Lululemon Athletica lowered its forecast for the year despite more than doubling revenue, because incremental hires and other strategic initiatives undertaken by its soon-to-be CEO are raising SG&A costs.

Citing strong sales at new stores and earlier than anticipated new store openings, Lululemon raised revenue guidance Monday to between $380 million and $385 million versus previous guidance of $370 million to $375 million. But, the company lowered its diluted earnings per share guidance for fiscal 2008 to 68 cents to 71 cents cents, versus 70 cents to 72 cents because of unbudgeted SG&A costs incurred in part because of initiatives undertaken by new Chief Operating Officer Christine Day. The company continues to expect long-term net revenue growth of approximately 25% and diluted EPS growth in excess of 25%.

The forecast continues to assume comparable store sales growth in the low-teens, or high-single-digits on a constant dollar basis, and 35 planned new store openings in North America.

In its conference call with analysts Monday, Lululemon attributed rising costs to three sources: 1) stock options granted to new executives; 2) hiring and training a new tier of assistant store managers; and 3) building the infrastructure needed to sustain Lululemons torrid growth pace. That prompted one analyst to press Lululemon executives for assurances that costs would not continue to rise unexpectedly in future quarters.

In an unusual move Tuesday morning, after the companys stock opened 8% below its Monday closing price, Lululemon issued a statement elaborating on its new guidance. It estimated executive changes, store manager training and infrastructure costs at $1.3 million, $1.5 million and $1.2 million, respectively.

The latter reflected higher than expected depreciation expenses on extensive computer systems being installed by the company. For instance, LULU switched to a new merchandise and warehouse system in the fourth quarter that CFO John Currie said likely wont yield savings until later this year. The company expects to roll out a new POS system to U.S. stores by August and to Canadian stores next year. It will install a new merchandise planning system in July in a bid to enhance product forecasting. The companys e-commerce initiative, meanwhile, is on track to contribute revenue in the second half of 2009, said Day, a former Starbucks executive recruited earlier this year to take over for CEO Bob Meers when he retires June 30.

Day said LULU is about halfway through hiring assistant store managers for its 85 stores.

“One of the key lessons I learned while at Starbucks in its high growth phase was that investing in people ahead of the curve is critical for longer term success,” said Day. “Weve got to have those leaders who understand what the future looks like, but also stay with those core people who built the company from ground up.”

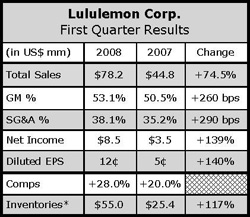

LULUs same-store sales rose 28% in the first quarter, thanks primarily to growing transactions. After adjusting to exclude the impact of a robust Canadian dollar, they gained 15% – the high end of guidance.

Lululemon opened three stores in North America in the quarter and has since opened four more in Troy, MI; Denver, CO; Chino Hills, CA; and Halifax, Nova Scotia. Day said her focus will be “in-filling our current market including New York, southern California, Texas, D.C., Chicago and Seattle.”

“I want to point out that the initial results in Troy, Michigan and Halifax stores were among the best in our company's history,” Meers told analysts on Monday. “These are secondary markets and we believe the hunger for our product in these new markets is a great indication of the success we will have as we continue to roll out across North America.”

Day appears determined to meet the companys ambitious expansion plans without straining its employees, jeopardizing its culture or getting ensnared in the supply chain problems that have haunted other rapidly growing companies. She said she now intends to open showrooms at least a year in advance of stores in new markets. The showrooms are used to recruit fitness instructors and other brand champions to promote the brand at the grass roots level before stores open. While they break even, showrooms are rarely profitable, she said.

On Monday, she said she has been focusing much of her effort on selecting store locations and making sure stores get the proper size runs and seasonally appropriate assortments. She announced that she had hired Sheree Waterson as EVP of general merchandise management and sourcing to help optimize operations. Waterson has more than 25-years retail experience, including as former president of Speedo at Warnaco Inc.. Day said Watersons background in e-commerce, sourcing and performance fabrics qualified her to oversee global production, visual merchandising, merchandising management and “market legacies.”