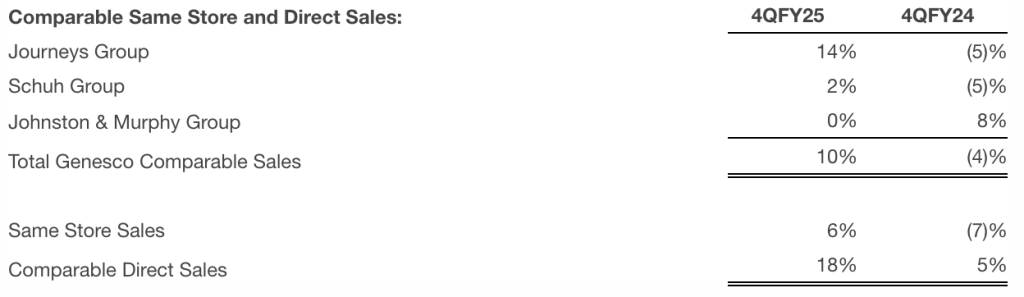

Genesco, Inc. has reported that the company’s net sales for the 13-week Fiscal 2025 fourth quarter increased 1 percent to $746 million for the period ended February 1, compared to $739 million in the 14-week fourth quarter of Fiscal 2024. The net sales increase reflects a 10 percent bump in comparable sales, including an 18 percent increase in e-commerce comparable sales and a 6 percent increase in same-store sales.

The company said the comp store sales gains were partially offset by the negative impact of the 53-week calendar shift, which included an extra week in the fourth quarter of Fiscal 2024, shifting a higher-volume week out of the fourth quarter into the third quarter in Fiscal 2025 and the impact of net store closings. If adjusted for this extra week and shift, net sales would have increased 7 percent.

Comparable Sales

The overall sales increase of 1 percent for the fourth quarter of Fiscal 2025 compared to the fourth quarter of Fiscal 2024 was driven by an increase of 5 percent at Journeys, partially offset by a decrease of 3 percent at Schuh, a decrease of 6 percent at Johnston & Murphy and a decrease of 12 percent at Genesco Brands. Schuh sales were down 4 percent for the fourth quarter on a constant-currency basis.

Fiscal 2025 fourth-quarter gross margin was 46.9 percent of sales, up 60 basis points compared with 46.3 percent in the prior-year Q4 period. The increase, as a percentage of sales compared to Fiscal 2024, is due primarily to lower markdowns at Journeys and improved margins at Genesco Brands and Johnston & Murphy, partially offset by increased promotional activity at Schuh.

Selling and administrative expenses for the fourth quarter of Fiscal 2025 decreased 60 basis points as a percentage of sales to 40.5 percent compared with 41.1 percent in the prior-year period. The decrease, as a percentage of sales compared to Fiscal 2024, primarily reflects decreased occupancy costs, selling salaries and other expenses as part of the company’s cost savings initiatives, partially offset by increased marketing and performance-based incentive compensation expenses.

Genesco’s GAAP operating income for the fourth quarter was $46.1 million, or 6.2 percent of sales in Fiscal 2025, compared with $37.3 million, or 5.0 percent of sales in the Fiscal 2024 fourth quarter. Adjusted for the Excluded Items in the fourth quarters of Fiscal 2025 and 2024, operating income for the fourth quarter of Fiscal 2025 was $47.9 million compared to $38.5 million last year. Adjusted operating margin was 6.4 percent of sales in the fourth quarter of Fiscal 2025 and 5.2 percent in the fourth quarter of last year.

The effective tax rate for the quarter was 25.8 percent in Fiscal 2025 compared to 43.0 percent in the fourth quarter of Fiscal 2024. The adjusted tax rate, reflecting Excluded Items, was 23.8 percent in Fiscal 2025 compared to 22.6 percent in the fourth quarter of Fiscal 2024. The higher adjusted tax rate for the fourth quarter of Fiscal 2025, compared to the prior-year fourth quarter, primarily reflects a change in the jurisdictional mix of increased Fiscal 2025 fourth-quarter earnings.

GAAP earnings from continuing operations were $33.6 million in the fourth quarter of Fiscal 2025 compared to $20.3 million in the prior-year fourth quarter. Adjusted for the Excluded Items in the fourth quarters of both Fiscal 2025 and 2024, fourth-quarter earnings from continuing operations were $35.8 million, or $3.26 per share, in Fiscal 2025, compared to $28.5 million, or $2.59 per share, in the fourth quarter of Fiscal 2024.

“We delivered a strong finish to the year with fourth-quarter sales and gross margins exceeding expectations and operating income up meaningfully from the prior year period,” commented Genesco’s Board Chair, President and CEO Mimi E. Vaughn. “Our performance was led by Journeys as the strategic growth initiatives we’ve implemented over the past 12 months fueled strong full-priced selling and mid-teens comp growth. At the same time, sales trends at Schuh and Johnston & Murphy further improved with fourth quarter comps for both businesses reaching the highest level of the year.”

Fiscal 2025 Financial Summary

- Net sales of $2.3 billion (52 weeks) were flat compared to FY24 (53 weeks).

- Comparable sales increased 3 percent, with stores flat and e-commerce up 12 percent.

- E-commerce sales represented 25 percent of retail sales compared to 23 percent last year.

- GAAP EPS was ($1.80) vs. ($2.10) last year and non-GAAP EPS was 94 cents vs. 56 per share in the prior year.

Vaughn continued, “It is rewarding to look back and see that we accomplished the strategic priorities we outlined at the start of Fiscal 2025 and that our efforts led to improved comparable sales and enhanced profitability as the year progressed. We are in the early innings of returning Journeys and the overall company to historical rates of sales and profits, but we are heading in the right direction. We are excited about the actions we are taking to build on our momentum in Fiscal 2026 centered around our footwear-focused strategy and Journeys’ strategic growth plan, and we feel confident we are positioning the business to deliver profitable growth and shareholder value over the long term.”

Cash, Borrowings and Inventory

As of February 1, 2025, the company’s cash position was $34.0 million, compared with $35.2 million as of February 3, 2024. Total debt at the end of the fourth quarter of Fiscal 2025 was zero compared with $34.7 million at the end of last year’s fourth quarter. Inventories increased 12 percent year-over-year, reflecting increased inventory for Journeys, Johnston & Murphy and Genesco Brands, partially offset by a decrease at Schuh.

Capital Expenditures and Store Activity

For the fourth quarter of Fiscal 2025, capital expenditures were $14 million, related primarily to retail stores and digital and omni-channel initiatives. Depreciation and amortization was $13 million.

During the quarter, the company opened four stores and closed 28 stores. The company ended the quarter with 1,278 stores compared with 1,341 stores at the end of the fourth quarter last year, or a decrease of 5 percent. Square footage was down 3 percent on a year-over-year basis.

Share Repurchases

The company did not repurchase any shares during the fourth quarter of Fiscal 2025. The company repurchased 399,633 shares for $9.8 million, or $24.49 per share, during Fiscal 2025. The company has $42.3 million remaining on its expanded share repurchase authorization, announced in June 2023.

Cost Savings Update

The company achieved the higher end of its target run-rate range of $45 million to $50 million in total expense savings through the cost reduction program that began in Fiscal 2024.

Fiscal 2026 Outlook

For Fiscal 2026, the company expects the following:

- Total sales are to be flat to up 1 percent compared to Fiscal 2025, including a foreign exchange negative impact of approximately $14 million and a closed store impact of approximately $30 million.

- Adjusted diluted earnings per share from continuing operations in the range of $1.30 to $1.70 per share.

Guidance assumes no further share repurchases and a tax rate of 29 percent.

Image courtesy Johnston & Murphy/Genesco, Inc.