Iconix Brand Group reported a loss of $6.3 million, or 13 cents a share, in the third quarter after a number of special charges against earnings of $33.7 million, or 58 cents, a year earlier.

Results for the Third Quarter Ended September 30, 2015

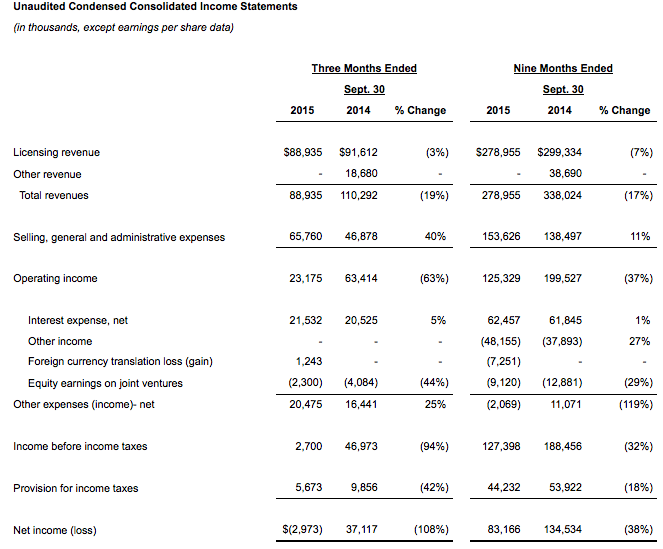

Licensing revenue for the third quarter of 2015 was approximately $88.9 million, a 3 percent decrease as compared to approximately $91.6 million in the third quarter of 2014. Licensing revenue was negatively affected by approximately $2.7 million due to foreign currency exchange rates. Excluding the effect of foreign currency exchange rates, licensing revenue was flat in the quarter. There was no “Other Revenue” in the third quarter of 2015, as compared to approximately $18.7 million of “Other Revenue” related to a joint venture for our Lee Cooper and Umbro brands in China recorded in the third quarter of 2014.

The company's results for the third quarter of 2015 include the following items:

- Approximately $12.2 million, or 16 cents per diluted share, of accounts receivable reserves and write-offs related to a comprehensive review of the company's license agreements and relationships with its licensees;

- Approximately $3.8 million, or 8 cents per diluted share, related to adjustments from the preparation of the company's 2014 federal tax return; and

- Approximately $7.1 million, or 10 cents per diluted share, of charges for professional fees associated with the continuing correspondence with the Staff of the U.S. Securities and Exchange Commission, the Special Committee's review and severance costs related to the transition of Iconix management.

Due in large part to these items and there being no “Other Revenue” in the quarter, all metrics decreased. Adjusted EBITDA attributable to Iconix for the third quarter of 2015 was approximately $30.5 million, a 53 percent decrease as compared to approximately $65.4 million in the prior year quarter.

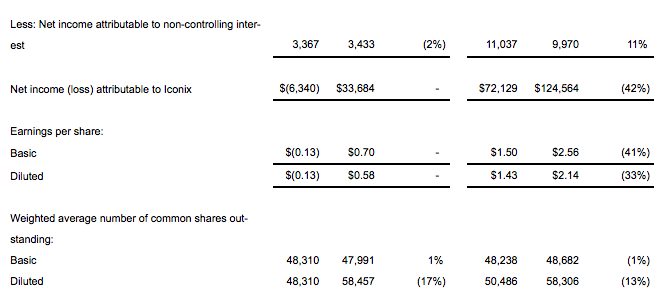

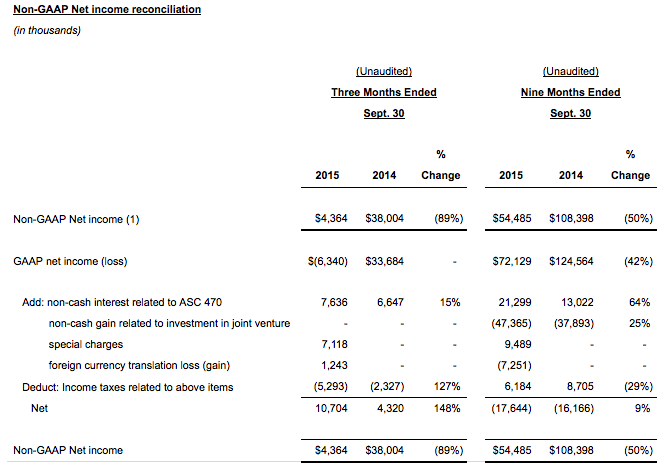

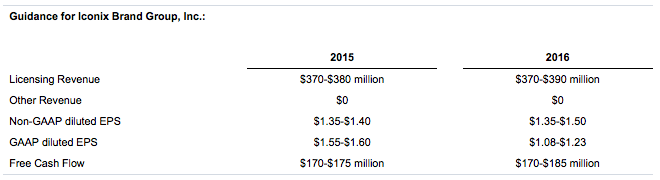

On a non-GAAP basis, as set forth in the tables below, net income attributable to Iconix was approximately $4.4 million, an 89 percent decrease as compared to the prior year quarter of approximately $38.0 million. Non-GAAP diluted EPS for the third quarter of 2015 was 9 cents a share, an approximate decrease of 88 percent as compared to 72 cents in the prior year quarter. Excluding the increase in accounts receivable reserve and write offs and the tax adjustment in the third quarter of 2015, non-GAAP diluted EPS was 33 cents a share. GAAP net income attributable to Iconix for the third quarter of 2015 reflects a loss of approximately $6.3 million, as compared to income of $33.7 million in the prior year quarter, and GAAP diluted EPS for the third quarter of 2015 reflects a loss of 13 cents a share as compared to earnings of 58 cents a share in the prior year quarter.

Free cash flow attributable to Iconix for the third quarter of 2015 was approximately $39 million, an 11 percent decrease as compared to the prior year quarter of approximately $43.9 million.

Results for the Nine Months Ended September 30, 2015

Licensing revenue for the nine months ended Sept. 30, 2015 was approximately $279.0 million, a 7 percent decrease as compared to approximately $299.3 million for the prior year period. Total licensing revenue was negatively affected by approximately $7.9 million due to foreign currency exchange rates. In addition, licensing revenue in the comparable 2014 period included $17.1 million of revenue related to the 5-year renewal of the Peanuts specials with ABC. Excluding the effect of foreign currency exchange rates and the ABC renewal, licensing revenue increased 2 percent.

There was no “Other Revenue” in the nine month period, as compared to approximately $38.7 million of “Other Revenue” related to the formation of joint ventures and sale of Sharper Image e-commerce and website recorded in the prior year period.

Adjusted EBITDA attributable to Iconix for the nine month period was approximately $135.7 million, a 34 percent decrease as compared to approximately $206.8 million in the prior year period. On a non-GAAP basis, as set forth in the tables below, net income attributable to Iconix for the nine month period was approximately $54.5 million, a 50 percent decrease as compared to approximately $108.4 million in the prior year period, and non-GAAP diluted earnings per share was approximately $1.10, an approximate decrease of 46 percent versus $2.05 for the prior year period. GAAP net income attributable to Iconix for the nine month period was approximately $72.1 million, a 42 percent decrease as compared to $124.6 million in the prior year period, and GAAP diluted EPS for the nine month period was $1.43, a 33 percent decrease as compared to $2.14 in the prior year period.

Free cash flow attributable to Iconix for the nine month period was approximately $144.5 million, a 13 percent increase over the prior year period of approximately $128.0 million.

Adjusted EBITDA, free cash flow, non-GAAP net income and non-GAAP diluted EPS are non-GAAP metrics, and reconciliation tables for each are attached to this press release.

“I would like to reiterate that the underlying fundamentals of our business are strong,” said Peter Cuneo, chairman and interim chief executive officer of Iconix. “We have gone through a difficult transition period, but Iconix continues to have significant business strengths including its diversified portfolio of consumer brands, profitable business model and strong free cash flow generation. All of us at the company are focused on capitalizing on these strengths and addressing the issues that have impacted more recent performance to improve our results and enhance value for shareholders.”

In addition, the company has recently retained Guggenheim Securities to assist with financial planning matters. The company is working closely with them to evaluate refinancing options related to the 2016 June Convertible Note maturity.

Iconix Brand Group, Inc. owns, licenses and markets a growing portfolio of consumer brands including: Candie's, Bongo, Badgley Mischka, Joe Boxer, Rampage, Mudd, Mossimo, London Fog, Ocean Pacific, Danskin, Rocawear, Cannon, Royal Velvet, Fieldcrest, Charisma, Starter, Waverly, Zoo York, Sharper Image, Umbro, Lee Cooper, Ecko Unltd. and Marc Ecko . In addition, Iconix owns interests in the Artful Dodger, Material Girl, Peanuts, Ed Hardy, Truth Or Dare, Billionaire Boys Club, Ice Cream, Modern Amusement, Buffalo, Nick Graham and Pony brands.