tax Cuts and Jobs Act.

- Net income increased 15 percent to $1.1 billion driven primarily by strong revenue growth, gross margin expansion and selling and administrative expense leverage while diluted earnings per share increased 18 percent from the prior year to 67 cents reflecting a 2.5 percent decline in the weighted average diluted common shares outstanding. Wall Street’s consensus estimate had been 62 cents.

By region, North America revenues for Nike Brand grew 5.6 percent to $4.1 billion and grew 6 percent on a currency-neutral basis. Nike Brand sales were up 3 percent on currency-neutral basis in the fiscal fourth quarter. EBIT (earnings before taxes and interest) in the region advanced 7.5 percent to $1.08 billion.

In the Europe, Middle East & Africa region, sales for Nike Brand rose 11.2 percent to $2.61 billion and added 9 percent on a currency-neutral basis. EBIT was $501 million, up 11.1 percent.

Greater China’s sales for Nike Brand grew 24.5 percent to $1.38 billion and added 20 percent on a currency-neutral basis. EBIT reached $502 million, a year-over-year gain of 24.7 percent.

In the Asia Pacific & Latin America region, sales for Nike Brand were up 6.8 percent to $1.27 billion but grew 14 percent on a currency-neutral basis. EBIT in the region grew 24.2 percent to $323 million.

Total Nike Brand sales advanced 9.7 percent to $9.42 billion and gained 10 percent on a currency-neutral basis. Total Nike Brand EBIT reached $1.59 billion, a gain of 10.7 percent.

Converse’s revenues were up 9.1 percent to $527 million and added 7 percent on a currency-neutral basis. Converse’s EBIT added 10.1 percent to $98 million.

August 31, 2018 Balance Sheet Review

Inventories for Nike, Inc. were $5.2 billion, flat to prior year, primarily driven by a clean marketplace with healthy inventories across all geographies due to strong full-price sell through on new innovation.

Cash and equivalents and short-term investments were $4.3 billion, $1.3 billion lower than last year as share repurchases, dividends and investments in infrastructure more than offset net income and proceeds from employee exercises of stock options.

Share Repurchases

During the first quarter, Nike Inc. repurchased a total of 17.8 million shares for approximately $1.4 billion as part of the four-year, $12 billion program approved by the Board of Directors in November 2015. As of August 31, 2018, a total of 167.2 million shares had been repurchased under this program for approximately $10.1 billion. In June 2018, the Board of Directors authorized a new four-year $15 billion share repurchase program that will commence upon the completion of the current program.