Heelys Inc. has retained Houlihan Lokey as financial advisor to evaluate possible strategic alternatives to increase shareholder value. It also reported a sharp Q3 earnings decline on a 52.3% revenue freefall.

The advisor hiring comes after Heelys in August rejected a $5.25 per share bid by Skechers, saying the offer was “premature at this time” and not reflective of the company's value. HLYS shares closed at $3.75 on Friday, up 6.8% for the week. In a statement Chairman Gary Martin noted the company is making progress on restoring profitability, but had “an obligation to our shareholders to consider strategic alternatives.”

Pressed by an analyst on its Q3 conference call, Martin said, “We don't know what all these alternatives are going to be and we don't know where this process could take us. In fact, there is no assurance that this process will result in any changes or actions We'll also not be providing any updates until the process is terminated or a definitive agreement is reached.”

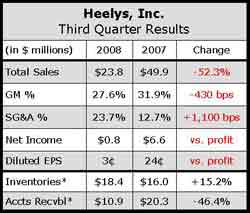

In the quarter, the $23.8 million in revenues was comprised of $14.4 million domestically and $9.4 million internationally. While considerably below Q307 levels, revenues increased over Q208 sales of $18.2 million. Gross margins improved 140 basis points year-over-year due to less discounting. With many customers shifting to at-once orders and lower Heelys' inventory levels across retail, promotional pressures have eased and retail price points moved back up. SG&A expenses increased slightly due to incremental infrastructure and operating costs associated with its direct international business, as well as higher legal and professional fees.

Heelys is focusing on “more trend right products and more targeted advertising” to drive demand, but remains focused on inventory and expense controls. Said Martin, “Until we generate higher sales volumes, operating margins will continue to be depressed relative to historical results.”