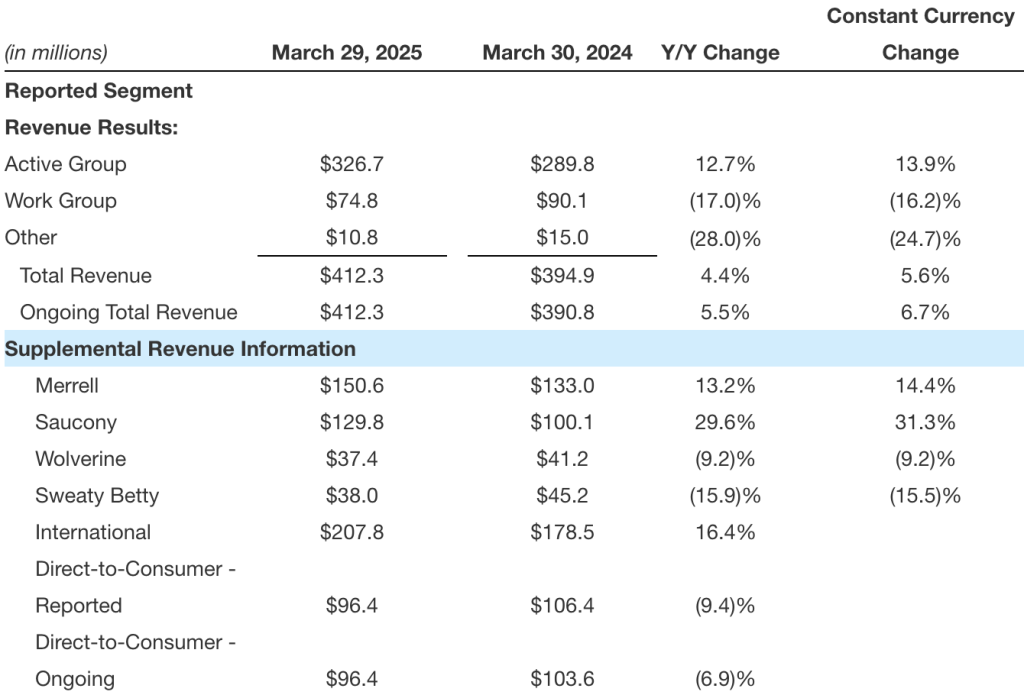

Wolverine World Wide, Inc. reported total revenues for the first quarter ended March 29, 2025, amounted to $412.3 million, a 4.4 percent increase from 394.9 million in the year-ago Q1 period. Sales increased 5.6 percent in constant-currency (cc) terms. On an ongoing basis, excluding the Sperry business divested in January 2024, sales grew 5.5 percent (+6.7 percent cc) year-over-year.

Merrell and Saucony posted strong quarters, while Wolverine Group and Sweaty Betty declined year-over-year. Merrell increased 13.2 percent (+14.4 percent cc) in the first quarter, and Saucony jumped 29.6 percent (+31.1 percent) year-over-year. International business increased 16.4 percent year-over-year.

First Quarter 2025 Sales Summary

Gross margin improved 140 basis points year-over-year to 47.3 percent of net sales in Q1, reportedly due to a healthier sales mix, lower promotional activity and the benefit of supply chain cost initiatives.

Operating expenses were reduced 5.1 percent to $175.1 million, or 4.8 percent of net sales, in Q1, compared to $184.5 million, or negative 0.8 percent, in the 2024 Q1 period.

On a reported basis, WWW reported diluted EPS of 13 cents per share in the first quarter, flipping the script from a loss of 19 cents per share in the 2024 Q1 period.

Full-Year 2025 Outlook

Due to uncertainty around tariffs and related macroeconomic conditions, the company said it is not providing a full-year 2025 outlook and is withdrawing its 2025 guidance issued on February 19, 2025.

***

See below for additional coverage of the overall Wolverine Worldwide business in Q1, as well as deeper dives into the Merrell and Saucony businesses.

EXEC: Saucony is the New Darling for Wolverine Worldwide as Sales Jump 30 Percent in Q1

EXEC: Merrell Parent’s CEO Lays Out Q1 Results, Tariff Plans and Q2 Growth Estimates