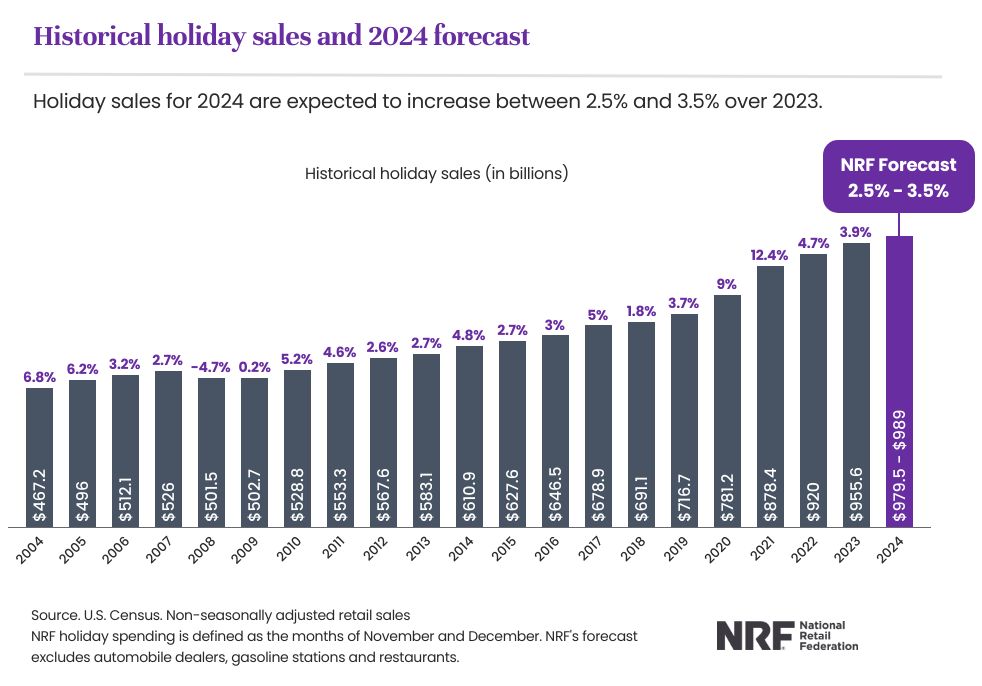

The National Retail Federation (NRF) is forecasting that Holiday selling season (Holiday) consumer spending will grow between 2.5 percent and 3.5 percent versus the 2023 Holiday period. That growth equates to between $979.5 billion and $989 billion in total Holiday spending in November and December, compared with $955.6 billion during the comparative period last year.

The forecast for the 2024 season falls more than 10 percentage points below the 3.5 percent achieved last year and the lowest Holiday growth trend since the 2018 season.

“The economy remains fundamentally healthy and continues to maintain its momentum heading into the final months of the year,” commented NRF President and CEO Matthew Shay during an event scheduled by NRF to release its much-anticipated forecast. “The winter holidays are an important tradition to American families, and their capacity to spend will continue to be supported by a strong job market and wage growth.”

The Holiday forecast is consistent with NRF’s forecast that annual sales for 2024 will increase in a range between 2.5 percent and 3.5 percent over full year 2023.

NRF said that e-commerce is is expected to be the primary contributor of overall retail sales growth for Holiday. Online and other non-store sales, which are included in the total, are expected to increase between 8 percent and 9 percent to a total of between $295.1 billion and $297.9 billion. This figure is up from $273.3 billion in the Holiday period last year. By comparison, last year non-store sales rose 10.7 percent over 2022.

“We remain optimistic about the pace of economic activity and growth projected in the second half of the year,” said NRF Chief Economist Jack Kleinhenz. “Household finances are in good shape and an impetus for strong spending heading into the holiday season, though households will spend more cautiously.”

NRF said retailers anticipate increased consumer demand during the holiday season, additional associates are needed to support business operations.

NRF expects retailers will hire between 400,000 and 500,000 seasonal workers this year, some of which may have been pulled into October to support retailers’ holiday buying events this month. This compares with 509,000 seasonal hires last year.

“One differentiating characteristic from last year’s holiday shopping season is that the shopping period between Thanksgiving and Christmas will be six days shorter, totaling 26 days,” the trade association noted. “Additional contributing factors this year could include the economic impact of Hurricanes Helene and Milton; even though the 2024 U.S. presidential election will take place during the winter holiday season, it is nearly impossible to measure its impact on current or future spending.”

NRF said its Holiday forecast is based on economic modeling using various key economic indicators including consumer spending, disposable personal income, employment, wages, inflation and previous monthly retail sales releases. NRF’s calculation excludes automobile dealers, gasoline stations and restaurants to focus on Core Retail as it does in its monthly Retail Monitor in partnership with CNBC.

NRF defines the Holiday Selling Season as November 1 through December 31.

Image courtesy UPS