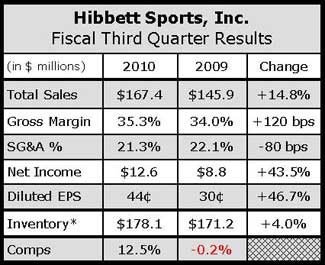

Hibbett Sports said heightened demand for sporting goods, increased foot traffic and more dollars per transaction drove same-store sales to 12.5% growth for the fiscal third quarter ended Oct. 30, marking the third consecutive quarter of double-digit comp growth for the retailer. Profits jumped 43.5% to $12.6 million, or 44 cents per diluted share, on consolidated sales than grew 14.8% to $167.4 million, prompting management to hike fourth quarter earnings forecasts and accelerate planned store openings for the remainder of fiscal 2010.

“We are very excited about our performance over the last three quarters,” said company President and CEO Jeff Rosenthal. “Not only has Hibbett achieved three consecutive quarters of double-digit comparable store sales growth, we have also experienced continued margin improvement.”

Rosenthal added that a concerted effort by Hibbett’s operation team resulted in an improvement in customer service during the quarter, along with a 1.36% increase in number of items per transaction and notable improvement in dollars per transaction. In-store shops from Nike and Under Armour have boosted foot traffic, he said, while an improved in-stock assortment also paid off during the quarter.

Monthly comps were up 13.4% in August, up 13.5% in September and up 9.5% in October.

Rosenthal added that Hibbett had been “a little bit more strategic” around promotions during the quarter, focusing on cleaning out aging inventory while holding strong on price points for current products.

By merchandise category, the activewear segment was up low-teens, driven by Nike, Under Armour and The North Face, with shorts and tees being the top performing key items.

Licensed gear was up low-20’s, driven by strong business in college, Major League Baseball and NBA products. Management added that college was up mid-teens on strength from both men’s and women’s. Auburn, Alabama, Oklahoma and Arkansas team sales were top sellers during the quarter. For MLB, management said the company had a “nice pop” at quarter-end from the Texas Rangers’ appearance in the World Series. LeBron James and rookie John Wall spurred growth for NBA products.

Management said the accessories business “remained strong” on solid returns from socks, shoe care and backpacks. Replenishment continued to support sales with strong in-stocks in stores while Phiten and Oakley continued to drive growth from a brand standpoint.

Hibbett’s equipment business was up low-double-digits with football, baseball and soccer being the key drivers. The top performing vendors for the quarter were Wilson, McDavid, Shock Doctor and Easton. The company’s fitness category was “weak” due to as-see-on-TV items faltering versus the year-ago period.

Footwear and cleated sales improved high-single digits for comps during the quarter on strong sales from Nike, Reebok and Asics products. Management said lightweight running and basketball were strong categories throughout the quarter while toning “continues to add incremental sales to the women’s footwear business.” Men's footwear was up low-double-digits, women's footwear was up low-double-digits and kids’ footwear was up high-single-digits for the quarter. Urban fashion apparel was down for the quarter.

Management said aged inventory is “in good shape,” adding that Q4 looks promising on solid assortments across the apparel and footwear categories.

The company expressed optimism going forward with its fleece programs from Under Armour and Nike along with outdoor products and “better allocations with penetration of key items” in-store.

For the first 19 days of November, same-store sales were up 19%. Management acknowledged that Q4 comparisons will be challenging due the year-ago NCAA championship of the Univ. of Alabama and a Super Bowl victory by the New Orleans Saints, but Rosenthal said management feels the company is in a “great position” to take advantage of Q4. Rosenthal said Saints and Crimson Tide gear accounted for about a third of licensed improvement in the year-ago period, adding that cold weather also accounted for roughly a third.

For fiscal 2011, management said Hibbett would focus on supplementing its footwear offering by incorporating new brands and new product categories, including outdoor sandals and women’s sandals.

As noted, strong profit growth prompted management to boost guidance for Q4 and fiscal 2011. The company increased its earnings guidance for fiscal 2011 to a range of $1.63 to $1.66 per diluted share, which equates to between 47 cents 50 cents per diluted share for the fourth quarter, and a mid-single-digit increase in comparable store sales for the fourth quarter.

In the third quarter, Hibbett opened 17 new stores and closed two stores, bringing the store base to 789 in 26 states as of Oct. 30, including the company's first store in South Dakota. For the full year HIBB expects to open between 40 and 42 new stores.