Newell Brands, the parent company of Marmot, Ex Officio, Stearns, Bubba, Coleman, and Contigo, among others, saw overall consolidated net sales decline 24.4 percent to $1.8 billion for the first quarter when compared to the prior-year first quarter. The decline was said to be due to the impact of the sale of the CH&S business at the end of the first quarter 2022, unfavorable foreign exchange, as well as category exits.

The Outdoor & Recreation segment, home to Marmot, Ex Officio, Stearns, Bubba, Coleman, and Contigo, generated net sales of $270 million in Q1 compared with $388 million in the prior-year period, reflecting a core sales decline of 27.4 percent, as well as the impact of unfavorable foreign exchange. Reported operating loss was $1 million, or negative 0.4 percent of sales, compared with operating income of $46 million, or 11.9 percent of sales, in the prior-year period. Normalized operating income was $13 million, or 4.8 percent of sales, compared with $50 million, or 12.9 percent of sales, in the prior-year period.

Reported consolidated gross margin was 26.7 percent of sales compared with 31.0 percent in the prior-year period, as the impact of fixed cost deleveraging, foreign exchange and inflation more than offset the benefits from pricing and Fuel productivity savings. Normalized gross margin was 27.1 percent of sales compared with 31.2 percent in the prior-year period.

Reported operating loss was $36 million compared with operating income of $217 million in the prior-year period. Reported operating margin was negative 2.0 percent compared with positive 9.1 percent in the prior-year period, as the impact of lower net sales, lower gross margin, as well as an increase in restructuring costs more than offset benefits from pricing, Fuel productivity savings and Project Phoenix savings. Normalized operating income was $43 million, or 2.4 percent of sales, compared with $254 million, or 10.6 percent of sales, in the prior year period.

The company reported a net loss of $102 million, or 25 cents per diluted loss per share, in the first quarter, compared with net income of $228 million, or 54 cents per diluted earnings per share, in the prior-year period.

Normalized net loss was $26 million, or 6 cents normalized diluted loss per share, compared with normalized net income of $149 million, or 35 cents normalized diluted earnings per share, in the prior-year period.

Newell Brands President Chris Peterson said, “First quarter results were relatively in-line with our expectations. We made meaningful progress implementing Project Phoenix and operationalizing the distribution and transportation benefits associated with Project Ovid. While we continue to face a very challenging macroeconomic environment, I am confident that our portfolio of leading consumer brands and talented employees will allow us to further strengthen the company in the years ahead, as we sharpen our strategy, optimize our cost structure and fully leverage the scale of the company.”

At the end of the first quarter, Newell Brands had cash and cash equivalents of $271 million and net debt outstanding of $5.4 billion.

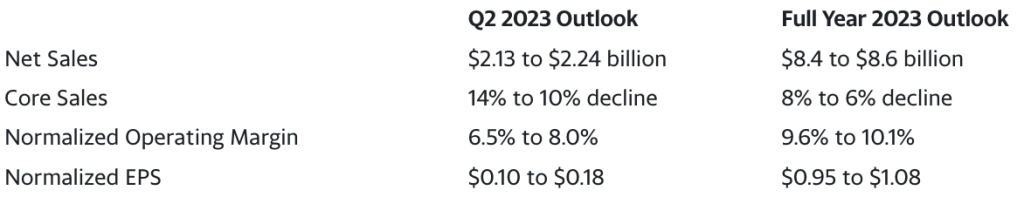

The company now expects full-year 2023 results to be towards the low end of the outlook range.

Photo courtesy Marmot/Chart courtesy Newell Brands