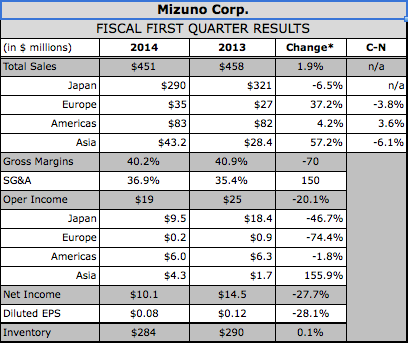

Mizuno Corp. reported revenue in its first quarter ended June 30 reached ¥46.1 billion ($451 mm), up 1.9 percent. On a currency-neutral basis, sales sagged 1.7 percent as growth in the running category offset a poor golf performance.

Mizuno Corp. reported revenue in its first quarter ended June 30 reached ¥46.1 billion ($451 mm), up 1.9 percent. On a currency-neutral basis, sales sagged 1.7 percent as growth in the running category offset a poor golf performance.

Particularly impacting the performance was “a reactionary decline following a rush in demand ahead of the consumption tax hike specific” in its home market in Japan.

Operating profits were down 20.1 percent to ¥1.98 billion ($19.4 mm) on an increase in marketing expenses. Manufacturing costs at overseas production sites dropped, improving the gross margin. Quarterly net income was ¥1.03 billion ($10.1 mm), down 27.7 percent.

In the Americas region, sales grew 4.2 percent to ¥8.4 billion ($82.6 mm) but were down 7.6 percent on a c-n basis. The volleyball business performed well, but the running, and especially the golf businesses, “struggled to overcome the impacts from inclement weather.” Operating profits in the reason eased 1.8 percent to ¥612 million ($6.0 mm).

In Japan, sales were down 6.5 percent to ¥29.6 billion ($289.8 mm). Mid-priced products, especially in golf and baseball, were sluggish in part due to the consumption tax hike.

In Europe, sales were up 37.2 percent to ¥3.6 billion ($35.4 mm) and gained 22 percent on a c-n basis. Running and handball were strong. Results for golf were “bleak, as orders for custom fitting did not stage any growth.” Operating profits tumbled 74.4 percent to ¥23 million ($200,000).

In the In Asia/Oceania region, sales were up 57.2 to ¥4.41 billion ($43.2 million). Operating profits rose 155.9 percent to ¥435 million ($4.3 mm).

Among categories, Footwear grew 8.6 percent to ¥14.95 billion ($146.4 mm), Apparel inched up 0.3 percent to ¥13.98 billion ($139.6 mm), and Equipment added 0.2 percent to ¥11.4 billion ($43.2 mm)

Mizuno maintained its forecasts for the full fiscal year. It expects revenue of ¥195.0 billion, up from ¥183.2 billion a year ago. Operating profit is projected to reach ¥8.0 billion against ¥5.7 billion; and net income to reach ¥5.0 billion versus ¥2.6 billion.