Genesco, Inc. (GCO) shares were up sharply on Friday morning, December 6, after the parent of Journeys, Schuh and Johnston & Murphy reported net sales were up 3 percent to $596 million for the third quarter of Fiscal 2025, compared to $579 million in the third quarter of Fiscal 2024.

The sales increase reportedly reflects a 6 percent increase in comparable sales, including a 15 percent increase in e-commerce comparable sales and a 4 percent increase in same-store sales, a favorable foreign exchange impact, partially offset by the adverse effects of moving ~$17 million generated in a strong week of back-to-school sales from the third quarter to the second quarter of 2024 related to the 53-week calendar shift and the impact of net store closings.

“Our quarterly performance once again exceeded expectations and marked a return to positive overall comparable sales,” noted Board Chair and CEO Mimi Vaughn in a report on December 6. “Following a strong start to the third quarter, including the heart of back-to-school, sales trends at Journeys remained robust in September and October, fueling a double-digit comp gain for the business. This result was driven by the initial phase of Journeys’ strategic growth plan, which has focused on elevating the consumer experience, including improving the product assortment and visually resetting our stores.” She added that EPS results would have been stronger without the shift of the critical back-to-school week into the second quarter this year.

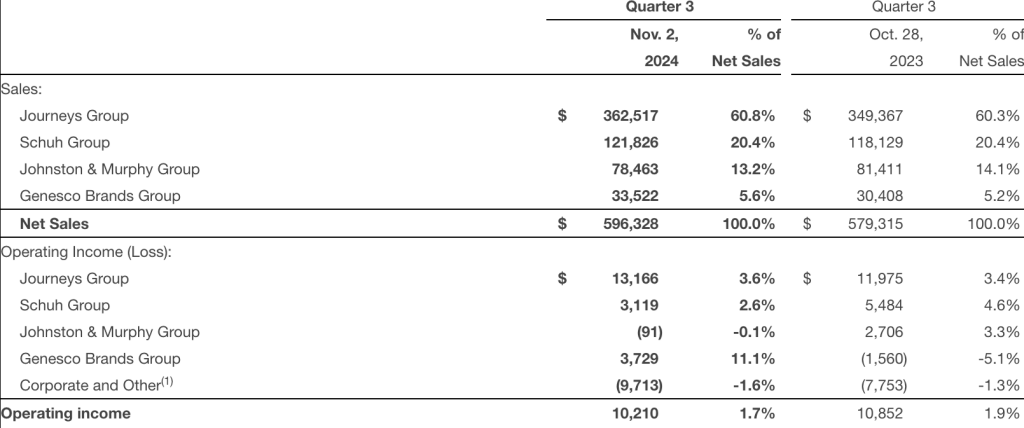

The overall sales increase for the third quarter of Fiscal 2025 compared to the third quarter of Fiscal 2024 was driven by an increase of 4 percent at Journeys, an increase of 3 percent at Schuh and a 10 percent increase at Genesco Brands, partially offset by a decrease of 4 percent at Johnston & Murphy. Schuh sales were down 2 percent for the third quarter this year on a constant-currency basis.

Sales/Earnings Summary by Segment

(in US$ thousands)

Income Statement Summary

Third-quarter gross margin decreased 30 basis points to 47.8 percent of sales, compared with 48.1 percent in Q3 last year. The decrease, as a percentage of sales, compared to Fiscal 2024, was due primarily to changes in Journeys’ product mix.

Selling and administrative expense for the third quarter decreased 10 basis points as a percentage of sales to 46.1 percent of sales compared to 46.2 percent in Q3 last year. The decrease, as a percentage of sales compared to Fiscal 2024, reflects the combination of our cost savings initiatives, the closure of unproductive stores and some improvement in other expenses, partially offset by additional selling salaries and marketing expenses.

Genesco’s GAAP operating income for the third quarter was $10.2 million, or 1.7 percent of sales this year, compared with $10.9 million, or 1.9 percent of sales in the third quarter last year. Adjusted for the Excluded Items in the third quarters of Fiscal 2025 and 2024, operating income for the third quarter was $10.3 million this year compared to $11.0 million last year. Adjusted operating margin was 1.7 percent of sales in the third quarter of Fiscal 2025 compared to 1.9 percent in the third quarter of last year.

The effective tax rate for the quarter was 311.5 percent in Q3 Fiscal 2025 compared to 22.5 percent in the third quarter last year. The adjusted tax rate, reflecting Excluded Items, was 27.1 percent in Fiscal 2025 compared to 27.8 percent in the third quarter last year. The lower adjusted tax rate for the third quarter this year compared to the third quarter last year reflects a reduction in the tax benefit recorded year to date due to lower projected earnings and taxes from our foreign jurisdictions. The divergence between the effective tax rate and the adjusted tax rate is due to recording a $26.3 million U.S. valuation allowance in the third quarter this year that is excluded from the adjusted tax rate.

The GAAP loss from continuing operations was $18.8 million in the third quarter of Fiscal 2025 compared to earnings from continuing operations of $6.6 million in the third quarter last year. Adjusted for the Excluded Items in the third quarters of both Fiscal 2025 and 2024 and the U.S. valuation allowance in the third quarter of Fiscal 2025, third-quarter earnings from continuing operations were $6.6 million, or $0.61 per share, in Fiscal 2025, compared to $6.2 million, or $0.57 per share, in the third quarter last year.

Cash, Borrowings and Inventory

Cash as of November 2, 2024, was $33.6 million, compared with $21.7 million as of October 28, 2023.

Total debt at the end of the third quarter of Fiscal 2025 was $100.1 million compared with $128.2 million at the end of last year’s third quarter.

Inventories increased 1 percent on a year-over-year basis, reflecting increased inventory for Genesco Brands, partially offset by a decrease at Schuh and Johnston & Murphy, while Journeys remained flat.

Capital Expenditures and Store Activity

Capital expenditures were $13 million for the third quarter of this year, primarily related to retail stores and digital and omni-channel initiatives.

Depreciation and amortization was $13 million.

During the quarter, the company opened two stores and closed 14, ending the quarter with 1,302 stores, compared with 1,360 stores at the end of the third quarter last year, or a decrease of 4 percent. Square footage was down 4 percent on a year-over-year basis.

Share Repurchases

Genesco, Inc. repurchased 17,922 shares during the third quarter of Fiscal 2025 for $0.4 million, or $24.50 per share. The company currently has $42.3 million remaining on its expanded share repurchase authorization, announced in June 2023.

Store Closing and Cost Savings Update

The company closed 12 Journeys stores in the third quarter of Fiscal 2025 for a total of 41 Journeys stores closed to date in Fiscal 2025 and expects to close up to an additional 10 Journeys stores in Fiscal 2025.

The company’s cost savings program remains on track to achieve a reduction in the annualized run rate of $45 to $50 million by the end of Fiscal 2025

Fiscal 2025 Outlook

For Fiscal 2025, the company now expects total sales to be down 1 percent to flat compared to Fiscal 2024, or flat to up 1 percent excluding the 53rd week in Fiscal 2024 versus prior expectations for a total sales decrease of 1 percent to 2 percent, or flat to down 1 percent excluding the 53rd week in Fiscal 2024.

Genesco, Inc. expects adjusted diluted earnings per share from continuing operations in the range of 80 cents to $1.00 per diluted share for the year versus prior guidance of 60 cents to $1.00 per diluted share.

The company said this guidance assumes no further share repurchases and a tax rate of 27 percent.

Image courtesy Journeys/Genesco, Inc.