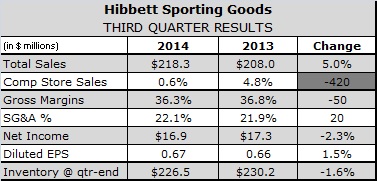

Hibbett Sports Inc. reported a sharp drop in comp store sales growth in the 13 weeks ended Nov. 1, but was able to grow sales 5.0 percent to $218.3 million by opening a record 26 stores during the period. Comparable store sales for the recent quarter increased just 0.6 percent compared with 4.8 percent a year earlier.

Hibbett Sports Inc. reported a sharp drop in comp store sales growth in the 13 weeks ended Nov. 1, but was able to grow sales 5.0 percent to $218.3 million by opening a record 26 stores during the period. Comparable store sales for the recent quarter increased just 0.6 percent compared with 4.8 percent a year earlier.

The Alabama-based retailer reported comparable store sales accelerated in August against high single-digit comps in the prior year but were offset by weaker comps in October as back-to-school sales tapered off and weather remained warm.

“However, we have seen an improved sales trend in early November with the onset of colder weather in many of our markets,” said Jeff Rosenthal, president and CEO for HIBB, which operates about 80 percent of its 5,000-square-foot stores in strip centers, often near a Wal-Mart.

Executives said basketball remains hot and that its customers are responding to high-ticket apparel items. Technical running shoe sales are lagging fashion running shoe sales, which continued to perform well.

Gross margin dipped 50 basis points to 36.3 percent compared with quarter ended Nov. 2, 2013 primarily due to markdowns of slow selling and aged inventory. SVP of Merchandising Jared Briskin said he expects margins to improve as the company further implements new mark-down management software that should reduce deep, end-of-season mark downs by helping merchants mark down slow moving inventory much earlier. HIBB reported its inventory per store declined about 8.2 percent compared with Nov. 1, 2013.

“We were a little over inventoried historically,” Rosenthal conceded.

Store operating, selling and administrative expenses inched up 20 bps to 22.1 percent of net sales, again due to the deleveraging effect of lower comparable store sales.

Net income reached $16.9 million, down 2.3 percent compared with $17.3 million for the 13-week period ended Nov. 2, 2013. Earnings per diluted share was 67 cents, up a penny from a year earlier.

HIBB closed the quarter with 969 in 31 states and square footage for the store base increased 6.5 percent to approximately 5.6 million square feet at Nov. 1, 2014, compared with 5.2 million square feet at Nov. 2, 2013.

The company raised its guidance for the fiscal year ending Jan. 31, 2015, to earnings per diluted share in the range of $2.72 to $2.77 compared with previous guidance of $2.63 to $2.73. It also reaffirmed an expected increase in comparable store sales in the low single-digit range.

Briskin, who was promoted to the SVP merchandizing position in late September, said he wants buyers to jump on trends faster. In the fourth quarter, for instance, he see opportunities to expand assortments of basketball and other footwear categories, as well as women and kid’s apparel in the fourth quarter.

“We really feel good about fleece in general , especially hoodies and pants,” Briskin said. “We see that as being key item drivers for the fourth quarter.”

Briskin said the trend from denim toward fleece joggers is still strong “lends itself to a strong footwear business, because it shows the shoe.”

The company ended the quarter with 969 stores in 31 states, up 65 from a year ago and expects to increase the pace in fiscal 2015, said Rosenthal. The companies tries to open all new stores within a two hour drive of an existing store.

“Weve hit Pennsylvania this year,” he said. “We are looking around New Jersey and Minnesota.”