Lightspeed Commerce, Inc. reported that total revenue amounted to $266.1 million in its fiscal first quarter ended June 30, an increase of 27 percent year-over-year.

- Transaction-based revenue was $174.1 million, an increase of 44 percent year-over-year.

- Subscription revenue came in at $83.3 million, an increase of 6 percent year-over-year.

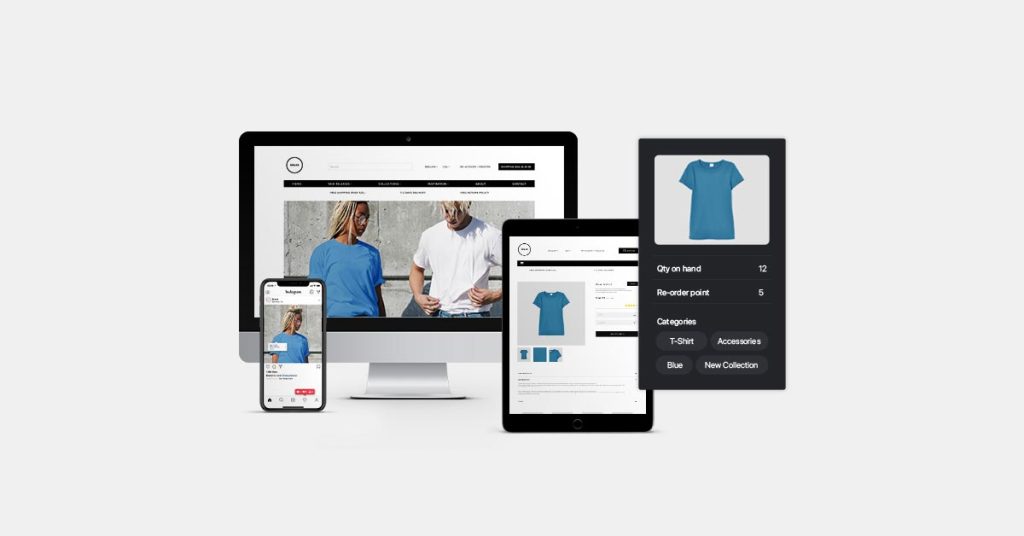

“This was my first full quarter returning as Lightspeed’s CEO, and I am thrilled to see the volume of capabilities we are releasing for our customers,” said Dax Dasilva, founder and CEO of Lightspeed Commerce, Inc. “Lightspeed continues to distinguish itself with advanced inventory management and B2B functionality that we believe no other retail platform can match, and in hospitality we are preparing to deliver never-before-seen levels of productivity improvement to streamline restaurant operations.”

The company posted a net loss of $35.0 million, or a loss of 23 cents per share, in Q1, compared to a net loss of $48.7 million, or a loss of 32 cents per share, in the prior-year quarter.

Adjusted Income amounted to $16.1 million, or 10 cents per share, as compared to an Adjusted loss of $2.2 million, or a loss of 1 cent per share, in the year-ago Q1 period.

Adjusted EBITDA was $10.2 million versus an Adjusted EBITDA loss of $7.0 million in the prior-year Q1 period.

Under its Normal Course Issuer Bid, Lightspeed repurchased and canceled 2,673,926 of its own shares for a total consideration, including transaction costs, of $39.9 million.

As at June 30, 2024, Lightspeed had $673.9 million in cash and cash equivalents.

“Fiscal 2025 is off to a great start with first quarter revenues and Adjusted EBITDA exceeding outlook,” said Asha Bakshani, CFO. “We have spent the last year expanding payments adoption and right-sizing our cost structure and that is reflected in our results today. We are now turning our focus to accelerating growth in our software business so that we can continue to pursue our goal of profitable growth.”

Outlook

The following outlook supersedes all prior statements made by the company and is based on current expectations.

Lightspeed remains confident that total revenue growth for the full fiscal year will be at least 20 percent. The company expects its initiatives to increase subscription revenue growth, such as outbound sales, price increases and account managers transitioning back to selling software, to gain momentum and benefit the second half of Fiscal 2025. Additionally, for the full year, Lightspeed is increasing its outlook for Adjusted EBITDA profitability given better-than-expected results from various cost-saving initiatives.

For the second quarter, the company would likely see similar trends to Lightspeed’s first quarter, with sales growth coming predominately from transaction-based revenue as we continue to expand adoption of the company’s payments and capital offerings.

For the second quarter’s year-over-year growth, the company is experiencing a significant revenue uplift due to the surge of Unified Payments customers who became live last year. Furthermore, the company said initiatives to grow software sales would only partially impact the upcoming quarter. As a result, the company’s outlook is as follows:

Second Quarter 2025

- Revenue of approximately $270 million to $275 million.

- Adjusted EBITDA of approximately $12 million.

Fiscal 2025

- Revenue growth of at least 20 percent.

- Adjusted EBITDA of a minimum of $45 million.

Image courtesy Lightspeed