GoPro, in its first earnings release as a public company, reported a loss of $19.8 million, or 24 cents a share, for the second quarter – almost four times bigger than the $5.1 million loss, or 6 cents, from a year earlier. The wider loss reflects a hike in general expenses due to costs from its recent initial public offering as well as a doubling of its research & development costs.

GoPro, in its first earnings release as a public company, reported a loss of $19.8 million, or 24 cents a share, for the second quarter – almost four times bigger than the $5.1 million loss, or 6 cents, from a year earlier. The wider loss reflects a hike in general expenses due to costs from its recent initial public offering as well as a doubling of its research & development costs.

Excluding some items, GoPro’s earnings on a non-GAAP basis were $11.8 million, or 8 cents a share, compared to a net loss of $3.2 million, or 3 cents, in the second quarter of 2013. Analysts on average had expected 7 cents a share. Adjusted EBITDA reached $25.7 million, up from $2.3 million.

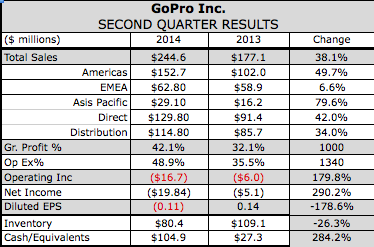

Sales reached $244.6 million, up 38.1 percent versus the 2013-second quarter. That figure exceeded analyst forecasts for $238 million in sales. Compared to the first quarter of 2014, sales were up 3.8 percent.

On a conference call with analysts, CEO Nicholas Woodman noted that sales benefited from improved relationships with large retailers, including Best Buy, Target and Amazon.com as well as strong demand for launches.

“We delivered a strong quarter of operating results driven by increased demand for our Hero 3+ Black Edition and demand for our accessory products,” said Woodman. “We are seeing a tremendous volume of quality content generated by our users and a 200 percent year over year increase in video views on YouTube, which is fueling our virtuous cycle whereby viewership of GoPro content drives sales.”

In the Americas, sales grew 49.7 percent to $152.7 million. The Asia-Pacific region saw the strongest growth, up 79.6 percent to $29.1 million, while EMEA sales were up 6.6 percent to $62.8 million.

“We are a global brand with room for expansion opportunities,” said Woodman. “Thirty-eight percent of revenue came outside of America and there are growth opportunities in Europe, Japan, China and Korea.”

Second quarter GAAP gross margin was 42.1, compared to gross margin of 32.1% in the second quarter of 2013 and 40.9 in the first quarter of 2014. Non-GAAP gross margin was 42.1 percent, compared to 32.1 percent in the 2013-second quarter and 41.1 percent in the 2014 first quarter.

Operating expenses jumped 49.4 percent to $119.5 million, or 48.9 percent of sales, up from $79.6 million, or 33.9 percent, a year ago. General & administrative expenses increased more than five-fold to $41.2 million from $7.0 million. R&D costs doubled to $34.7 million from $16.7 million. Sales and marketing expenses increased 11.8 percent to $43.7 million from $39.1 million.

CFO Jack Lazar forecast the camera maker was looking at earnings of 6 to 8 cents per share in the current quarter on revenue of between $255 million and $265 million. Lazar also noted that operating expenses would come back down, and were expected to return to between $92.5 million and $95 million in the current quarter.

On Friday, GoPro closed at $40.97, down $7, or 14.6 percent, on the day. The results came out Thursday after the market’s close. On June 26, GoPro priced its IPO of stock at $24 a share, which was the high end of its expected range.