Lululemon Athletica, Inc. increased its full-year revenue and profit forecasts on Thursday, November 5, citing a resilient consumer and strong demand in the U.S. during the holiday shopping season. The company now expects fiscal year 2024 revenue between $10.45 billion and $10.49 billion, compared with its prior forecast range of $10.38 billion to $10.48 billion.

LULU shares were up nearly 10 percent in after-hours trading on Thursday.

“Our performance in the third quarter shows the enduring strength of Lululemon globally, as we saw continued momentum across our international markets and in Canada,” offered Calvin McDonald, CEO of Lululemon Athletica, Inc. “Looking to the future, we are pleased with the start to our holiday season, and we remain focused on accelerating our U.S. business and growing our brand awareness around the world. Thank you to our dedicated teams for continuing to deliver for our guests and stakeholders.”

Third quarter net revenue increased 9 percent year-over-year (y/y) to $2.4 billion for the 13-week period ended October 27. Sales increased 8 percent on a constant dollar (cc) basis.

Americas net revenue increased 2 percent y/y, and International net revenue increased 33 percent (+30 percent cc) year-over-year.

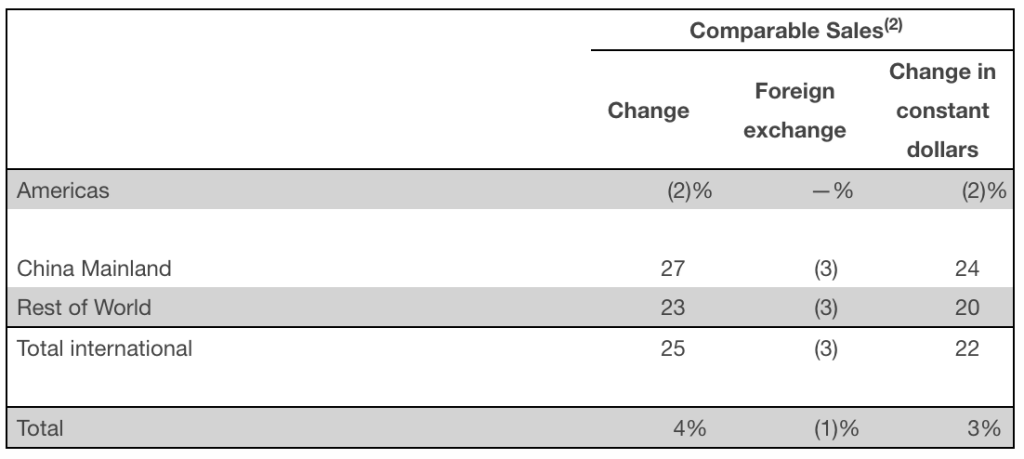

Comparable sales increased 4 percent (+3 percent cc) for the third quarter. Americas comparable sales decreased 2 percent year-over-year, and International comparable sales increased 25 percent (+22 percent cc) year-over-year.

Income Statement Summary

Gross profit increased 12 percent y/y to $1.4 billion in the third quarter. Adjusted gross profit increased 9 percent. Gross margin increased 150 basis points y/y to 58.5 percent of sales. Adjusted gross margin increased 40 basis points.

Income from operations increased 45 percent y/y to $490.7 million in Q3. Adjusted income from operations increased 12 percent. Operating margin increased 520 basis points y/y to 20.5 percent of sales. Adjusted operating margin increased 70 basis points.

The effective income tax rate for the third quarter of 2024 was 30.2 percent compared to 28.5 percent for the third quarter of 2023. The adjusted effective tax rate was 28.1 percent for the third quarter of 2023.

Diluted earnings per share were $2.87 in Q3 compared to $1.96 per share in the third quarter of 2023. Adjusted diluted earnings per share were $2.53 in the third quarter of 2023.

“Our third-quarter results, which exceeded our expectations, demonstrate the ability of our teams to be agile in a dynamic operating environment,” said company CFO Meghan Frank. “With the majority of the fourth quarter still in front of us, we are focused on deepening engagement with our guests and bringing new consumers into the brand. We are committed to delivering on our Power of Three ×2 revenue target of $12.5 billion in 2026 and look forward to all that lies ahead.”

The company added 28 new company-operated stores during the third quarter, including 14 from the acquisition of the Mexico operations, for a total of 749 stores.

Stock Repurchase Program

During the third quarter of 2024, the company repurchased 1.6 million shares of its common stock for $408.5 million. On December 3, 2024, the board of directors approved a $1.0 billion increase to the company’s stock repurchase program. Including this increase, as of December 5, 2024, the company had approximately $1.8 billion remaining authorized on its stock repurchase program.

Balance Sheet Highlights

The company ended the third quarter of 2024 with $1.2 billion in cash and cash equivalents, and the capacity under its committed revolving credit facility was $393.5 million.

Inventories at the end of the third quarter of 2024 increased 8 percent to $1.8 billion compared to $1.7 billion at the end of the third quarter of 2023.

2024 Outlook

- For the fourth quarter of 2024, the company expects net revenue to be in the range of $3.48 billion to $3.51 billion, representing growth of 8 percent to 10 percent, or 3 percent to 4 percent excluding the 53rd week of 2024. Diluted earnings per share are expected to be in the range of $5.56 to $5.64 per share for the quarter. This assumes a tax rate of approximately 29.5 percent.

- For full-year 2024, the company now expects net revenue to be in the range of $10.45 billion and $10.49 billion, representing growth of 9 percent, or 7 percent excluding the 53rd week of 2024. This updated guidance compares to the previous forecast range of $10.38 billion to $10.48 billion for the year. Diluted earnings per share are now expected to be in the range of $14.08 to $14.16 per share for the year. This assumes a tax rate of approximately 30 percent.

The guidance does not reflect potential future repurchases of the company’s shares.

Image courtesy Lululemon Athletica, Inc.