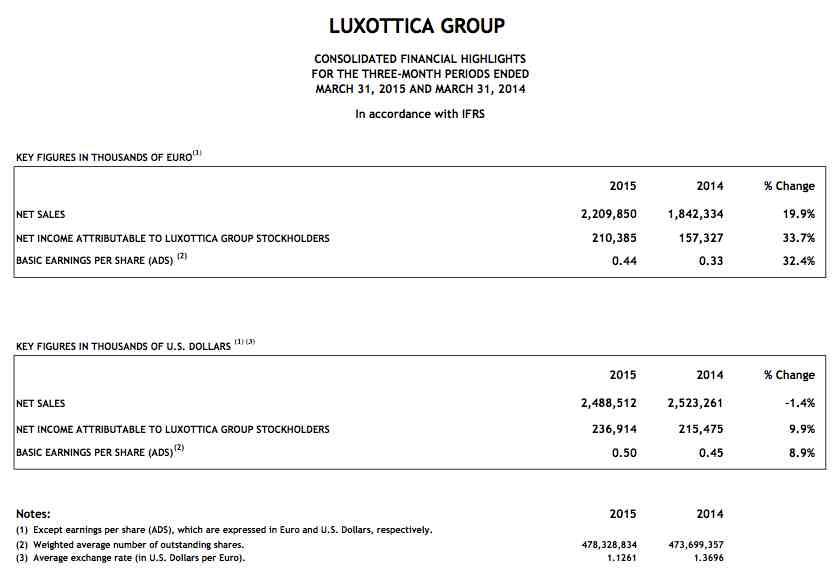

Luxottica Group, the parent of Oakley and Sunglass Hut, reported sales rose 22 percent in the first quarter while profits rose 34 percent.

In the first quarter of the year, Luxottica delivered outstanding results providing the foundation for another year of strong growth in sales and profitability. The organic performance of the business was very solid, with foreign exchange rates providing a material tailwind and leading to record sales and operating income, the best ever achieved in the history of the Group.

Luxottica’s new leadership has started to implement organizational changes in key businesses and geographies with the goal of further integrating the Group’s operations and making the growth strategy even more effective.

Strategic priorities at the top of the Group’s agenda include growing share in emerging markets, developing and expanding the brand portfolio and strengthening retail and e-commerce channels.

Emerging markets: emerging markets represent a great opportunity and is a top priority for the Group. Following on the successful strategy implemented in Brazil, a new leadership structure based on a country General Manager has been put in place in China which is aimed at achieving fast growth and generating synergies among all the business areas.

Oakley integration: integration of Oakley has begun with a focus on production systems and sales channels along with the reorganization of the business in order to provide the Oakley brand with the same organizational structure and operating efficiency implemented throughout the rest of the Luxottica Group. This is expected to generate significant synergies in the range of €100 million once fully deployed. The Oakley Retail and Apparel business is also changing with new leadership and the goal of doubling both revenues and the number of “O” stores over the next three years.

Retail: the excellent performance of Sunglass Hut, coupled with the recent significant improvements of LensCrafters in North America, have accelerated the plan to invest approximately €200 million per year for the next five years (totalling approximately €1 billion) to open or remodel stores. Before year-end, a new LensCrafters format will be launched in North America, with the plan of progressively rolling it out in 2016.

E-commerce: the Group remains focused on the expansion of new distribution channels, particularly e-commerce. The excellent results of Ray-Ban.com, Oakley.com and SunglassHut.com have inspired a reflection on what is the best strategic and organizational formula to transform e- commerce into a structural growth driver with the ambition of becoming a relevant part of the Group’s revenues in the mid-term.

“We have just closed an exceptional quarter, our first as a team, reaching some important financial and organizational milestones,” – commented Massimo Vian and Adil Khan, Chief Executive Officers of Luxottica.

“From an organizational standpoint, we implemented several changes, which we believe will accelerate growth and profitability. We initiated the integration of Oakley’s salesforce into Luxottica’s organization, creating a single market-facing team that will give the brand more firepower in strategic markets such as North America and Europe. And we introduced a new country leadership in China, responsible for the performance of the Wholesale, Retail and e- commerce businesses, allowing the Group to pursue accelerated expansion with a more holistic approach in the important Chinese market.

Our Wholesale Division performed well across brands and in all geographies, particularly in North America and emerging markets, boosted by the Group’s first Michael Kors collection, which made an impressive debut around the world. In addition, the positive mix effect and efficiency gains have resulted in significant higher margins.

The Retail Division also had a solid performance for the quarter, especially in North America where LensCrafters reinforced its recent sales improvements and Sunglass Hut continued double-digit growth worldwide.

New creative and groundbreaking collections introduced by the Group have drawn interest and sparked enthusiasm among clients, which, combined with the highest levels of service, provides a distinct competitive advantage.

We’re pleased with our results for the first four months of the year and a solid order book bodes well for expected growth over the next few quarters.”

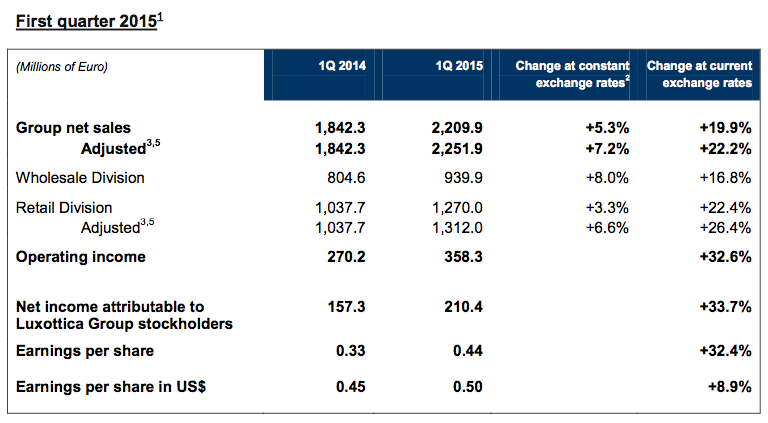

Group adjusted sales rose by 22 percent, or +7.2 percent at constant exchange rates, to €2.2 billion, a record level for a single quarter. This performance was driven by acceleration in both divisions from 2014 as evidenced by net sales increasing by 16.8 percent in Wholesale and, on an adjusted basis3,5, by 26.4 percent in Retail.

Group operating income soared by 33 percent to €358 million, with an operating margin now at 15.9 percent3,5, expanding 120bps3,5 versus the first quarter of last year. Operating margin grew by 100bps to 25.1 percent in Wholesale and 110bps3,5, on an adjusted basis, to 13.1 percent3,5 in Retail.

Net income reached €210 million, recording 34 percent growth over the prior period. This generated EPS of €0.44 (US$0.50 at the exchange rate of €/US$ 1.1261).

Free cash flow generation was equal to €38 million (after an extraordinary tax payment of €29 million) for the three months ended March 31, 2015, compared with €60 million in the same quarter of the previous year. This was mainly due to the continuous improvements in profitability and working capital management. Net debt3 at the end of the quarter was €1,005 million (€1,013 million at December 31, 2014), with a net debt/adjusted EBITDA3,5 ratio remaining stable at 0.6x.

Group performance for the first quarter of 2015

“We have just closed an exceptional quarter, our first as a team, reaching some important financial and organizational milestones,” commented Massimo Vian and Adil Khan, chief executive officers of Luxottica.

“From an organizational standpoint, we implemented several changes, which we believe will accelerate growth and profitability. We initiated the integration of Oakley’s sales force into Luxottica’s organization, creating a single market – facing team that will give the brand more firepower in strategic markets such as North America and Europe. And we introduced a new country leadership in China, responsible for the performance of the Wholesale, Retail and e-commerce businesses, allowing the Group to pursue accelerated expansion with a more holistic approach in the important Chinese market.

“Our Wholesale Division performed well across brands and in all geographies, particularly in North America and emerging markets, boosted by the Group’s first Michael Kors collection, which made an impressive debut around the world. In addition, the positive mix effect and efficiency gains have resulted in significant higher margins.

The Retail Division also had a solid performance for the quarter, especially in North America where Lens Crafters reinforced its recent sales improvements and Sunglass Hut continued double-digit growth worldwide.

New creative and groundbreaking collections introduced by the Group have drawn interest and sparked enthusiasm among clients, which, combined with the highest levels of service, provides a distinct competitive advantage. We’re pleased with our results for the first four months of the year and a solid order book bodes well for expected growth over the next few quarters.”

North America

North America remains a sweet spot for the Group, recording +29 percent3,5 growth in sales at current exchange rates, with both divisions driving this strong growth. Wholesale results were also boosted by the launch of Michael Kors, which outperformed the Group’s expectations. Retail comparable store sales4 grew across key retail chains, with LensCrafters at +5.9 percent, confirming the improvement seen in the second half of 2014, and Sunglass Hut accelerating at +7.4 percent compared to the second half of last year.

Europe

Sales in Europe accelerated, growing by 8.5 percent at current exchange rates. The performance of the Wholesale division was mainly fueled by Italy, France, Spain, UK and Turkey. Within Retail, Sunglass Hut confirmed its growth trend by posting double digit comparable store sales4 in Continental Europe.

Asia-Pacific

Growth in the Asia-Pacific region (+19 percent at current exchange rates) was driven by China, India and Southeast Asia, where revenues grew by over 30 percent. Meanwhile, LensCrafters sales in China continue to grow double digits. In Australia where a reorganization process has started, including a change in OPSM leadership to better compete in this increasingly challenging environment, comparable store sales4 grew 1.4 percent, with a mixed performance between Sunglass Hut (growing double digits) and OPSM (marginally negative). The Group continues to pursue its wholesale expansion strategy with the upcoming opening of a new commercial subsidiary in Indonesia.

Latin America

Latin America grew by 22 percent at current exchange rates, with both Wholesale and Retail driving this excellent performance. Brazil, one of largest wholesale markets for Luxottica, recorded +18 percent growth despite prolonged macroeconomic difficulties. In Mexico, synergies between Wholesale and Retail have supported revenue growth of over 38 percent, an exceptional result, especially in light of the Group’s 20th anniversary in the country. The Group continues its wholesale expansion strategy in the region with the opening of new subsidiaries in Colombia and Chile before year-end.

The Board of Directors of Luxottica Group S.p.A. also approved the grant of awards for 2015 under the Performance Shares Plan 2013-2017. The Plan, approved by the ordinary meeting of stockholders on April 29, 2013, is in the form of a stock grant plan. It provides that beneficiaries will be granted the right to receive, without consideration, ordinary shares of the Company as long as certain financial targets set by the Board of Directors at the time of grant are achieved at the end of a specified three-year reference period. In particular, the Board of Directors, upon recommendation of the Human Resources Committee, approved an ordinary grant and an extraordinary one, with consolidated cumulative EPS targets related to the period 2015-2017, with different and more challenging targets for the extraordinary grant.

Under the ordinary grant, the Board awarded to 629 beneficiaries, 893,160 rights to receive Luxottica Group shares at the end of the relevant reference period. Under the second grant, the Board awarded to five beneficiaries, 688,800 rights to receive Luxottica Group shares at the end of the relevant reference period. Under the extraordinary grant, the Board assigned to the CEO for Markets 327,600 rights and to the CEO for Product and Operations 98,400 rights; under the ordinary grant, the Board assigned to the CEO for Product and Operations 36,000 rights.

The terms of the Plan are described in more detail in the Board of Directors Report to the April 29, 2013 ordinary stockholders meeting and within the “Information Document” included in the Report, available on the Company’s website www.luxottica.com under the Governance/General Meeting/Archive section.

Based on the official price of the Company’s ordinary shares on the Mercato Telematico Azionario organized and managed by Borsa Italiana on the day of grant, the estimated cost that the Company expects to incur in connection with the 2015 grants is approximately €95 million.