Life Time Group Holdings, Inc. is reporting preliminary estimated financial results for the fiscal third quarter ended September 30 in connection with its launch of a process to refinance its 5.750 percent Senior Secured Notes due 2026 and 8.000 percent Senior Notes due 2026.

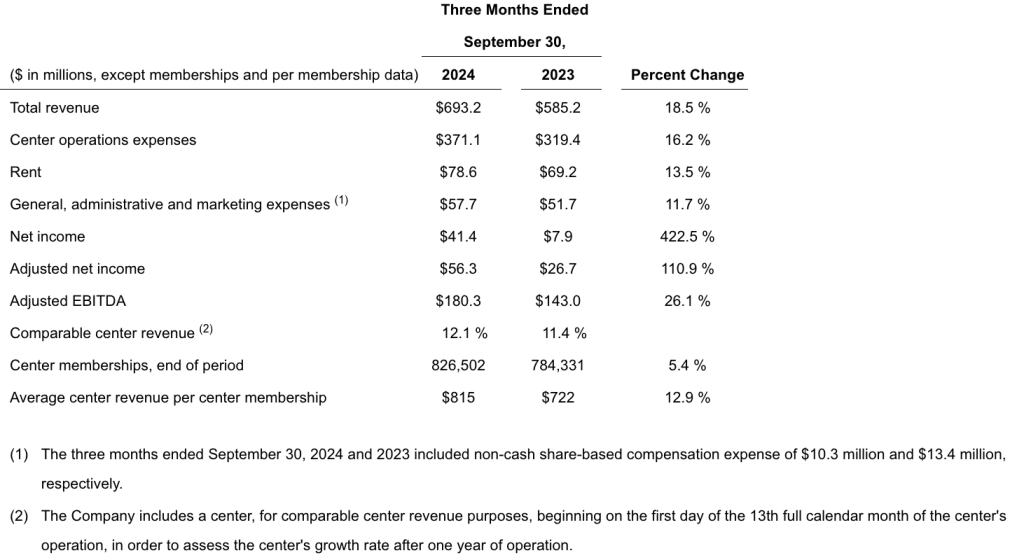

Total third quarter revenue is estimated to be $693.2 million, an increase of 18.5 percent over the prior-year third quarter. Net income is estimated to be $41.4 million, an increase of 422.5 percent over the prior-year Q3 period. Adjusted net income is estimated to be $56.3 million, an increase of 110.9 percent over the prior year quarter.

Adjusted EBITDA is estimated to be $180.3 million, an increase of 26.1 percent over the prior-year quarter.

“We estimate our net cash provided by operating activities for the three months ended September 30, 2024 will be $151.1 million, an increase of 31.8 percent compared to the prior year quarter, the company said in a media release. “We estimate our free cash flow for the three months ended September 30, 2024 will be $138.3 million, including $65 million of proceeds from sale-leaseback transactions on two properties.”

Reduced net debt leverage ratio is expected to reach an estimated 2.4X, compared to 3.7X at September 30, 2023.

“As of September 30, 2024, our total available liquidity was $529.8 million, which included availability under our $650 million revolving credit facility and cash and cash equivalents,” the company said.

The company revealed it further expects to deliver second consecutive quarter of positive free cash flow before sale-leaseback transactions.

Erik Weaver, executive vice president and chief financial officer, stated, “We are pleased to announce certain of our preliminary estimated third quarter financial results as we launch our debt refinancing. Our business continues to deliver strong revenue and adjusted EBITDA growth as we further strengthen our balance sheet. We look forward to providing our full financial results on October 24, 2024.”

Image and Chart courtesy Life Time