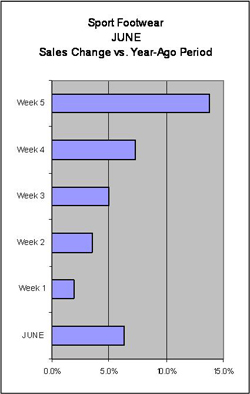

The month of June presented a mixed bag of results for the sporting goods and athletic footwear and apparel markets as retailers in the mall turned up the heat on the promotional fire in footwear and apparel to drive growth towards the back end of the month. Based on point-of-sale data compiled by SportScanINFO, SportsOneSOurce is estimating that overall Sport Footwear sales rose in the mid-single-digits for the month, but average selling prices suffered from various promotional efforts that drive more units out the door, reversing the ASP growth trend seen for the year-to-date period. The efforts were not employed across all categories or brands, but appeared to be more targeted in their approach to liquidate older inventory or slower moving categories or styles. SportsOneSource estimates that Sport Apparel sales were up in the high-single-digits for the five-week retail fiscal month of June, but unit sales were up nearly twice that rate, growing in the mid-teens. Overall Athletic Equipment sales were also up in the mid-single-digits for the month, but unit sales lagged the dollar sales growth.

for the sporting goods and athletic footwear and apparel markets as retailers in the mall turned up the heat on the promotional fire in footwear and apparel to drive growth towards the back end of the month. Based on point-of-sale data compiled by SportScanINFO, SportsOneSOurce is estimating that overall Sport Footwear sales rose in the mid-single-digits for the month, but average selling prices suffered from various promotional efforts that drive more units out the door, reversing the ASP growth trend seen for the year-to-date period. The efforts were not employed across all categories or brands, but appeared to be more targeted in their approach to liquidate older inventory or slower moving categories or styles. SportsOneSource estimates that Sport Apparel sales were up in the high-single-digits for the five-week retail fiscal month of June, but unit sales were up nearly twice that rate, growing in the mid-teens. Overall Athletic Equipment sales were also up in the mid-single-digits for the month, but unit sales lagged the dollar sales growth.

Sport Footwear sales increased most in June in the Internet/Catalog, Sport Specialty and Full-Line Sporting Goods channels, with each posting double-digit gians for the month ended July 7, 2007. The Athletic/Urban Specialty and Family Footwear channels posted mid-single-digit increases, while the Mid-Tier inched up in the low-single-digits and the Discount/Mass channel posted a decline.

Footwear with average selling prices between $50 and $75 saw the largest increase in dollar sales, while footwear between $75 and $90 and under $50 posted declines. Footwear over $90 saw sales increased in the low-single-digits.

Nike/Jordan saw its market share widen over the rest of the pack again in June, but lost share in every price point range except in footwear over $90. The company picked up more share in womens product than it did on the mens side. New Balance, adidas, Reebok and Skechers rounded out the top five vendors in overall Sport Footwear market share, while Asics and Puma pushed Reebok and adidas out of the top five in womens Sport Footwear.

Nike led all unit sales for the month with its womens Celso Thong Plus in black.  In dollars, the mens Air Jordan Retro 3 led all other Sport Footwear, followed by the ubiquitous Air Force 1, while Asics claimed the top spot in womens with the 2120, followed by Reeboks Princess white/white.

In dollars, the mens Air Jordan Retro 3 led all other Sport Footwear, followed by the ubiquitous Air Force 1, while Asics claimed the top spot in womens with the 2120, followed by Reeboks Princess white/white.

The Canvas, Sandals, Baseball/Softball Cleats, Lifestyle Fashion Athletic, Hiking, Trail Running, Skate and Heelys categories posted the most growth for the month with double-digit gains, while Tennis, Classics, Basketball, Walking and Football Cleats all saw declines for the period.