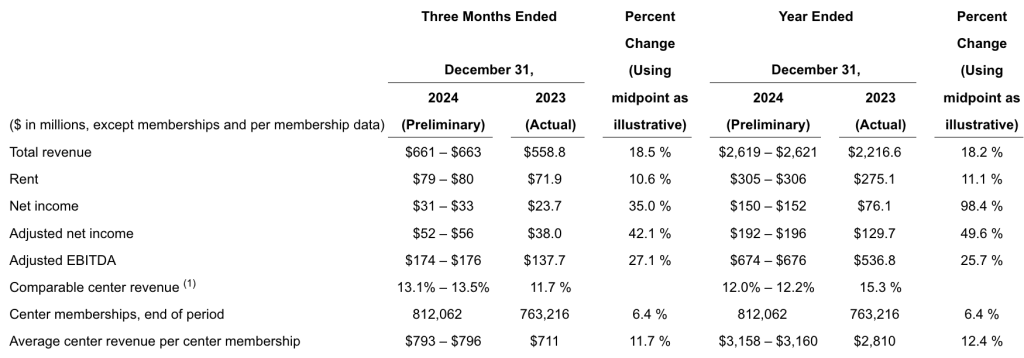

Life Time Group Holdings, Inc. released preliminary estimated unaudited financial results for the fourth quarter and full-year fiscal 2024, indicating that total revenue growth for each period will grow in the mid-teens compared to the company’s respective comparative periods in 2023.

Net income for the full-year period is estimated to have nearly doubled year-over-year, while Adjusted EBITDA is expected to increase more than 25 percent for the year.

The company also introduced initial guidance ranges for the full-year fiscal 2025.

“I am extremely proud of our financial performance in 2024,” shared Bahram Akradi, founder, chairman and CEO of Life Time Group Holdings, Inc. “Our fourth quarter and full-year results continue to demonstrate the strong desirability for our athletic country clubs, programs and services. This has resulted in record levels of member engagement and retention, both of which are important drivers of our growth strategy. The growth in our memberships, membership dues revenue, and our in-center revenue, combined with our efficient operating model, has fueled our expanding margins. As reflected in our 2025 guidance, we are well-positioned to build upon the success of 2024.”

Fourth Quarter and Full Year 2024 Preliminary Estimated Ranges

(1) The company includes a center, for comparable center revenue purposes, beginning on the first day of the 13th full calendar month of the center’s operation, in order to assess the center’s growth rate after one year of operation.

(1) The company includes a center, for comparable center revenue purposes, beginning on the first day of the 13th full calendar month of the center’s operation, in order to assess the center’s growth rate after one year of operation.

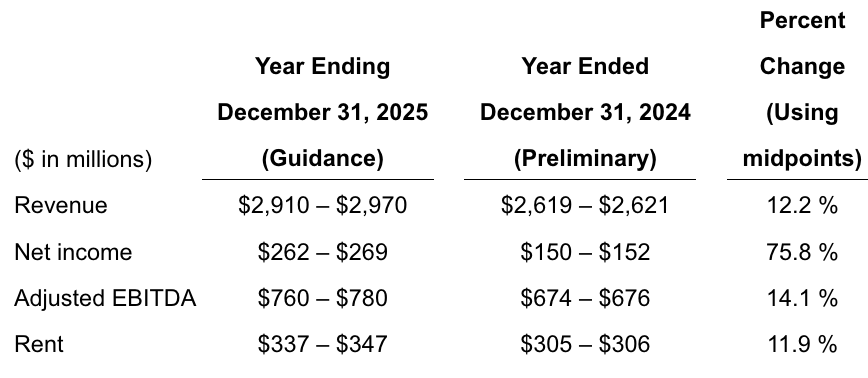

Select Fiscal 2025 Annual Guidance

Life Time also released the following select financial guidance for full-year fiscal 2025:

The company also expects to achieve the following operational and financial results for full-year fiscal 2025:

- Maintain positive free cash flow on an annual basis and manage net debt to Adjusted EBITDA leverage ratio to achieve and then maintain at or below 2.25x;

- Open 10-to-12 new centers;

- Comparable center revenue growth of 7 percent to 8 percent;

- Adjusted EBITDA growth driven primarily by dues revenue growth and expanded operating leverage;

- Rent to include non-cash rent expenses of $35 million to $38 million; and

- Interest expense, net of interest income, of approximately $90 million to $94 million, reflecting reduced debt levels compared to the prior year and the debt refinancing completed in the fourth quarter of fiscal 2024.