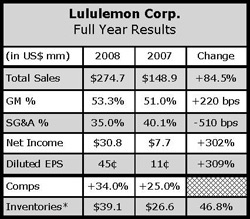

lululemon athletica inc. doubled its sales in the fourth quarter on a 24% increase in same store sales after adjusting for a stronger Canadian dollar. The Vancouver, B.C.-based retailer of yoga apparel and lifestyle products said it expected comp stores sales to continue growing in the low teens in 2008 when it plans to add 35 more stores, including its first in Hawaii, Michigan, Connecticut, and Eastern Canada. The company had 38 stores all under 3,000 square feet – in its 2007 comp base. It added another 27 in 2007, including 10 in the fourth quarter, and ended the year with 81 in the United States and Canada. Comp stores sales rose 41% before adjusting for the appreciation of the Canadian dollar.

fourth quarter on a 24% increase in same store sales after adjusting for a stronger Canadian dollar. The Vancouver, B.C.-based retailer of yoga apparel and lifestyle products said it expected comp stores sales to continue growing in the low teens in 2008 when it plans to add 35 more stores, including its first in Hawaii, Michigan, Connecticut, and Eastern Canada. The company had 38 stores all under 3,000 square feet – in its 2007 comp base. It added another 27 in 2007, including 10 in the fourth quarter, and ended the year with 81 in the United States and Canada. Comp stores sales rose 41% before adjusting for the appreciation of the Canadian dollar.

In a conference call with analysts, lululemon CEO Bob Meers said the company continues to expand from yoga inspired apparel and gear into exercise gear. He confirmed that the company will “very shortly” begin selling swim and cycling apparel and that its recently introduced running apparel was “an instant hit.”

“As we continue to evolve from yoga inspiration to exercise gear, we have introduced a variety of products designed for the fit plus 40 marketplace and that looks like it is being totally incremental to our business,” said Meers. “Our bra business has started to catch on and our mens business continues to grow very strongly.”

Lululemon reported net revenue increased 101% to $105.1 million for the quarter ended Jan. 31, from $52.2 million for the fourth quarter of fiscal 2006. Net revenue from corporate-owned stores was $92.5 million, an increase of 117% from $42.6 million for the fourth quarter of fiscal 2006. Franchise and other revenues, which include wholesale, phone sales, and showrooms, totaled $12.6 million and represented the other 12% of total revenue in the quarter

Gross profit as a percentage of net revenue increased 270 basis points to 54.1% from 51.4% in the fourth quarter of fiscal 2006. SG&A expense, meanwhile, plummeted to 33.45% from 47.2% of total revenues and would have fallen further if not for $1.5 million in air freight costs needed to replenish stores before the holidays. The improved margins resulted in a nearly 10 fold rise in income from operations to $21.7 million, or 20.6% of revenues, compared to $2.2 million, or 4.2% of revenues, in the fourth quarter of fiscal 2006.

Net income rose to $14.6 million from $887,000, or to 21 cents per fully diluted share, compared to 1 cent in the prior years quarter.

The retailer reported that it ended the year with 46.8 percent more inventory a level CFO John Currie described as very lean thanks to post holiday mark downs and warehouse sales. Currie said that enabled lululemon to rebuild inventory with a fresh assortment of new product for 2008.

This year, the company expects revenues to grow 25% to $370 million to $375 million with diluted earnings per share reaching 70 to 72 cents. That compares to diluted earnings per share of 45 cents last year and 11 cents in 2006. A new ERP system installed by the company should reduce or eliminate the need to use air freight to replenish stores moving forward, said Currie. The earnings guidance also assumes expenses of $500,000 to $1 million for an e-commerce site.

The guidance assumes comp stores sales growth in the low teens or high single digits on a constant dollar basis.

Meers said global consumer trends toward healthy living, exercise and stress reduction were growing lululemons market.

Nevertheless, the company said it will wind down its four-store franchise operation in Japan, which Meers said was taking up a disproportionate amount of managements time and straining lululemons supply chain. He said Japans culture, which emphasizes more formal attire, worked against lululemon.

Meers said he does not see such obstacles in Australia, where the company already operates, or Europe, where it may expand soon.

Meers introduced his successor Christine Day during the call. The former Starbucks executive was hired in January to run lululemons retail, community relations and real estate operations and promoted last week to the position of president and COO. She will be appointed CEO upon Meers retirement June 30.

As EVP of retail operations, Day moved quickly to increase the numbers of assistant managers in stores and begin training them earlier. Meers told analysts that performance suffered at some Texas and Canadian stores when the company took short cuts to ramp them up quickly.

Meers said lululemon expects to announce soon other executive hires in the areas of product development, advance material design, planning, merchandising, logistics, sourcing and distribution.

Meers, who was previously president of the Reebok brand, will continue advising lululemon from his retirement until the end of the companys 2008 fiscal year.