Heelys, Inc. has seen its brand go from market darling to  market dog in less than a year and may well see its Holiday fortunes go the way of scooters and other short-lived fads. Instead of ramping up for another strong Holiday season, the company has apparently spent the last two quarters dealing with heavy inventories at retail and the accompanying calls for returns, cancellations, and markdown money or marketing funds. The lone potential good news came from the revelation that Shoe Carnival and Famous Footwear will have the brand in-store by mid-November to exploit potential Holiday sales in the mid-tier retail channel. Heelys will pick up all 285 Carnival doors and 400 Famous doors in the expanded distribution plan.

market dog in less than a year and may well see its Holiday fortunes go the way of scooters and other short-lived fads. Instead of ramping up for another strong Holiday season, the company has apparently spent the last two quarters dealing with heavy inventories at retail and the accompanying calls for returns, cancellations, and markdown money or marketing funds. The lone potential good news came from the revelation that Shoe Carnival and Famous Footwear will have the brand in-store by mid-November to exploit potential Holiday sales in the mid-tier retail channel. Heelys will pick up all 285 Carnival doors and 400 Famous doors in the expanded distribution plan.

According to retail point-of-sale data compiled by SportScanINFO, average selling prices at retail for Heelys wheeled footwear product has been on the decline for the last three months and has dropped sharply over the last four weeks. The SSI data reveals that the out-the-door retail price for a pair of Heelys shoes was $44.44 the last week of the retail fiscal month, roughly $20 a pair below last years price.

Mike Staffaroni, Heelys, Inc. president and CEO, told analysts and investors during a quarterly conference call that he hopes that prices will go back up after retail inventories are cleaned up and they get closer to the Holiday selling period. Staffaroni said they have “aggressively” increased marketing and advertising spend, especially on national TV ads, to help fuel fourth quarter sales. Still, management doesnt expect a sharp up-tick in orders either.

“We do not anticipate shipping a significant amount of product beyond our currently booked fourth quarter orders, as we're very committed to work with our retailers towards trimming their inventories to more appropriate levels by year-end,” said Mike Hessong, HLYSs CFO.

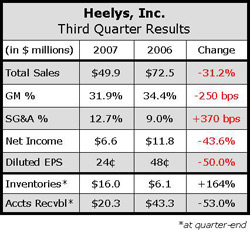

An increase in “discretionary marketing assistance” provided to retailers and an increase in the inventory reserve certainly had an impact on Q3 margins, which declined 250 basis points for the period, a trend that may continue into Q4 as HLYS attempts to liquidate its own inventory, which was up 164% at the end of the quarter.

The prospects for new products appear to be dim, as well, as Heelys is still working on booking Spring product. Mr. Staffaroni suggested that retailers are taking a wait n see attitude. “As of today, you could still write an order for February delivery,” he said.

The business outside the U.S. was a bit of a different story. Europe has reportedly exceeded expectations for the year, led by gains in the U.K. Management also said they are starting to see increased demand on the continent, particularly in Germany and France.

HLYS had roughly $89 million in cash at the end of the quarter.

>>> Heelys is hoping that the historical trends for the Holiday period will help clean out the inventory issues. The question is whether there is another season left for the fad

>>> Some might suggest they spend a little cash on a skate brand or two

Jarden may have a few after the K2 deal…