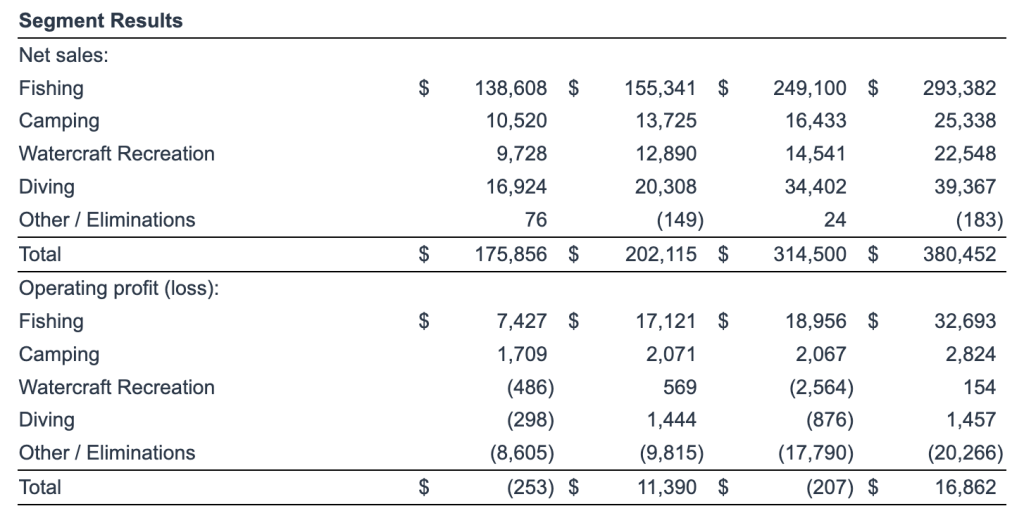

Johnson Outdoors Inc. reported that total net sales in the second quarter declined 13 percent to $175.9 million, compared to $202.1 million in the prior-year second fiscal quarter. All four business segments of the company reportedly faced “challenging market conditions and increased competitive pressure” in the quarter ended March 29, according to a company press release statement.

“Our second quarter results reflect challenging marketplace conditions,” said Helen Johnson-Leipold, chairman and CEO, Johnson Outdoors Inc. “In the season ahead, we are investing in marketing and promotions and supporting our new product launches, like the new Minn Kota Quest trolling motor line that is seeing positive response from the trade. We are also continuing to work hard to improve our cost structure and reduce inventory levels. Looking ahead, we remain focused on investing in innovation and strengthening our brands to continue to position Johnson Outdoors for long-term marketplace success.”

More than half of Camping’s decline was said to be due to the divestiture of the company’s Military and Commercial Tents (Eureka!) business last year and Diving sales were impacted by geopolitical issues affecting travel to certain regions of the world.

Gross margin was 34.9 percent of net sales in Q2, compared to 37.3 percent in the prior-year quarter. The margin decline was said to be due primarily to unfavorable overhead absorption and promotional price reductions.

Operating expenses of $61.7 million decreased $2.3 million from the prior-year period, due primarily to lower sales volumes between quarters, lower incentive compensation and professional services expense, partially offset by increased promotional spending.

Total company operating loss was $0.25 million for the second quarter versus operating profit of $11.4 million in the prior-year second quarter.

Profit before income taxes was $3.0 million in the second quarter, compared to $19.9 million in the prior-year second quarter. In addition to the decline in operating profit, Other income also declined by approximately $5.4 million due primarily to a gain of approximately $6.6 million related to the divestiture of the Military and Commercial Tents product lines in the Camping Segment in the prior-year quarter.

Net income was $2.2 million, or 21 cents per diluted share, versus $14.9 million, or $1.45 per diluted share, in the prior-year second quarter. The effective tax rate was 28.4 percent in Q2, compared to 25.5 percent in the prior-year second quarter.

Fiscal 2024 year-to-date net sales were $314.5 million, a 17 percent decrease over last year’s first half period. Net income for the 2024 fiscal first half was $6.1 million, or 59 cents per diluted share, versus $20.7 million, or $2.02 per diluted share, in the prior-year fiscal H1 period.

JOUT reported cash and short-term investments of $84.3 million as of March 29, 2024.

Depreciation and amortization were $9.9 million in the six months ending March 29, 2024, compared to $7.8 million in the prior six-month period.

Capital spending totaled $10.2 million in the current fiscal H1 period compared with $14.0 million in the prior-year comparative period.

In March 2024, the company’s Board of Directors approved a quarterly cash dividend to shareholders of record as of April 11, 2024, which was payable April 25, 2024.

“Competitive marketplace conditions requiring investment in promotional activity and pricing actions dampened our profits,” offered David W. Johnson, VP and CFO, Johnson Outdoors Inc. “While we’ve been making progress on inventory levels, we are continuing our efforts to improve profitability by managing expenses and expanding our cost savings program. Our debt-free balance sheet and cash position continue to enable us to invest in strategic opportunities to strengthen the business, while consistently paying dividends to shareholders.”

Image courtesy Johnson Outdoors