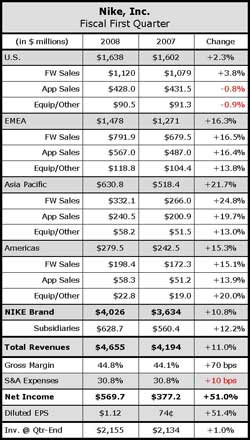

Nike, Inc. saw contributions from across the globe  in its fiscal first quarter ended August 31, posting double-digit sales gains and operating profit growth in every region outside of the U.S. The company once again saw its subsidiary business growth outpace the growth of the Nike brand business, which was held back a bit by a soft mall business in the U.S., challenges in basketball, and weaker non-performance apparel sales in the domestic market. About three percentage points of the total 11% sales gain for Q1 was attributed to fluctuations in currency exchange rates. On the profit side, the bottom line got a nice boost from a one-time benefit related to prior losses in the international market, which delivered about 20 cents to the bottom line. Net income would have still been up 24.3% compared to Q1 last year.

in its fiscal first quarter ended August 31, posting double-digit sales gains and operating profit growth in every region outside of the U.S. The company once again saw its subsidiary business growth outpace the growth of the Nike brand business, which was held back a bit by a soft mall business in the U.S., challenges in basketball, and weaker non-performance apparel sales in the domestic market. About three percentage points of the total 11% sales gain for Q1 was attributed to fluctuations in currency exchange rates. On the profit side, the bottom line got a nice boost from a one-time benefit related to prior losses in the international market, which delivered about 20 cents to the bottom line. Net income would have still been up 24.3% compared to Q1 last year.

NKE revealed a number of items of interest during their quarterly conference call with analysts that signal a strengthening of resolve in some areas and shifting priorities in others. First, the company has made the decision to sell the Nike Bauer Hockey business, which delivered about $160 million in revenues last year, but was seen as having little material effect on the business.

Second, management also announced that they were doing a strategic review of the value channel and the role that the Exeter Brands business plays there. Company CEO Mark Parker suggested that they have other levers to pull that exist in their portfolio, and suggested the potential for more acquisitions in this area.

Also of note was a move by Nike, Inc. to shift the focus of some of their womens-only stores to “multi-gender” formats. The test has proved to be a positive one as management pointed to a “significant improvement” in both productivity and profitability of those stores that have already shifted. The two stores involved in the “transition” are in the Woodfield Mall in Chicago and The Grove in Los Angeles.

Lastly, Nike management said that its renewed focus on the running specialty business is starting to pay off already, suggesting that the channel is one of the fastest growing areas of business in the U.S.

Regarding the U.S., Nike said that they were up in “every major account across all channels with the exception of the mall guys” during the fiscal first quarter. The urban guys and the independent sporting goods business were also said to be performing well. Cancellation rates in the U.S. were said to have improved a little over the last few quarters, but inventories were up in the low-single-digits.

U.S. footwear revenues were up 3.8% for the quarter, but unit sales increased at a high-single-digit rate, yielding a mid-single-digit decline in average selling prices that management attributed to a shift in product mix away from higher-priced basketball product. Unit sales growth was driven by sport culture (fashion athletic), Jordan and action sports product. Growth in performance apparel was offset by declines in Jordan apparel and core basics such as t-shirts and fleece.

One area that may be helping boost the U.S. business is owned-retail, which grew 13% for the quarter on expansion of stores and a 4% comp stores sales gain at the first quality Nike stores and the same rate at the outlet stores.

U.S pre-tax income declined  2.4% for the period, due primarily to increased discounts and lower margins on close-outs.

2.4% for the period, due primarily to increased discounts and lower margins on close-outs.

The EMEA region, which includes Europe, the Middle East and Africa, saw nice gains in the U.K., which grew 10% for the quarter, and the emerging market countries, where revenues were up over 17% for the period. The region, which posted growth of 16.3% for the quarter, picked up seven points of the gain from the weaker U.S. Dollar. Futures growth came from nearly every country in the region.

Asia Pacific only relied on two points of growth from currency on its way to posting a 21.7% increase in revenues for the quarter. Currency-neutral footwear sales were up 23% for Q1, while apparel grew 17% and equipment sales improved 13%. Most countries posted currency-neutral revenue growth for the quarter, led by 50% gains in China and 25% growth in Korea. Japan revenues were down 3%, but futures there are up through spring and the company is boasting improved sell-through and reduced cancellations.

The Americas saw currency-neutral revenues improve 11%, driven by strong growth in Argentina and Mexico, with double-digit growth coming from all three business units. Nike also saw a boost in apparel sales as they took over distribution in Brazil.

Growth in the subsidiary businesses, which includes Converse, Nike Bauer Hockey, Nike Golf, Cole Haan, Hurley and the Exeter Brands group, was driven by “strong growth” and Converse, NBH and Nike Golf. Pre-tax income would have been up 30% excluding a Converse arbitration settlement.

>>> The weak futures gain in the U.S. likely reflects the mall as well