Genesco, Inc., parent company to Journeys, Schuh, Johnston & Murphy, and other brands, reported net sales for the second quarter of Fiscal 2025 amounted to $525 million, compared to $523 million in the second quarter of Fiscal 2024.

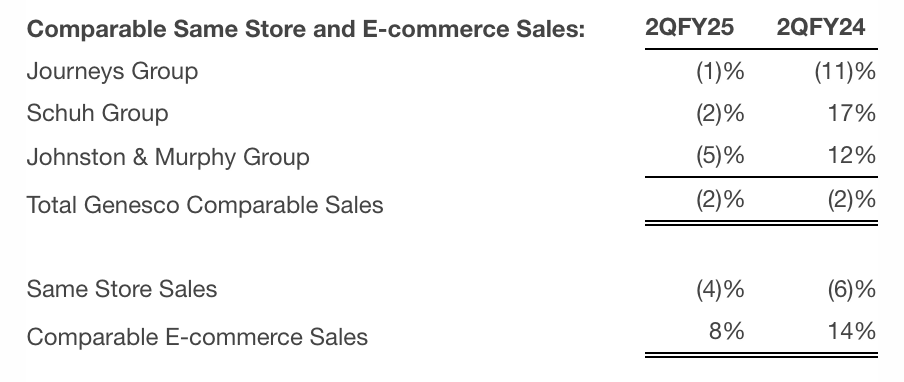

The sales increase reportedly includes approximately $20 million to $25 million due to the move of a strong week of back-to-school sales from the third quarter last year to the second quarter this year related to the 53-week calendar shift. Along with an 8 percent increase in e-commerce comparable sales, the increase was partially offset by a decline in store sales, the impact of net store closings and decreased wholesale sales.

Comparable Store Sales

The overall sales increase for the second quarter of Fiscal 2025 compared to the second quarter of Fiscal 2024 was reportedly driven by a 4 percent increase at Journeys and an increase of 1 percent at Schuh, partially offset by a decrease of 9 percent at Johnston & Murphy and a 13 percent, or $4 million, decrease at Genesco Brands. Schuh sales were up 1 percent for the second quarter this year on a constant-currency basis.

Second quarter gross margin this year was 46.8 percent of net sales, compared with 47.7 percent in Q2 last year. Adjusted gross margin for the second quarter this year decreased 90 basis points year-over-year as a percentage of sales. The decrease as a percentage of sales compared to Fiscal 2024 was reportedly due primarily to a higher mix of sale products at Schuh and changes in the product mix at Journeys.

GAAP loss from continuing operations was $9.9 million in the second quarter of Fiscal 2025 compared to a $31.6 million in the second quarter last year. Adjusted for the Excluded Items in all periods, the second quarter loss from continuing operations was $9.1 million, or 83 cents per share, in Fiscal 2025, compared to $9.6 million, or 85 cents per share, in the second quarter last year.

Balance Sheet Summary

- Cash as of August 3, 2024 was $45.9 million, compared with $37.4 million as of July 29, 2023.

- Total debt at the end of the second quarter of Fiscal 2025 was $77.8 million compared with $131.5 million at the end of last year’s second quarter.

- Inventories decreased 8 percent on a year-over-year basis, reflecting decreased inventory for Journeys, Schuh and Johnston & Murphy, partially offset by an increase at Genesco Brands.

Fiscal 2025 Outlook

- Genesco now expects total sales to decrease 1 percent to 2 percent compared to Fiscal 2024, or flat to down 1 percent excluding the 53rd week in Fiscal 2024 versus prior expectations for a total sales decrease of 2 percent to 3 percent, or down 1 percent to 2 percent excluding the 53rd week in Fiscal 2024; and

- Continues to expect adjusted diluted earnings per share from continuing operations in the range of 60 cents to $1.00

Guidance assumes no further share repurchases and a tax rate of 27 percent.

Image courtesy Journeys

See below for additional SGB Media coverage of the CEO and CFO comments about each retail brand, channel trends, the issue with vulcanized footwear spreads, and the company’s outlook for the year:

Genesco, Inc. CEO and CFO Share Journeys, Schuh and J&M Details from Q2