Macy’s, Inc. reported net sales of $8.1 billion in the 14-week fiscal 2023 fourth quarter, down 1.7 percent versus the 13-week fiscal fourth quarter of 2022.

- Digital sales decreased 4 percent versus the fourth quarter of 2022.

- Brick-and-mortar sales were roughly flat versus the fourth quarter of 2022.

Comparable sales, on a 13-week basis, were down 5.4 percent on an owned-retail basis and down 4.2 percent on an owned-plus-licensed basis.

Nameplate Highlights

Macy’s comparable sales, on a 13-week basis, were down 6.0 percent on an owned-retail basis and down 4.7 percent, on an owned-plus-licensed basis.

- The Macy’s nameplate saw strength in beauty, particularly fragrances and prestige cosmetics, and its Backstage off-price business while women’s shoes saw continued softness along with relatively weaker performance in cold-weather apparel and accessories.

Bloomingdale’s comparable sales, on a 13-week basis, were down 1.5 percent on an owned-retail basis and down 1.6 percent on an owned-plus-licensed basis.

- Bloomingdale’s nameplate saw strength in beauty, women’s contemporary sportswear, and Bloomingdale’s Outlets business, while men’s and designer handbags continued to be soft.

Bluemercury comparable sales, on a 13-week basis, were up 2.3 percent on an owned-retail basis.

- The Bluemercury nameplate continued to see strength in skincare and color cosmetic categories.

Other revenue of $255 million, down $64 million.

- Represented 3.1 percent of net sales, 80 basis points lower than the fourth quarter of 2022.

- Net credit card revenue declined 26 percent from 2022 to $195 million. As expected, the decline was driven by the impact of higher net credit losses in the portfolio.

Income Statement

Gross margin for the quarter was 37.5 percent, up from 34.1 percent in the fourth quarter of 2022.

- Merchandise margin improved 260 basis points year over year, primarily due to lower clearance markdowns.

- Delivery expenses as a percentage of net sales improved 80 basis points from the prior year, reflecting better inventory allocation and ongoing efforts to improve the supply chain.

Selling, general and administrative (SG&A) expenses of $2.4 billion, a $51 million decrease from the fourth quarter of 2022.

- SG&A expense as a percent of total revenue was 28.7 percent, 10 basis points higher compared to the fourth quarter of 2022 due to lower total revenue.

- SG&A expense dollars benefited from the company’s commitment to ongoing expense discipline, partially offset by investments in the business.

Macy’s posted a diluted loss per share of 26 cents and Adjusted diluted earnings per share of $2.45 for the fourth quarter, compared to diluted earnings per share of $1.83 and Adjusted diluted earnings per share of $1.88 in the fourth quarter of 2022.

Diluted loss per share in the fourth quarter of 2023 included $1.0 billion of impairment, restructuring and other costs primarily related to actions that support profitable growth and market share gains, and align with A Bold New Chapter. Included within this is a roughly $950 million non-cash asset impairment charge, primarily related to the approximately 150 locations planned for closure over the next three years and the remaining associated with corporate assets.

Full-Year 2023 Highlights

Net sales of $23.1 billion, down 5.5 percent versus 2022.

- Digital sales decreased 7 percent versus 2022.

- Brick-and-mortar sales decreased 5 percent versus 2022.

Comparable sales, on a 52-week basis, down 6.9 percent on an owned basis and down 6.0 percent on an owned-plus-licensed basis versus 2022.

- Customer counts for the company’s nameplates totaled:

- 41.2 million active customers shopped the Macy’s nameplate

- 4.0 million active customers shopped the Bloomingdale’s nameplate

- Approximately 711 thousand active customers shopped the Bluemercury nameplate

Other revenue of $774 million, down $233 million from 2022.

- Represented 3.4 percent of net sales, 70 basis points lower than 2022.

- The year-over-year decline, as expected, reflects the impact of higher net credit losses in the portfolio.

2023 Income Statement

Gross margin for the year was 38.8 percent, up from 37.4 percent in 2022.

- Merchandise margin improved 80 basis points from 2022 largely due to lower clearance markdowns and improved freight costs, partially offset by changes in category mix and elevated shortage.

- Delivery expense as a percent of net sales improved 60 basis points from 2022 primarily due to improved carrier rates from contract renegotiations and improvements in inventory allocation.

Inventory was up approximately 2 percent versus 2022 and down approximately 16 percent versus 2019.

- Inventory turnover for the year decreased approximately 2 percent versus 2022 and increased approximately 12 percent versus 2019.

SG&A expense of $8.4 billion, a $86 million decrease from 2022.

- SG&A expense as a percent of total revenue was 35.1 percent, 190 basis points higher than 2022, driven by the year-over-year decline in total revenue.

- The decrease in SG&A expense dollars reflects continued expense discipline, partially offset by investments in the business.

- The year-over-year change also includes the impact of minimum wage increases for store colleagues that were fully implemented as of May 1, 2022.

Diluted earnings per share of 38 cents and Adjusted diluted earnings per share of $3.50 in fiscal 2023, compared to a diluted earnings per share of $4.19 and an Adjusted diluted earnings per share of $4.48 in 2022.

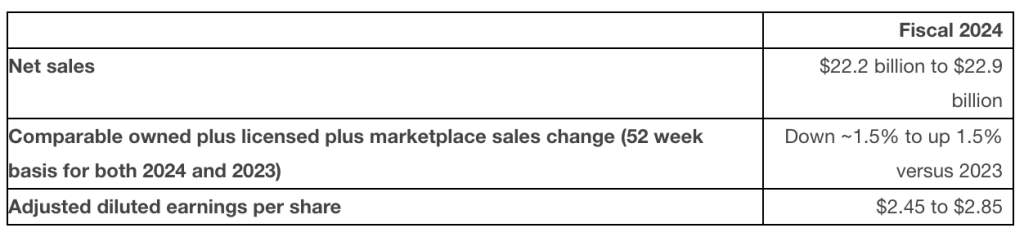

2024 Guidance

Macy’s, Inc. introduced 2024 guidance in a transition and investment year that reflects continued operational progress and investments in key customer-focused initiatives in support of its new strategy.

Adjusted diluted EPS excludes any potential impact from the proposed credit card late fee ruling. Additionally, the impact of any potential future share repurchases associated with the company’s current share repurchase authorization is not considered.

Image courtesy Macy’s, Inc.

***

See below for more SGB Media coverage of Macy’s “A Bold New Chapter” plan and store closures.

Macy’s, Inc. to Shutter Macy’s 150 Doors, Boost Investment and Door Count in Luxury