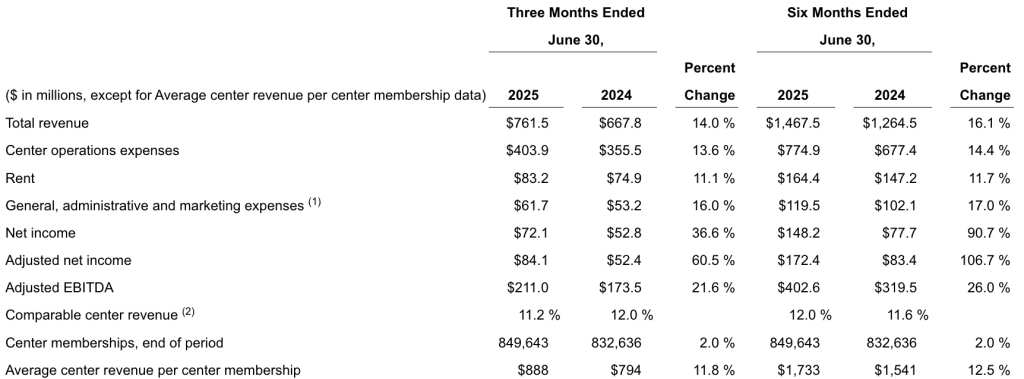

Life Time Group Holdings, Inc. (LTH) Founder, Chairman and CEO Bahram Akradi said total visits, visits per membership, and retention continued to achieve all-time highs in the second quarter of 2025 as revenue increased 14.0 percent year-over-year (y/y) to $761.5 million in the period. The double-digit growth was said to be due to continued strong growth in membership dues and in-center revenue, driven by an increase in average dues, membership growth in new and ramping centers, and higher member utilization of in-center offerings, particularly in Dynamic Personal Training.

- Center memberships of 849,643 increased 2.0 percent y/y, and increased 2.8 percent compared to the 2025 first quarter, which sequential growth was reportedly due in part to typical seasonality.

- Total subscriptions, which include center memberships and on-hold memberships, of 898,850 increased 2.3 percent y/y.

Center operations expenses increased 13.6 percent y/y to $403.9 million, said top be primarily due to operating costs related to the new and ramping centers, additional center operating expenses related to increased club utilization in the company’s mature centers, as well as costs to support in-center business revenue growth.

General, administrative and marketing expenses increased 16.0 percent y/y to $61.7 million, said to be primarily due to the timing of share-based compensation and benefit-related expenses, increases in center support overhead to enhance and broaden member services and experiences, information technology costs, and costs attributable to the secondary offering of common stock completed in June 2025.

Net income increased 36.6 percent y/y to $72.1 million primarily due to improved business performance and tax-effected net cash proceeds of $9.3 million received from employee retention credits under the CARES Act, partially offset by a tax-effected net loss of $9.0 million on a sale-leaseback transaction.

Net income in the prior-year Q2 period included tax-effected net benefits of $6.0 million from a net gain on sale-leaseback transactions and $3.4 million from a gain on the sale of land.

Adjusted net income increased 60.5 percent y/y to $84.1 million and Adjusted EBITDA increased 21.6 percent y/y to $211.0 million as the company experienced greater flow through of the increased revenue and benefited from the structural improvements to the business that have improved company margins.

New Center Openings

LTH opened four new centers during the second quarter of 2025 and operated a total of 184 centers at quarter-end.

Cash Flow Highlights

Net cash provided by operating activities for the six months ended June 30, 2025 was $379.6 million, an increase of 45.5 percent compared to the prior-year end of first half.

LTH achieved positive free cash flow of $112.5 million for the second quarter of 2025, including $138.8 million of net proceeds from a sale-leaseback transaction of three properties. We achieved positive free cash flow of $153.8 million for the six months ended June 30, 2025.

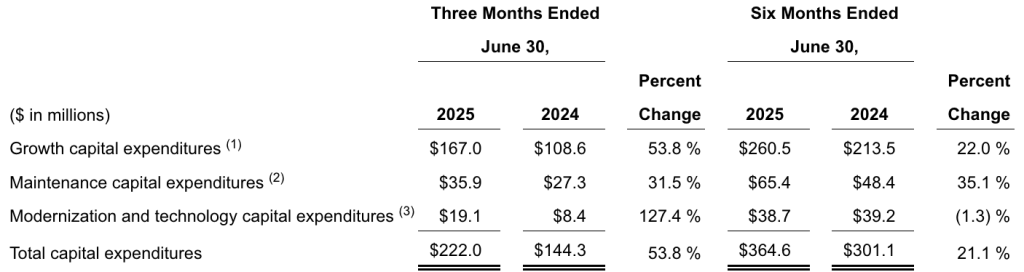

Capital expenditures by type of expenditure were as follows:

Liquidity and Capital Resources

Net debt leverage ratio improved to 1.8 times as of June 30, 2025, from 3.0 times as of June 30, 2024.

As of June 30, 2025, total available liquidity was $794.0 million, which included $618.5 million of availability on a $650.0 million revolving credit facility and $175.5 million of cash and cash equivalents.

At June 30, 2025, there were no outstanding borrowings under the LTH revolving credit facility and there were $31.5 million of outstanding letters of credit.

The company had $175.5 million in cash and cash equivalents, which was said to be higher than historical levels due to the sale-leaseback transaction completed shortly before the end of the quarter. LTH expects to use this cash to fund growth initiatives.

Effective April 8, 2025, LTH entered into interest rate swap agreements for its entire term loan facility notional amount of $997.5 million, which converted the variable interest rate of the term loan facility to a fixed interest rate of 3.409 percent, plus the applicable margin that was reduced 0.25 percent to 2.25 percent effective June 19, 2025.

On June 18, 2025, S&P Global Ratings upgraded the company’s issuer credit rating to ‘BB-‘ from ‘B+’. As a result, the company’s term loan facility margin improved by 25 basis points and its revolving credit facility improved by 25 basis points to Secured Overnight Financing Rate (SOFR) plus 2.00 percent, or the Base Rate plus 1.00 percent.

Full-Year 2025 Guidance

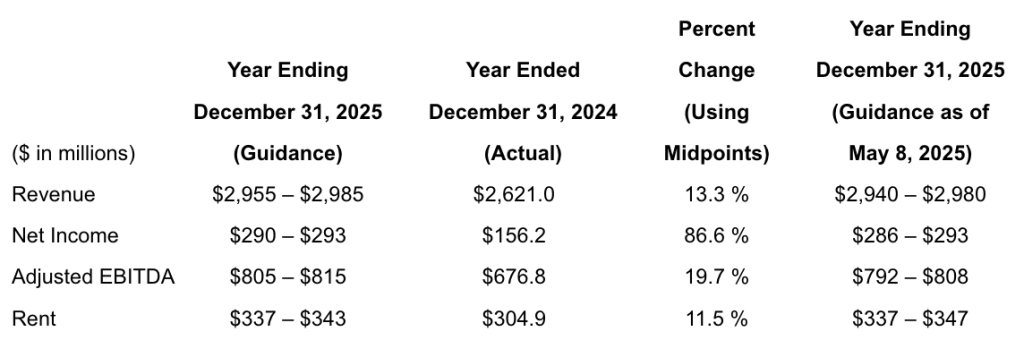

LTH is also reiterating or updating the following operational and financial guidance for full-year fiscal 2025:

- Open 10 new centers.

- Manage our net debt leverage ratio to remain at or below 2.00 times.

- Comparable center revenue growth of 9.5 percent to 10.0 percent, increased from our previous expectations of 8.5 percent to 9.5 percent.

- Adjusted EBITDA growth driven primarily by dues revenue growth and expanded operating leverage.

- Rent to include non-cash rent expense of $34 million to $37 million, decreased from our previous expectations of $35 million to $38 million.

- Interest expense, net of interest income and capitalized interest, of approximately $80 million to $84 million.

- Provision for income tax rate estimate of 24 percent, increased from our previous expectations of 23 percent.

- Cash income tax expense of $25 million to $27 million, which compares to our previous expectation of $39 million to $41 million and reflects tax benefits of the One Big Beautiful Bill Act.

- Depreciation and amortization expense of $288 million to $294 million, tightened from our previous expectation of $286 million to $294 million.

- Complete $100 million in additional sale-leaseback transactions in the second half of the year, resulting in total gross proceeds of approximately $250 million for the year.

Image courtesy Life Time Group Holdings, Inc.