Johnson Outdoors, Inc. posted lower revenue and earnings for the fiscal year ending September 29 as Fiscal 2023 sales fell 11 percent compared to the previous year, operating profit decreased $54.6 million, or 82 percent, and net income fell $25.0 million, or 56 percent, from the prior fiscal year.

“The end of the elevated pandemic-driven demand of the past few years, combined with higher inventory levels at retail, resulted in lower sales and profits for our 2023 fiscal year,” said company Chairman and CEO Helen Johnson-Leipold. “Our fiscal fourth quarter was particularly impacted by significantly slower demand. Heading into fiscal 2024, we are working hard to outperform the challenging marketplace and improving our profitability profile. We’re excited about new innovations announced this year, including Minn Kota’s new line of motors and Old Town’s award-winning power-assisted pedal drive boat. We will continue to invest in innovation to keep our brands strong, and to maximize opportunities to enhance the long-term growth and profitability of all our businesses.”

Fiscal Fourth Quarter

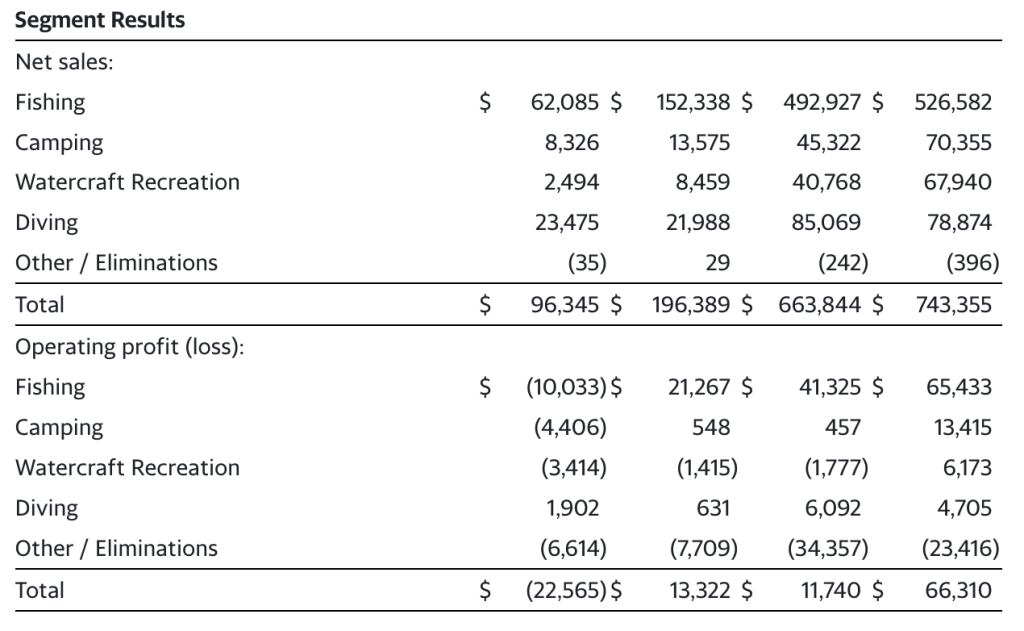

Consolidated net sales in the fiscal fourth quarter were $96.3 million, a $100.1 million decrease from the prior-year fourth quarter’s sales of $196.4 million.

The net loss for the fourth quarter was $16.0 million, or a loss of $1.56 a share, compared to net income of $9.7 million, or EPS of 95 cents a share in the fiscal 2022 fourth quarter.

- Gross profit declined to $28.4 million in Q4, compared to $68.6 million in the prior-year quarter due to “lower sales, increased inventory reserves, and unfavorable overhead absorption.”

- Operating expenses decreased $4.3 million to $51.0 million due primarily to a reduction in sales volume-driven expenses and lower incentive compensation expense.

- Operating loss of $22.6 million in the fourth quarter compared to an operating profit of $13.3 million in the prior-year fourth quarter.

- Loss before income taxes was $22.1 million in the fourth quarter, compared to profit before income taxes of $11.8 million in the prior-year fourth quarter.

Fiscal Full-Year 2023

Consolidated revenue fell 11 percent to $663.8 million in fiscal 2023 ended September 29 versus fiscal 2022 revenue of $743.4 million. Key factors in the year-over-year comparison were reported as:

- Fishing revenue decreased 6 percent as demand moderated to pre-pandemic levels;

- Diving sales increased 8 percent, comparing favorably to the prior fiscal year, due to strong performance in a recovering market;

- Camping decreased $25.0 million due primarily to a significant decline in demand as well as the sale of the Military and Commercial tents product lines in the fiscal second quarter; and

- Watercraft Recreation sales decreased $27.2 million, reflecting significant reductions in the overall market demand.

Consolidated operating profit was $11.7 million in fiscal 2023, which compared unfavorably to operating profit of $66.3 million in the prior fiscal year due to the lower sales volumes and a $27.3 million increase in operating expenses. Deferred compensation expense increased $9.1 million as a result of marking plan assets to market and was entirely offset in Other Income. Additionally, higher warranty expenses, investments in research and development costs, and higher marketing and professional services costs further drove the operating expense increase versus fiscal 2022.

Profit before income taxes was $25.8 million in fiscal 2023, compared to $58.9 million in fiscal 2022. Other Income improved by $17.8 million over the prior year due primarily to improved gains on deferred compensation plan assets and a $6.6 million gain on the sale of the Eureka! Military and Commercial Tents business.

Net income for the fiscal year fell to $19.5 million, or $1.90 per diluted share, a 56 percent decline versus $44.5 million, or $4.37 per diluted share, in the prior fiscal year.

The company reported cash and investments of $152.6 million at year-end, a $22.8 million increase from the prior year-end, with no debt on its balance sheet.

Depreciation and amortization were $16.3 million compared to $14.2 million in fiscal 2022. Capital spending totaled $22.7 million in fiscal 2023 compared with $31.7 million in fiscal 2022.

In September 2023, the company’s Board of Directors approved a 3 percent increase in the quarterly cash dividend to shareholders of record as of October 13, 2023, which was payable on October 27, 2023.

“Heading into fiscal year 2024, we’re focused on carefully managing higher-than-normal inventories and improving profitability with a defined cost savings program in place and prudent expense management,” said CFO David W. Johnson. “The balance sheet remains debt-free and our healthy cash position enables us to continue investing in strategic opportunities to strengthen the business and consistently pay dividends to shareholders.”

Photo courtesy Old Town