Lululemon Athletica intends to continue with its current plan of opening six stores this year despite a continued soft market and tighter gross margins. The vertical retailer said that for the past six months it has been concentrating on real estate strategy, reducing initial store investment and occupancy costs, reducing store operating expenses and refining its inventory set and flow, but higher costs for materials and tighter inventories are also increasing the cost of goods.

Company president and CEO Christine Day said in a conference call with investors that ideally, once the real estate market has picked up and consumer shopping habits have improved, the retailer will open “around 15 and then maybe up to 25” locations a year, stating that demand from e-commerce and showrooms are fueling that increased interest.

Near the end of June 2008, Lululemon added a cycle of promotional discount sales to clear the summer goods, a move it will not repeat this year at as high a level due to stronger inventory management and the fact that the companys clearance strategy has worked well at outlets.

The company has, however, implemented a one-time accessories markdown associated with its yoga market that has caused sales to jump about 40%.

The company has, however, implemented a one-time accessories markdown associated with its yoga market that has caused sales to jump about 40%.

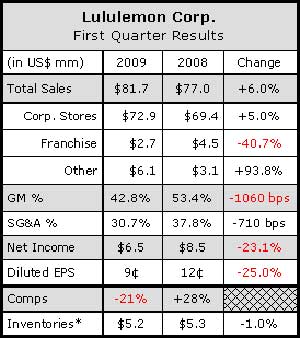

Lululemons net revenue for the quarter ended May 3 increased 6.0% to $81.7 million from $77.0 million for the first quarter of fiscal 2008. Net revenue from corporate-owned stores was $72.9 million, an increase of 5% from $69.4 million for the first quarter of fiscal 2008. Much of the shift in comps were due to changes in foreign currency exchange rates. On a constant currency rate basis, comps were down 8% in Q1 compared to a 15% increase in comps in Q1 last year.

Gross profit as a percentage of net revenue decreased to 42.8% of sales from 53.4% of net revenue in the first quarter of fiscal 2008.

The company has taken on recent increased production costs as LULU upgraded its zippers from a generic zipper to YKK, costing about 80 additional cents. The company is also investing in heavier yarns, which they see increasing demand on higher quality.

The company has taken on recent increased production costs as LULU upgraded its zippers from a generic zipper to YKK, costing about 80 additional cents. The company is also investing in heavier yarns, which they see increasing demand on higher quality.

Income from operations was $9.9 million, or 12.1% of net revenue, compared to $11.9 million, or 15.5% of net revenue, in the first quarter of fiscal 2008.

Diluted earnings per share were 9 cents on net income of $6.5 million, compared to diluted earnings per share of 12 cents on net income of $8.5 million in the first quarter of fiscal 2008.

Lululemon launched its e-commerce site on April 14, about six months ahead of schedule. Day said the goal for the online business is to have approximately 90% of the same SKUs as are in-store, either 90% of the existing assortment or in a shoulder season. The cost of pushing the e-commerce initiative was minimal during the quarter, as most of the money was invested at the end of the previous year. “We're not at optimal margin yet, probably because we've got a lot more sales leverage but we feel it's been a very smooth launch,” said Day. “Costs are in line with what we expected.”

The company continues to operate with no debt. LULU ended the quarter with $59.3 million in cash and cash equivalents as compared to $56.8 million at the end of fiscal 2008. Inventory at the end of the quarter totaled $44.6 million, down 14.2% from $52.1 million at the end of fiscal 2008, and down $10.4 million or 18.9% from the end of first quarter 2008.

“We were conservative with the timing of our deliveries and were therefore under inventory at the end of the quarter due to better than expected first quarter sales,” explained Day. “As a result, we're air freighting some product shipments in Q2 in order to catch up.”

Citing its intentions to open one of their new stores as early as the second quarter this year, LULU anticipates reported revenue to be in range of $85 million to $90 million for the quarter, with an EPS of 8 cents to 9 cents and a similar gross margin profile in Q2 to that of Q1, benefiting from the companys more efficient cost structure and labor management as well as foreign currency translation.

Citing its intentions to open one of their new stores as early as the second quarter this year, LULU anticipates reported revenue to be in range of $85 million to $90 million for the quarter, with an EPS of 8 cents to 9 cents and a similar gross margin profile in Q2 to that of Q1, benefiting from the companys more efficient cost structure and labor management as well as foreign currency translation.