Gildan Activewear, Inc. reported sales grew 2 percent in the third quarter with flat sales in activewear and gains in the hosiery and underwear category. Results were in line with expectations with the sales gains following several quarters of declines. The company, however, now sees sales and earnings landing at the lower end of guidance due to macroeconomic pressures.

Highlights of the Quarter

(all amounts are in U.S. dollars except where otherwise indicated)

- Net sales of $870 million, up 2 percent;

- Operating margin of 17.8 percent, adjusted operating margin1 of 18.1 percent;

- GAAP diluted EPS of $0.73 and adjusted diluted EPS1 of $0.74;

- Cash flow from operations of $305 million and free cash flow of $265 million; and

- Capital returned to shareholders of $113 million during the quarter through dividends and share repurchases

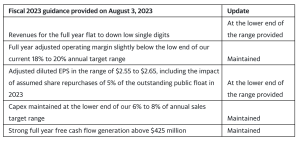

- The company updates its fiscal 2023 guidance to the lower end of previously provided revenue and EPS ranges while maintaining expected FCF generation above $425 million

“Our competitive position remains very strong in a challenging environment driven by our industry-leading vertically integrated manufacturing platform. We delivered third quarter performance which came in overall in line with our expectations. We resumed our sales growth trajectory and delivered operating margin within our target range,” said Glenn Chamandy, Gildan’s president and CEO.

During the third quarter, the company delivered net sales of $870 million, up 2 percent over the prior year’s sales of $850 million, as Gildan moved past the impact of strong prior year comparative periods tied to post-pandemic replenishment. Gildan also delivered solid adjusted operating margin of 18.1 percent. Consequently, GAAP diluted EPS came in at $0.73 and adjusted diluted EPS at $0.74, both down as anticipated from $0.84 in the third quarter last year. Cash flows from operating activities were strong for the quarter totaling $305 million, and Gildan generated $265 million of free cash flow after capital expenditures of $43 million. This positioned the company well to continue to execute its capital allocation priorities during the quarter and Gildan repurchased 2.7 million shares at a cost of $80 million under its normal course issuer bid (NCIB) program. This program, which was recently renewed, authorizes the repurchase of up to 5 percent of the company’s outstanding common shares. Gildan ended the third quarter with a net debt of $1,018 million and a leverage ratio of 1.6 times net debt to trailing twelve months adjusted EBITDA well within its targeted debt levels.

Q3 2023 Operating Results

Net sales for the third quarter came in at $870 million, up 2 percent over the prior year, consisting of Activewear sales of $744 million and sales in the hosiery and underwear category of $126 million.

For Activewear, while POS was positive on a year-over-year basis, sales for this category were essentially flat during the quarter. Gildan benefited from the favorable impact of fleece shipments which were driven by strong sell-through and seasonal replenishment, though as anticipated, the trade-down within this activewear category persisted this quarter. This benefit was offset by lower volume in certain other activewear categories and slightly lower net selling prices. International markets remained particularly challenging, performing well below its expectations, with sales down 23 percent during the quarter versus the prior year as a result of lower demand and price pressures across all markets.

Gildan saw increasing momentum in the hosiery and underwear category in the quarter with sales up 16 percent versus the prior year. This increase was mainly driven by sales volume growth, reflecting the expansion of its private label offering and the roll-out of new underwear programs in the mass retail channel, as well as strength in hosiery. Despite industry-wide weak replenishment for men’s underwear and socks year-over-year, Gildan said it continued to achieve solid performance in this category.

Gildan generated gross profit of $239 million, or 27.5 percent of sales in the third quarter, down $13 million and 220 basis points respectively, versus the prior year. The lower gross margin was primarily driven by higher raw materials and manufacturing input costs as well as slightly lower net selling prices. As expected, Gildan said it saw a sequential improvement of 170 basis points to its gross margin in the third quarter as pressure stemming from the flow-through of peak cotton costs in the first half of the fiscal year abated.

SG&A expenses of $82 million were flat year-over-year, and as a percentage of sales, SG&A was down 20 basis points to 9.5 percent, primarily reflecting the benefit of sales leverage.

For the third quarter, Gildan generated operating income of $155 million, or 17.8 percent of sales and adjusted operating income of $157 million, or 18.1 percent of sales, down respectively 270 and 190 basis points compared to the prior year, reflecting the lower gross margin and adjusted gross margin.

After reflecting net financial expenses of $21 million, up $11 million over the prior year due to higher interest rates and average net borrowing levels, and the positive benefit of a lower outstanding share base, Gildan reported GAAP diluted EPS and adjusted diluted EPS for the quarter of $0.73, and $0.74, respectively, both down from $0.84 in the prior year.

Cash flows from operating activities in the third quarter totaled $305 million versus $66 million in the prior year, mainly due to significantly lower working capital requirements. After accounting for capital expenditures totaling $43 million in the third quarter, down from $75 million in the prior year, Gildan generated $265 million of free cash flow, compared to the use of $7 million of free cash flow in the prior year period. Capital expenditures have moderated as Gildan neared the completion of phase one of its new manufacturing complex in Bangladesh, with the first facility currently ramping up its operations as planned. At the end of the third quarter of 2023, net debt stood at $1,018 million with a leverage ratio of 1.6 times net debt to trailing twelve months adjusted EBITDA well within targeted debt levels.

Year-to-Date Operating Results

Net sales for the nine months ended October 1, 2023, were $2,413 million, down 4 percent over the same period last year, reflecting a decrease of 7 percent in Activewear sales, partly offset by an increase of 10 percent in the hosiery and underwear category. The decline in Activewear sales was primarily due to lower sales volumes compared to the prior year which benefited from distributor inventory replenishment following the pandemic, as well as the unfavorable impact of product mix stemming from current macro-economic conditions. Year-over-year POS trends for the Activewear category showed progressive improvement from the first to the second quarter and into the third quarter. International sales of $172 million were down 14 percent versus the prior year period. The strong performance in the hosiery and underwear category, with sales of $389 million in the first nine months of 2023, was driven by both underwear and sock volume growth. Gildan said it is benefiting from the expansion and the roll-out of retail programs in the mass channel for these products, following a period of inventory adjustments at retailers.

Gildan generated gross profit of $644 million in the first nine months, down $114 million versus the prior year, driven by the decline in sales and lower gross margins. Gross margin of 26.7 percent was down by 340 basis points over this period, mainly a result of the flow-through impact on its cost of sales of peak fiber costs and higher manufacturing input costs, both of which were anticipated. These factors were partly offset by higher net selling prices.

SG&A expenses for the first nine months of 2023 of $242 million were $11 million below prior-year levels. SG&A expenses as a percentage of net sales were 10.0 percent, in line with the prior year, as sales deleverage was offset by the benefit of lower expenses including lower variable compensation as well as a trade accounts receivable recovery.

Gildan generated operating income of $466 million, or 19.3 percent of sales, which included the benefit of a $77 million net insurance gain and a $25 million gain from the sale and leaseback of one of its U.S. distribution facilities, partly offset by higher restructuring costs of $35 million, compared to operating income of $511 million, or 20.3 percent of sales in the first nine months of last year. Excluding these items, adjusted operating income was $398 million, or 16.5 percent of sales, down $105 million, or 350 basis points year over year, mainly reflecting lower sales and gross margin pressure in the first nine months as noted above.

After reflecting increased net financial expenses of $58 million due to higher interest rates and average net borrowing levels, and the positive benefit of a lower outstanding share base, Gildan reported GAAP diluted EPS and adjusted diluted EPS for the first nine months of $2.14 and $1.82 respectively, both down from GAAP diluted EPS and adjusted diluted EPS of $2.46, in the prior year. GAAP net earnings included the after-tax impact of the net gains and restructuring charges outlined above.

Outlook

Gildan said, “Under our GSG strategy, we remain committed to driving market share gains in key categories through the roll-out of new retail programs and the continued leveraging of our industry-leading vertically integrated manufacturing platform including the start-up of our new manufacturing complex in Bangladesh. Our third quarter unfolded largely as expected and we continue to expect our revenues to grow in the fourth quarter against an easier comparative in the prior year. This said, we now expect full-year revenues and earnings per share to be at the lower end of the previously provided range, reflecting softer demand trends in certain markets stemming from the macro environment.”

Accordingly, Gildan adjusted its Fiscal 2023 guidance as follows: