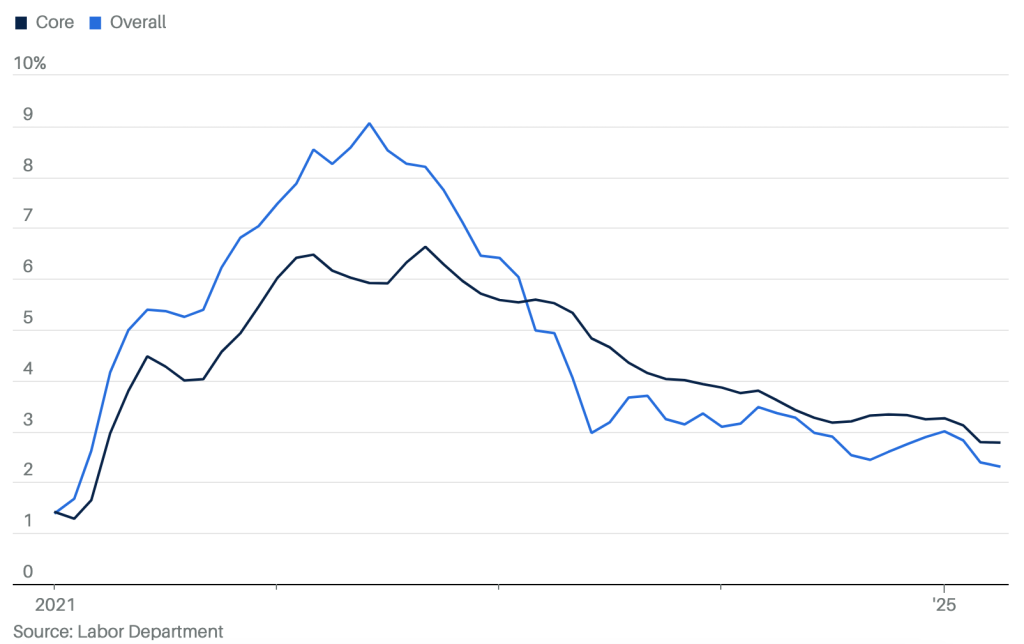

The U.S. Bureau of Labor Statistics (BLS) has reported the Consumer Price Index (CPI) for April rose 0.2 percent versus the 0.3 percent consensus estimate and dipped 0.1 percent from March 2025.

On an annual basis, CPI came in at 2.3 percent, reportedly the slowest annual rate since early 2021, countering the consensus estimate that it would hold at 2.4 percent.

Core CPI was pegged at 0.2 percent compared with estimates of a 0.3 percent rise and was up 0.1 percent in March. Year-over-year, Core CPI rose 2.8 percent versus the 2.8 percent consensus estimates and 2.8 percent versus the prior month.

The core CPI measure saw monthly increases in household furnishings and operations, medical care, motor vehicle insurance, education, and personal care. Meanwhile, declines were recorded in airline fares, used cars and trucks, communication, and apparel, according to the BLS.

Megan Leonhardt wrote on Barron’s that there is little evidence that the tariffs implemented by the Trump Administration in February and March are feeding through to inflation just yet.

She noted that some categories more closely tied to imports from China, such as apparel, have yet to show much effect from tariffs. Apparel costs fell 0.2 percent month-over-month in April and have declined 0.7 percent year-over-year.

This CPI report marks the first to reflect the economic and business uncertainty triggered by President Trump’s April 2 “Liberation Day” tariff announcements. However, recent agreements with the U.K. and China may signal to investors that the White House is scaling back its most aggressive tariff threats.

John Bowman wrote on Seeking Alpha that tariffs haven’t significantly impacted prices yet, as businesses are stockpiling and finding alternatives, delaying the inflationary effects. He said the Fed is cautious, maintaining rates due to potential stagflation risks, but current data is encouraging for economic optimism.

“That optimism may not be enough for rate cuts, and the PPI release on the 15th will be more telling of how tariffs are impacting prices, as they will affect producer pricing before consumer pricing,” Bowman said.

Image, chart and data courtesy U.S. Labor Dept.