GoPro Inc. reported a profit against a year-ago loss in the fourth quarter as sales climbed 13 percent. Results benefited from expense controls and strong demand for the HERO 7 action camera.

“Thanks to a strong product line-up and efficient execution, GoPro grew both camera unit sell-through and market share in 2018, resulting in GAAP profitability in the fourth quarter and second half of the year,” said founder and CEO Nicholas Woodman. “With this momentum and a continued focus on expense management, we’re planning for growth and profitability in 2019.”

GoPro Highlights

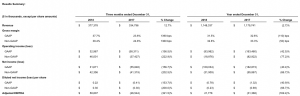

- Revenue for Q4 2018 was $377 million, up 13 percent year-over-year.

- GAAP gross margin for Q4 2018 was 38 percent, up from 32 percent in the prior quarter. Non-GAAP gross margin for Q4 2018 was 38 percent, up from 33 percent in the prior quarter.

- Q4 2018 GAAP net income was $32 million, or $0.22 per share. Non-GAAP net income was $42 million, or $0.30 per share. On a year-over-year basis, GAAP net income increased by $88 million.

- GoPro reduced Q4 2018 GAAP and non-GAAP operating expenses by $29 million and $22 million, a year-over-year reduction of 21 percent and 18 percent, respectively.

- Cash and investments totaled $198 million at the end of Q4 2018.

- Revenue for the full year 2018 was approximately $1.15 billion, down 3 percent year-over-year.

- Excluding our aerial business, revenue would have increased 3 percent year-over-year.

GoPro.com represented more than 10 percent of revenue in Q4 2018, growing more than 50 percent year-over-year. - In the US, GoPro captured 97 percent dollar share and 87 percent unit share of the action camera category in Q4 2018. The top-five cameras sold by unit volume were GoPro cameras, and GoPro’s three HERO7 cameras were the top-three selling action cameras according to the NPD Group.

In the US, Fusion captured 38 percent dollar share of the spherical camera market in Q4 2018 according to the NPD Group. - In Europe, in the $199 and above price band, GoPro held 91 percent unit share and 90 percent dollar share in Q4 2018, up from 83 percent and 84 percent, respectively, year-over-year. Four out of the top-five cameras sold by unit volume were GoPro cameras according to GfK.

- In Japan, GoPro captured 57 percent unit share in Q4 2018, up from 50 percent in Q4 2017, according to GfK.

- In China, GoPro grew unit sell-through by 2 percent year-over-year in Q4 2018, according to GfK.

In Korea, GoPro market share in Q4 2018 was 36 percent and 53 percent by units and dollars, up from 28 percent and 44 percent in Q4 2017, respectively, according to GfK. - In Thailand, in Q4 2018 GoPro sell-through increased by 169 percent in units and 154 percent in dollars, year-over-year, according to GfK. Market share was 88 percent and 91 percent by units and dollars, respectively, year-over-year.

- Social followers increased by over three million in 2018 to approximately 38 million, driven primarily by increases on Instagram and YouTube. GoPro gained one million social followers in Q4 2018.

- GoPro’s Million Dollar Challenge Campaign generated an all-time high of 25,000 customer content submissions, and the resulting highlight reel has been viewed more than 25 million times with more than 3 million engagements across all social platforms.

- GoPro Plus subscription service reached 199,000 active paying subscribers as of today, up 8 percent since September 30, 2018 and up more than 50 percent year-over-year.

The 30 cents share excluding one-time items came in above Wall Street’s consensus estimate of 26 cents. Revenues of $377 million were just ahead of analysts’ average estimate of $374.2 million.

Results Summary: