Nike, Inc. reported fiscal third quarter revenues were slightly up on both a reported and currency-neutral (C-N) basis at $12.4 billion for the three-month period ended February 29, 2023.

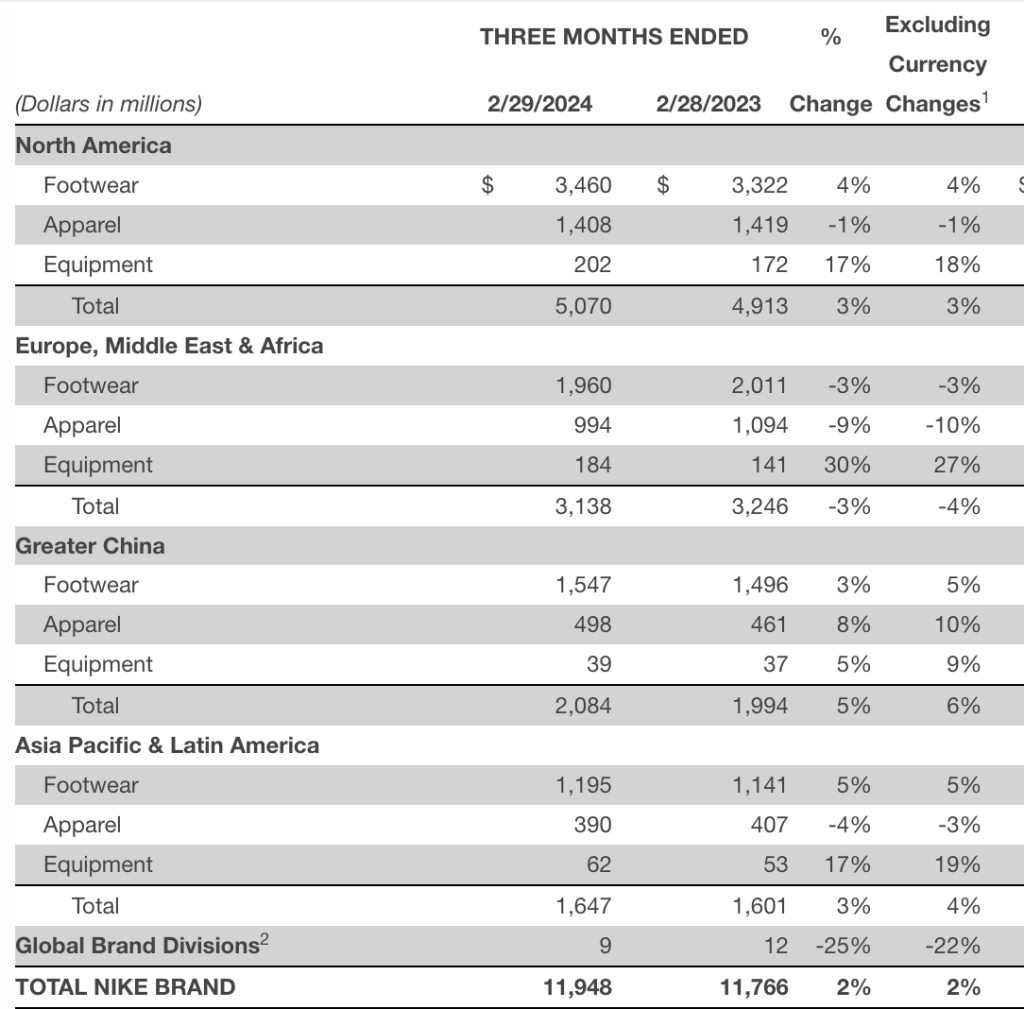

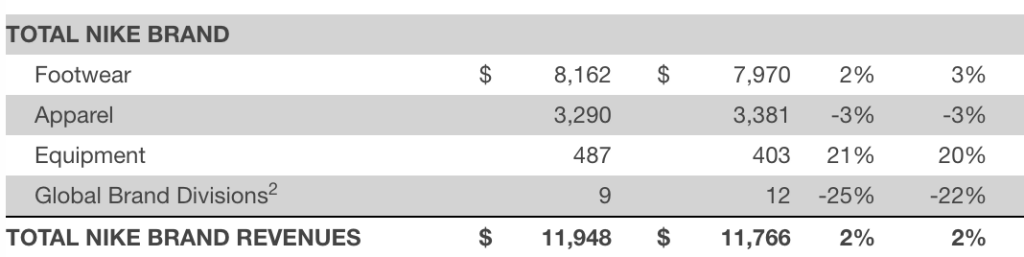

- Revenues for the Nike Brand were $11.9 billion, up 2 percent on a reported and currency-neutral basis, as currency-neutral growth in North America, Greater China and APLA was said to be offset by declines in EMEA.

- Nike Direct revenues were $5.4 billion, slightly up on a reported and currency-neutral basis.

- Nike Brand Digital sales decreased 3 percent on a reported basis and 4 percent on a currency-neutral basis.

- Wholesale revenues were $6.6 billion, up 3 percent on a reported and currency-neutral basis.

- Revenues for Converse were $495 million, down 19 percent on a reported basis and down 20 percent on a currency-neutral basis, primarily due to declines in North America and Europe.

Regional Sales Results

Category Sales Results

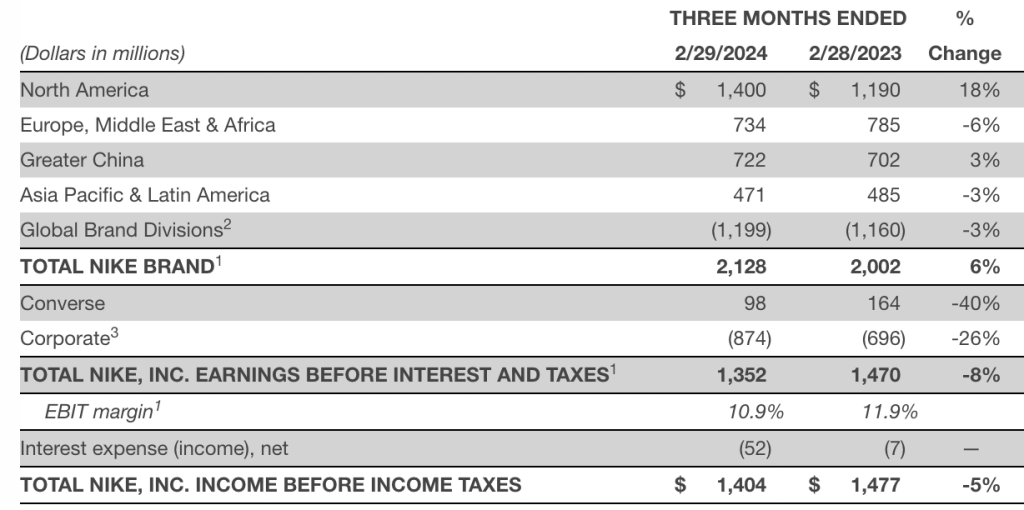

Gross margin increased 150 basis points to 44.8 percent, primarily driven by strategic pricing actions and lower ocean freight and logistics costs, partially offset by higher product input costs and a detriment of 50 basis points due to restructuring charges..

Selling and administrative expense increased 7 percent to $4.2 billion, including $340 million of restructuring charges.

- Demand creation expense was $1.0 billion, up 10 percent, reflecting an increase in marketing expense.

- Operating overhead expense increased 6 percent to $3.2 billion, primarily due to restructuring charges, partially offset by lower wage-related expenses.

The effective tax rate was 16.5 percent compared to 16.0 percent for the same period last year.

Net income was $1.2 billion, down 5 percent year-over-year, and diluted EPS was 77 per share, decreasing 3 percent.

Diluted earnings per share was 77 cents in Q3, including 21 cents of restructuring charges. Excluding these charges, Diluted EPS would have been 98 cents per share.

Nike Brand Regional EBIT Results

“We are making the necessary adjustments to drive Nike’s next chapter of growth,” said John Donahoe, president & CEO, Nike, Inc. “We’re encouraged by the progress we’ve seen, as we build a multiyear cycle of new innovation, sharpen our brand storytelling and work with our wholesale partners to elevate and grow the marketplace.”

Matthew Friend, EVP & CFO, Nike, Inc. said, “Our teams are focused on what matters most to return to strong growth. We are taking action to build a faster, more efficient Nike and maximize the impact of our new innovation cycle.”

Balance Sheet Review

Inventories for Nike, Inc. were $7.7 billion, down 13 percent compared to the prior quarter-end, reflecting a decrease in units.

Cash and equivalents and short-term investments were $10.6 billion, down approximately $0.2 billion from last year, as cash generated by operations was more than offset by share repurchases, cash dividends, capital expenditures and bond repayment.

Shareholder Returns

Nike said it continues to have a strong track record of investing to fuel growth and consistently increasing returns to shareholders, including 22 consecutive years of increasing dividend payouts. In the third quarter, Nike returned approximately $1.4 billion to shareholders, including:

Dividends of $562 million, up 6 percent from the prior year.

Share repurchases of $866 million, reflecting 7.9 million shares retired as part of the Company’s four-year, $18 billion program approved by the Board of Directors in June 2022. As of February 29, 2024, a total of 73.8 million shares have been repurchased under the program for a total of approximately $8.0 billion.

Image courtesy Nike

See below for SGB Media coverage on the solutions Nike is putting in place to get back to growth:

EXEC: Nike Admits it Has a Problem, and Its Solution is… Air?